- Japan

- /

- Consumer Durables

- /

- TSE:1766

Token (TSE:1766) Q2: 40% TTM Earnings Growth Challenges Cautious Market Narrative

Reviewed by Simply Wall St

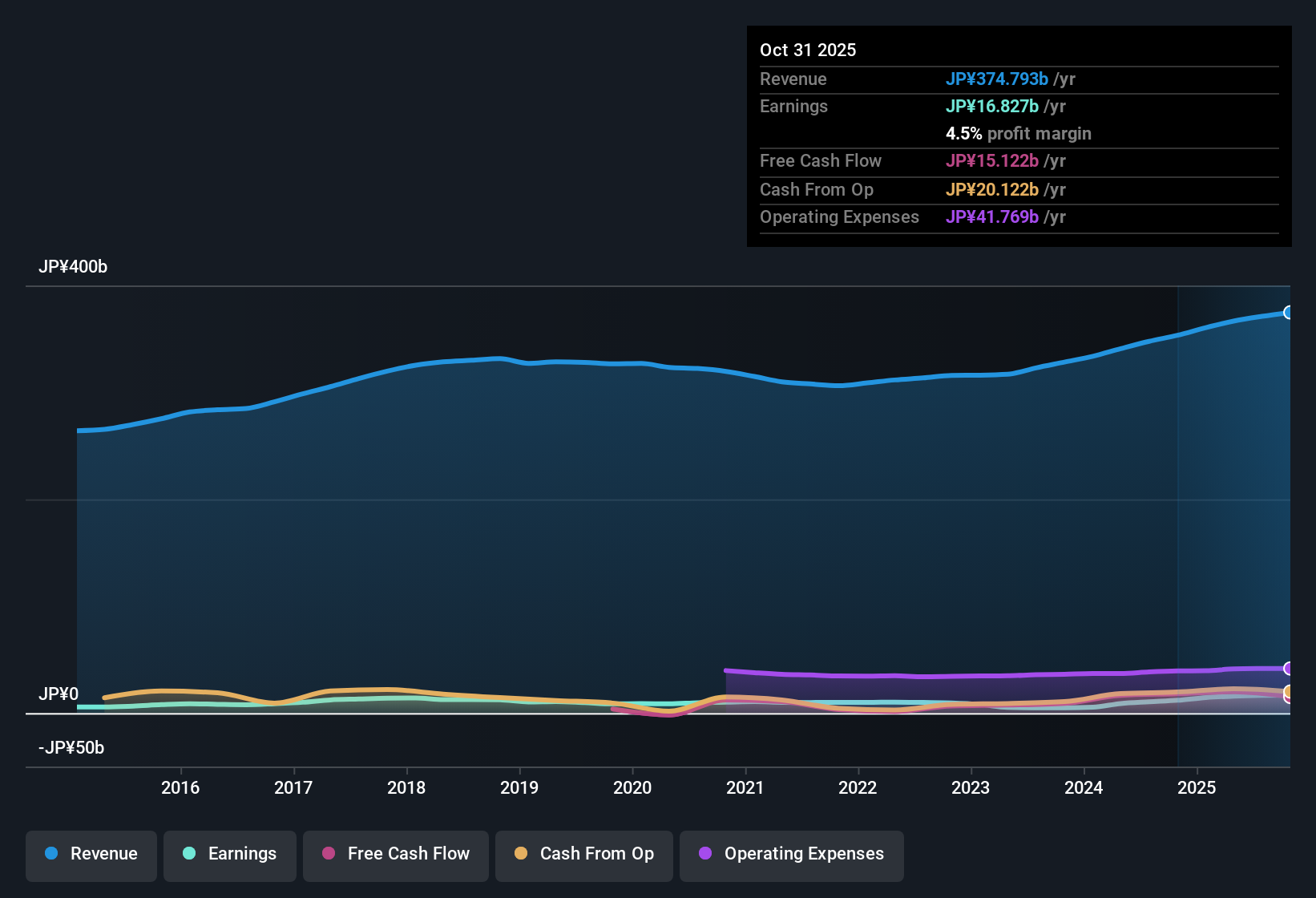

Token (TSE:1766) has laid out a solid Q2 2026 scorecard, posting revenue of ¥93.7 billion and net income of ¥3.7 billion, with basic EPS coming in at ¥275.59. Over the past five quarters, the company has seen revenue move from ¥89.0 billion in Q1 2025 to a peak of ¥95.5 billion in Q4 2025 before settling at ¥93.7 billion in the latest quarter. EPS has ranged between ¥249.48 and ¥340.46 as profitability has ebbed and flowed. With trailing net margins higher than a year ago and earnings up over the last 12 months, investors may consider how durable these margins look as a potential driver of future growth and income.

See our full analysis for Token.With the headline numbers on the table, the next step is to see how this earnings report aligns with the prevailing narratives around Token, highlighting where the story is being confirmed and where expectations may need to be adjusted.

Curious how numbers become stories that shape markets? Explore Community Narratives

40.4% earnings growth outpaces 9.2% trend

- Earnings rose 40.4% over the past year, well above Token’s 5 year compound earnings growth rate of 9.2% per year, indicating the latest 12 month performance is much stronger than its longer term average.

- What stands out for a bullish view is that this stronger earnings phase sits on top of steady revenue expansion, with trailing 12 month revenue at ¥374,793 million versus ¥347,682 million a year earlier. However, forward earnings growth is only forecast at 2.04% per year, which heavily supports bulls on recent execution but limits the case for rapid compounding ahead.

- Revenue is forecast to grow 6.2% per year compared with a 4.6% forecast for the broader Japanese market, tying the optimistic story to a slightly faster top line path.

- At the same time, the slower 2.04% earnings growth outlook versus the market’s 8.5% forecast challenges any bullish claim that the recent 40.4% jump is a new normal rather than a strong year within a more modest trend.

Margins improve to 4.5% despite softer EPS

- Trailing net profit margin has increased to 4.5% from 3.4% a year earlier, while quarterly EPS has eased from ¥340.46 in Q3 2025 to ¥275.59 in Q2 2026 as net income moved from ¥4,577 million to ¥3,705 million.

- Critics focusing on a more bearish angle might point to the recent step down in quarterly EPS alongside a higher share of non cash earnings. However, the margin lift over the last 12 months provides a counterpoint by showing that profitability on each yen of sales has improved even as the most recent quarters saw net income move from ¥4,577 million in Q3 2025 to ¥3,705 million in Q2 2026.

- The increase in trailing net margin from 3.4% to 4.5% suggests that, at least over the last year, Token has generated more profit relative to revenue even though Q1 2026 net income of ¥4,217 million has slipped to ¥3,705 million in Q2.

- The data also flags that a high portion of earnings has been non cash, so bears who worry about earnings quality can reasonably use this to question how much of the margin improvement will translate into cash flow that supports dividends and reinvestment.

Share trades 35% below DCF fair value

- At a share price of ¥14,700, Token trades around 35.1% below the stated DCF fair value of ¥22,646.99 and on an 11.7 times P/E multiple versus a 33.8 times peer average and an industry average that is similar to its own 11.7 times.

- From a valuation focused bullish perspective, this combination of a discount to DCF fair value and to peer P/E multiples, plus a 2.45% dividend yield, is strongly supported by the 40.4% earnings growth over the past year. Yet what is striking is that forward earnings are only expected to grow 2.04% per year, which limits how far that valuation gap can be justified purely by future growth.

- The roughly 35.1% gap between the ¥14,700 market price and the ¥22,646.99 DCF fair value underpins the idea that the market is not fully pricing in the recent uplift in trailing 12 month net income to ¥16,827 million.

- However, with revenue only forecast to rise 6.2% per year and earnings by 2.04% per year, the low P/E ratio relative to peers may also reflect the high share of non cash earnings and the more modest long term growth profile embedded in the current financials.

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Token's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Token’s impressive recent earnings jump contrasts with its muted 2.04% forecast growth and ongoing questions around the sustainability and cash quality of its margins.

If you want companies where future expansion looks clearer and more durable, use our stable growth stocks screener (2094 results) to quickly focus on businesses delivering steadier revenue and earnings progress than Token currently promises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Token might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1766

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)