- Japan

- /

- Professional Services

- /

- TSE:9757

Undiscovered Gems Three Stocks To Explore In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound with easing core U.S. inflation and strong bank earnings, major indices like the S&P 500 and Russell 2000 have seen significant gains, reflecting renewed investor optimism. In this environment of cautious economic recovery, identifying promising small-cap stocks can offer unique opportunities for growth, especially those that demonstrate resilience and potential in sectors benefiting from current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 30.82% | 63.88% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA offers an AI-powered order-to-cash software as a service platform, serving clients both in France and internationally, with a market cap of €326.97 million.

Operations: Sidetrade generates revenue primarily from its software and programming segment, amounting to €47.82 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

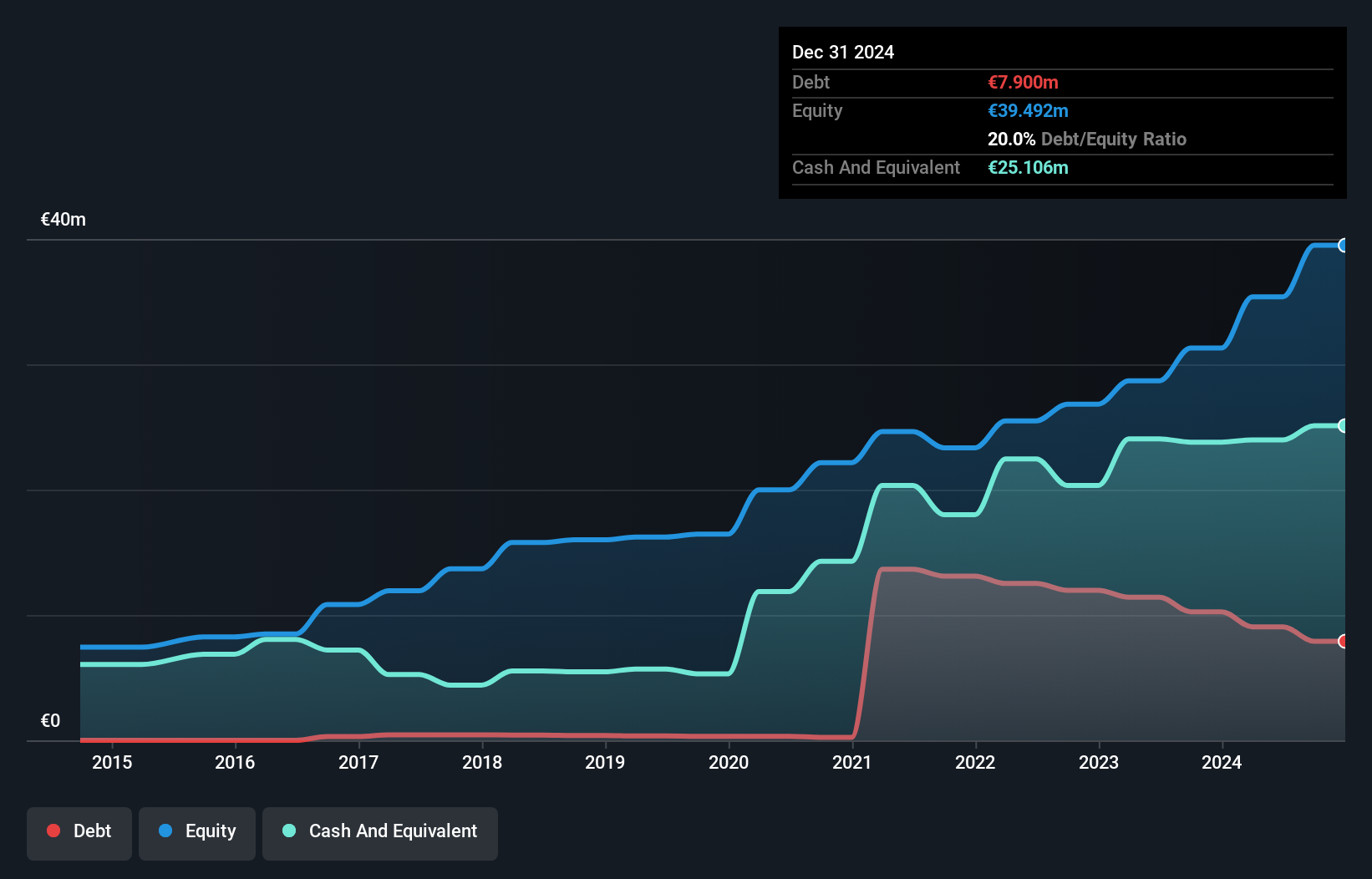

Sidetrade, a nimble player in the tech sector, has shown impressive earnings growth of 122% over the past year, outpacing its industry average of 12%. The company is trading at a slight discount of 4.3% below its estimated fair value, suggesting potential undervaluation. With an EBIT coverage ratio of 141.6x for interest payments, Sidetrade's financial health appears robust. Despite an increase in debt-to-equity from 2.1 to 25.6 over five years, it maintains high-quality earnings and positive free cash flow, indicating solid operational efficiency amid evolving market dynamics.

- Get an in-depth perspective on Sidetrade's performance by reading our health report here.

Understand Sidetrade's track record by examining our Past report.

Sato Holdings (TSE:6287)

Simply Wall St Value Rating: ★★★★★★

Overview: Sato Holdings Corporation is involved in the manufacture and sale of labeling products both in Japan and internationally, with a market cap of ¥71.29 billion.

Operations: Sato Holdings generates revenue primarily from its Auto-ID Solutions segments, with ¥85.40 billion from overseas and ¥85.56 billion from Japan.

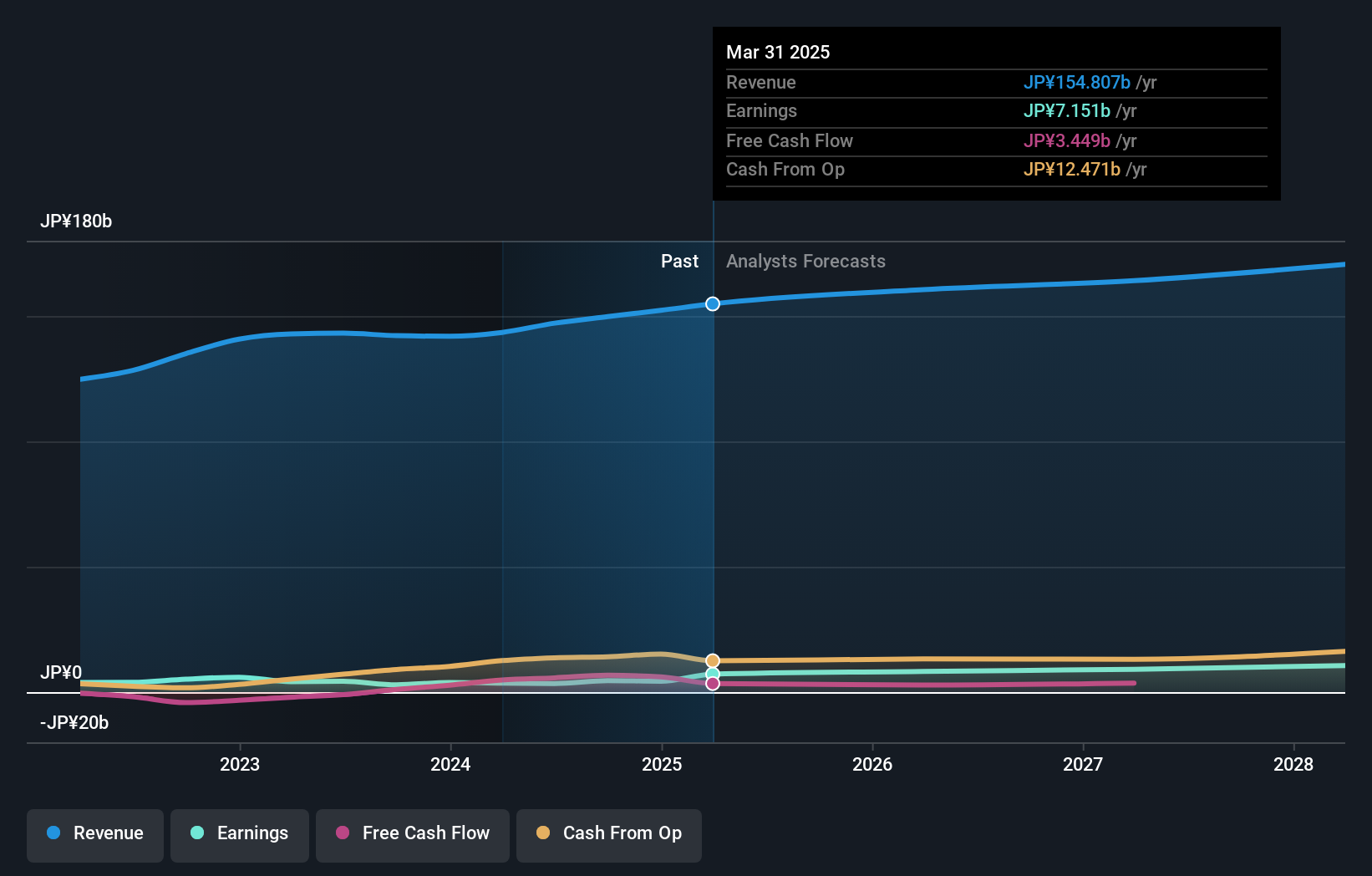

Sato Holdings is showing promise with a solid track record in the past year, highlighted by an impressive 56% earnings growth that outpaces the industry. The company has reduced its debt-to-equity ratio from 20.5% to 16.5% over five years, indicating better financial health. Recent corporate guidance suggests optimism with increased net sales expectations to ¥153.5 billion and operating income projections of ¥11.4 billion for fiscal year ending March 2025. Despite a one-off loss of ¥2.4 billion impacting recent results, Sato's free cash flow remains positive, suggesting resilience and potential for future growth in its sector.

- Delve into the full analysis health report here for a deeper understanding of Sato Holdings.

Review our historical performance report to gain insights into Sato Holdings''s past performance.

Funai Soken Holdings (TSE:9757)

Simply Wall St Value Rating: ★★★★★★

Overview: Funai Soken Holdings Incorporated is a Japanese company that offers consulting services across multiple industries, with a market capitalization of ¥108.99 billion.

Operations: The company generates revenue primarily from consulting services, amounting to ¥22.51 billion, followed by digital solutions at ¥4.77 billion, and logistics services contributing ¥4.63 billion.

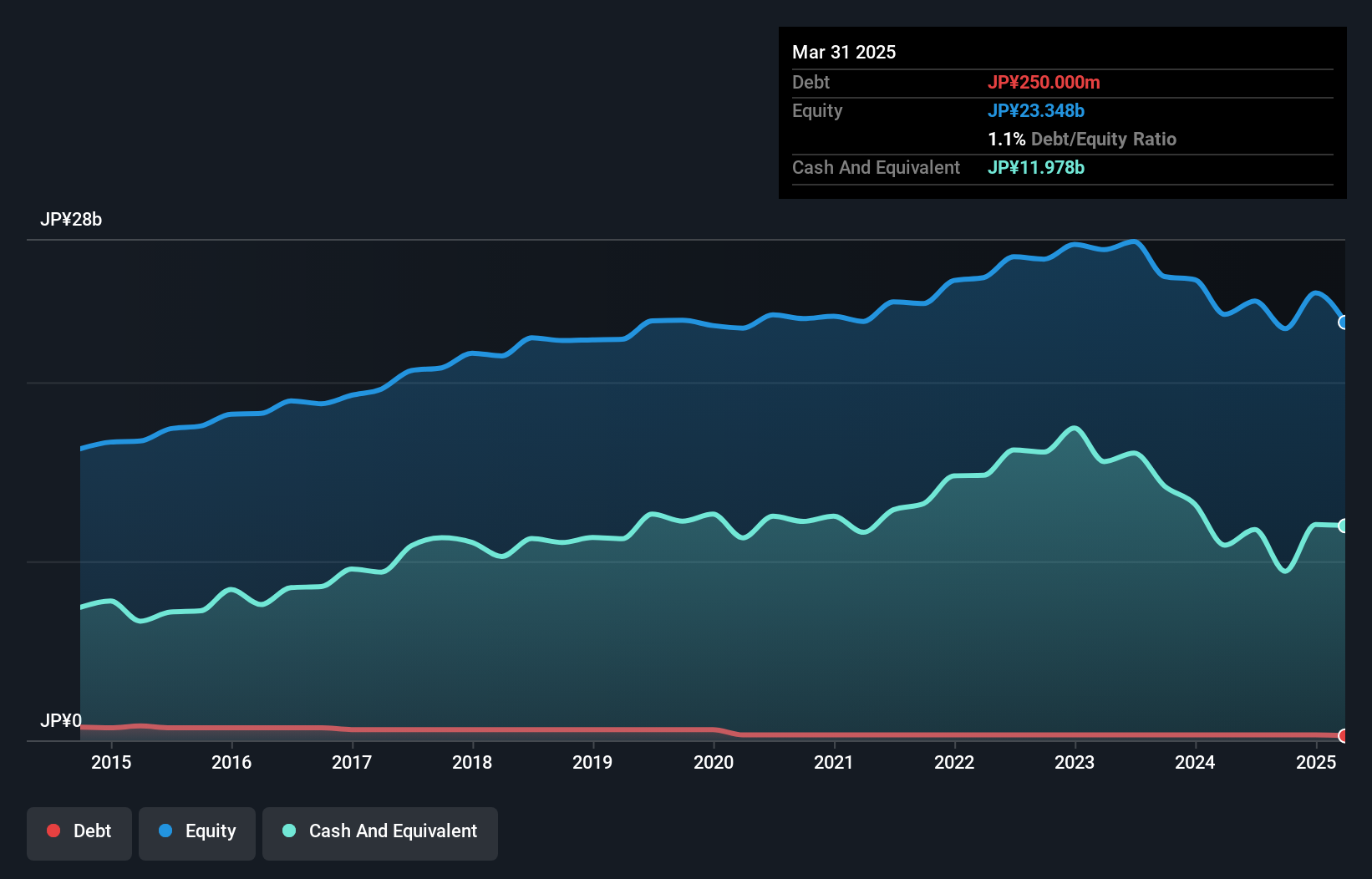

Funai Soken, a dynamic player in its field, showcases impressive financial health with earnings growing 21.8% over the past year, outpacing the industry average of 10.4%. The company seems well-positioned financially, as it holds more cash than total debt and has reduced its debt to equity ratio from 2.6 to 1.3 over five years. Trading at a value that is 23.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. With free cash flow positive and strong interest coverage, Funai Soken appears robust amidst industry challenges, hinting at promising prospects ahead with forecasted growth of 10.66% annually.

- Click here to discover the nuances of Funai Soken Holdings with our detailed analytical health report.

Gain insights into Funai Soken Holdings' past trends and performance with our Past report.

Make It Happen

- Click through to start exploring the rest of the 4659 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9757

Funai Soken Holdings

Provides consulting services for various industries in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives