- Saudi Arabia

- /

- Insurance

- /

- SASE:8200

Unveiling Undiscovered Gems With Strong Fundamentals December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of economic shifts, with central banks adjusting interest rates and the Nasdaq Composite reaching record highs, small-cap stocks have faced challenges, evidenced by the Russell 2000's recent underperformance against larger indices. In this environment, identifying stocks with robust fundamentals becomes crucial for investors seeking opportunities amid broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Saudi Reinsurance (SASE:8200)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Saudi Reinsurance Company operates as a provider of diverse reinsurance products across Saudi Arabia, the broader Middle East, Africa, Asia, and internationally, with a market capitalization of SAR 4.19 billion.

Operations: The company's revenue is primarily derived from Property and Casualty (P&C) segments, with significant contributions from Fire (SAR 222.93 million), Engineering (SAR 109.28 million), and Specialty lines (SAR 101.86 million). Additionally, the Motor segment contributes SAR 61.01 million to the revenue stream. The net profit margin shows a notable trend at a certain percentage that reflects its operational efficiencies or challenges in managing costs relative to its revenue generation across diverse markets.

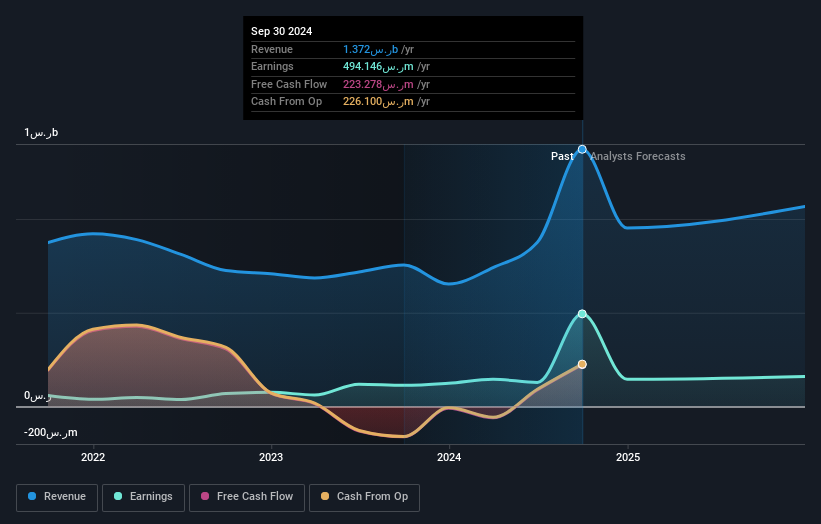

Saudi Reinsurance has shown impressive performance with earnings growth of 336.1% over the past year, outpacing the insurance industry's -6.9%. The company reported a net income of SAR 399.67 million for Q3 2024, significantly higher than SAR 34.07 million in the previous year, and basic earnings per share rose to SAR 4.49 from SAR 0.38. Despite an increase in its debt-to-equity ratio to 3.5% over five years, Saudi Reinsurance maintains strong financial health as its interest payments are well covered by EBIT at a multiple of 25x, indicating robust operational efficiency and stability under new CEO Ahmed Al Jabr's leadership.

- Take a closer look at Saudi Reinsurance's potential here in our health report.

Understand Saudi Reinsurance's track record by examining our Past report.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market capitalization of CHF 1.31 billion.

Operations: The company's revenue streams are primarily derived from its operations in the Americas, Asia-Pacific, and Europe, Middle East and Africa regions, with CHF 352.67 million, CHF 273.16 million, and CHF 452.85 million respectively.

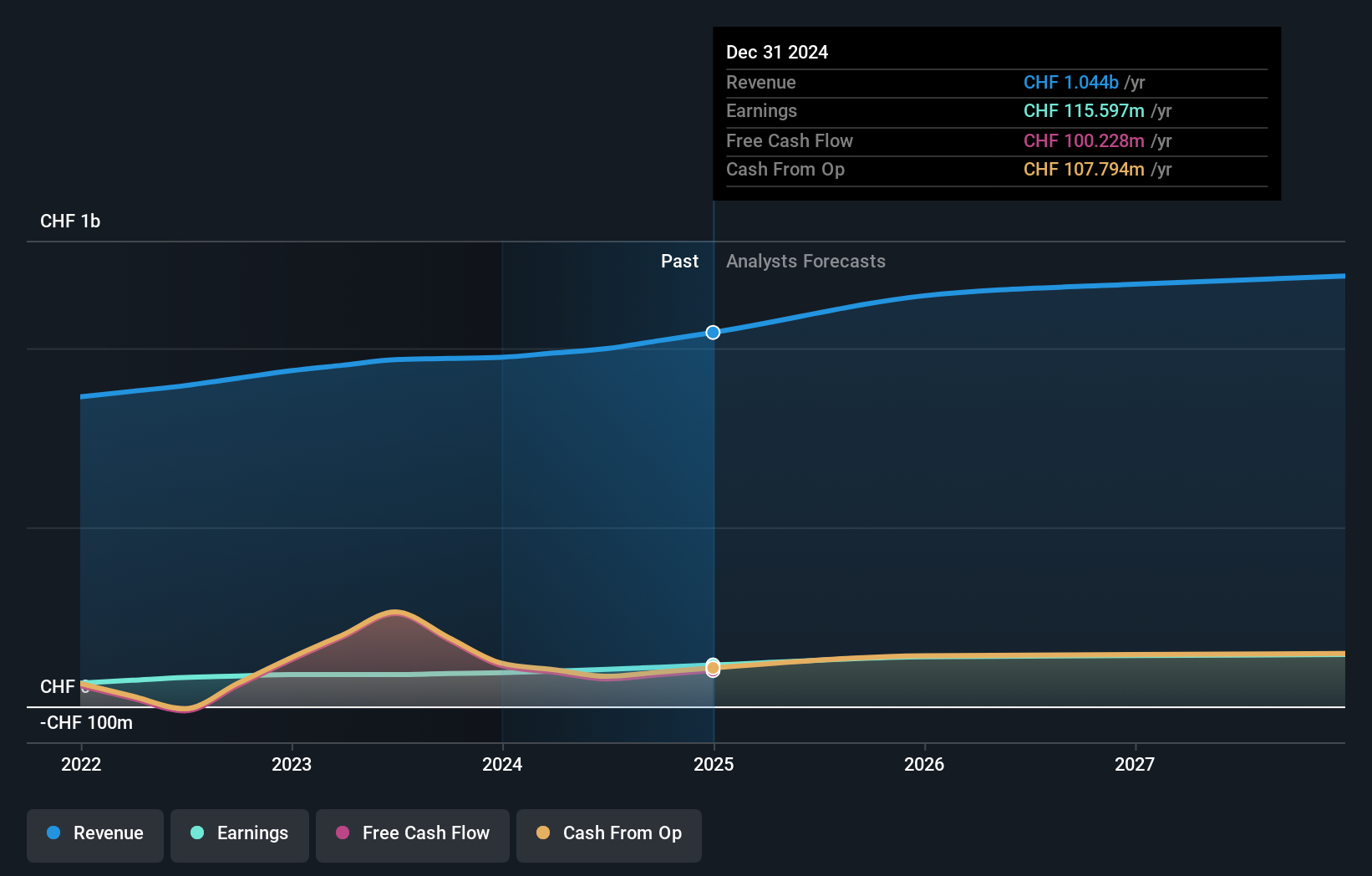

Compagnie Financière Tradition, a nimble player in the financial sector, has demonstrated robust performance with earnings growth of 16.1% over the past year, outpacing its industry peers who saw a -3.3% change. The company trades at 22.6% below its estimated fair value, suggesting potential undervaluation in the market. Over five years, CFT improved its debt to equity ratio from 75.7% to 47.1%, enhancing financial stability and indicating prudent management of liabilities. Despite shareholder dilution recently, CFT's high-quality earnings and positive free cash flow position it well for continued success within the competitive capital markets landscape.

OYO (TSE:9755)

Simply Wall St Value Rating: ★★★★★☆

Overview: OYO Corporation offers geological survey services both in Japan and internationally, with a market capitalization of ¥57.75 billion.

Operations: OYO Corporation's revenue is primarily derived from its geological survey services, both domestically and internationally. The company has a market capitalization of ¥57.75 billion.

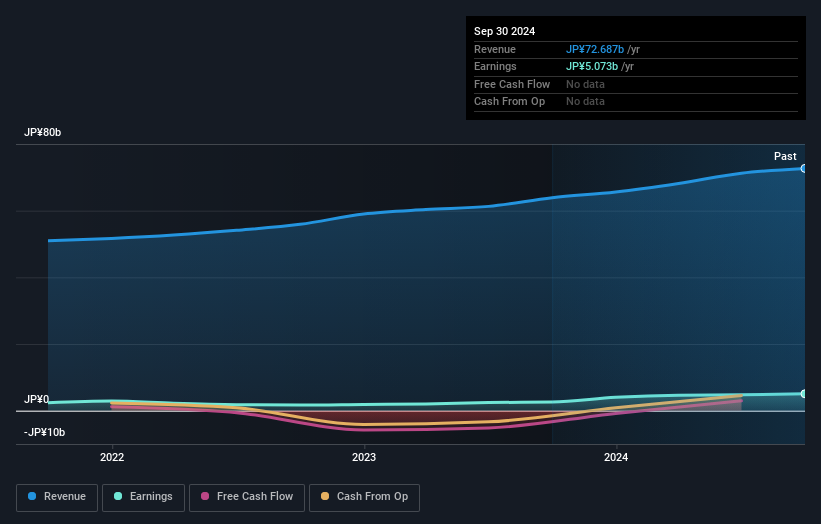

OYO, a nimble player in the hospitality sector, has shown remarkable resilience with earnings growth of 96.6% over the past year, significantly outpacing the Commercial Services industry's 8.7%. The company trades at 6.2% below its estimated fair value, suggesting potential undervaluation in the market. Despite an increase in its debt-to-equity ratio to 5.5% over five years, OYO's financial health remains robust as it holds more cash than total debt and maintains high-quality earnings that comfortably cover interest obligations. These factors suggest a solid footing for future expansion opportunities within its industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of OYO.

Assess OYO's past performance with our detailed historical performance reports.

Taking Advantage

- Click through to start exploring the rest of the 4499 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8200

Saudi Reinsurance

Provides various reinsurance products in the Kingdom of Saudi Arabia, rest of the Middle East, Africa, Asia, and internationally.

Solid track record with adequate balance sheet.