- Japan

- /

- Professional Services

- /

- TSE:9743

Investors Appear Satisfied With Tanseisha Co., Ltd.'s (TSE:9743) Prospects As Shares Rocket 26%

Tanseisha Co., Ltd. (TSE:9743) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

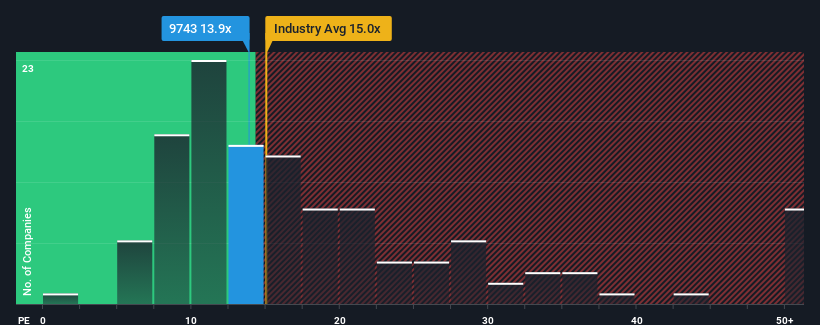

In spite of the firm bounce in price, there still wouldn't be many who think Tanseisha's price-to-earnings (or "P/E") ratio of 13.9x is worth a mention when the median P/E in Japan is similar at about 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Tanseisha has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Tanseisha

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Tanseisha's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 41%. The latest three year period has also seen an excellent 173% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 8.9% per year during the coming three years according to the two analysts following the company. That's shaping up to be similar to the 9.4% per year growth forecast for the broader market.

With this information, we can see why Tanseisha is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Tanseisha's P/E?

Tanseisha appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Tanseisha maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Tanseisha (of which 1 doesn't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Tanseisha, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tanseisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9743

Tanseisha

Engages in the research, planning, design, layout, production, construction, and operation of commercial, public, hospitality, event, and business and cultural spaces in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives