- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A166090

Hana Materials And 2 Other Stocks That May Be Trading At A Discount

Reviewed by Simply Wall St

As global markets navigate a period of mixed performances and economic adjustments, investors are keenly observing the impact of rate cuts by major central banks and the anticipation of further monetary policy shifts. While technology stocks like those in the Nasdaq Composite have shown resilience, other indices have faced declines amidst inflationary pressures and labor market changes. In such an environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential discounts. This article explores Hana Materials and two other companies that may present opportunities for value-seeking investors amidst these fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| UMB Financial (NasdaqGS:UMBF) | US$122.18 | US$244.23 | 50% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$46.49 | US$92.69 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.298 | €0.59 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.60 | A$9.14 | 49.7% |

| Equifax (NYSE:EFX) | US$265.81 | US$530.33 | 49.9% |

| QD Laser (TSE:6613) | ¥297.00 | ¥591.10 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.32 | €64.59 | 50% |

Let's review some notable picks from our screened stocks.

Hana Materials (KOSDAQ:A166090)

Overview: Hana Materials Inc. manufactures and sells silicon electrodes and rings in South Korea with a market cap of ₩462.84 billion.

Operations: Hana Materials Inc. generates revenue through the production and sale of silicon electrodes and rings in South Korea.

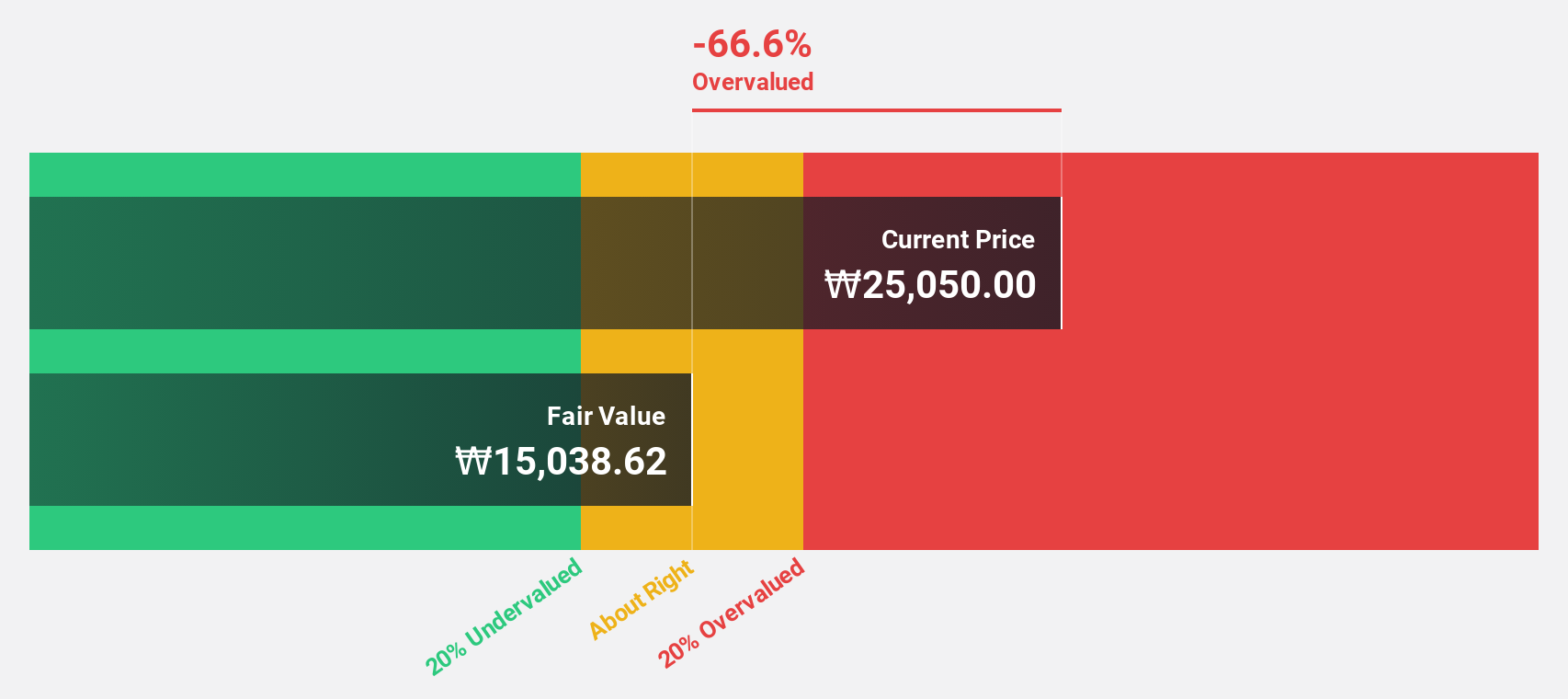

Estimated Discount To Fair Value: 15.6%

Hana Materials is trading at ₩23,750, about 15.6% below its estimated fair value of ₩28,138.46. Despite high debt levels and a reduced profit margin from last year, the company shows promising growth prospects with earnings expected to grow significantly over the next three years and revenue projected to increase faster than the KR market average. Recent share buybacks totaling KRW 3.09 billion may also support shareholder value in the long term.

- The growth report we've compiled suggests that Hana Materials' future prospects could be on the up.

- Get an in-depth perspective on Hana Materials' balance sheet by reading our health report here.

Gift Holdings (TSE:9279)

Overview: Gift Holdings Inc. operates restaurants in Japan, the Republic of South Korea, and internationally with a market cap of ¥69.08 billion.

Operations: The company generates revenue from its Food and Beverage Business, amounting to ¥28.47 billion.

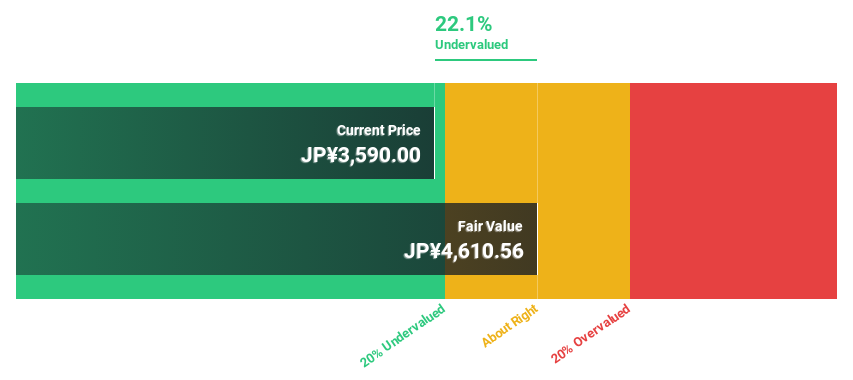

Estimated Discount To Fair Value: 24.2%

Gift Holdings, trading at ¥3,460, is undervalued by over 20% compared to its fair value of ¥4,564.69. Despite recent sales declines and high share price volatility, the company's earnings are projected to grow significantly at 27.9% annually over the next three years—outpacing the JP market average. The opening of new international franchises like in Seoul may enhance future cash flows but currently has a minor impact on performance projections for fiscal year 2025.

- Insights from our recent growth report point to a promising forecast for Gift Holdings' business outlook.

- Take a closer look at Gift Holdings' balance sheet health here in our report.

NOMURA (TSE:9716)

Overview: NOMURA Co., Ltd. specializes in research, planning, consulting, design, layout, production and construction, as well as operation and management for space creation both in Japan and internationally, with a market cap of ¥90.57 billion.

Operations: The company's revenue segments include research, planning, consulting, design, layout, production and construction services, along with operation and management for space creation in Japan and internationally.

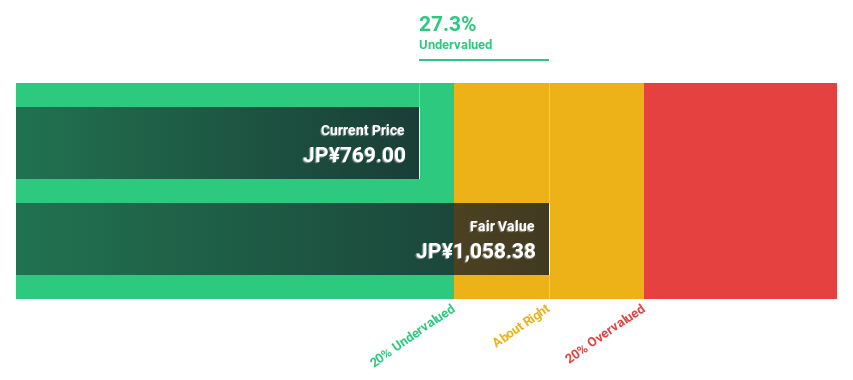

Estimated Discount To Fair Value: 23.4%

Nomura is trading at ¥812, undervalued by over 23% against its estimated fair value of ¥1,059.82. Its earnings are projected to grow significantly at 27.95% annually, surpassing the JP market average growth rate of 7.9%. Despite this potential for growth, its dividend yield of 3.33% is not well covered by earnings, and the forecasted return on equity remains modest at 11%.

- Upon reviewing our latest growth report, NOMURA's projected financial performance appears quite optimistic.

- Dive into the specifics of NOMURA here with our thorough financial health report.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 906 more companies for you to explore.Click here to unveil our expertly curated list of 909 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hana Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A166090

Hana Materials

Manufactures and sells silicon electrodes and rings in South Korea.

Excellent balance sheet and fair value.

Market Insights

Community Narratives