- Japan

- /

- Professional Services

- /

- TSE:9644

There's Reason For Concern Over Tanabe Consulting Group Co.,Ltd.'s (TSE:9644) Massive 29% Price Jump

Tanabe Consulting Group Co.,Ltd. (TSE:9644) shares have continued their recent momentum with a 29% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

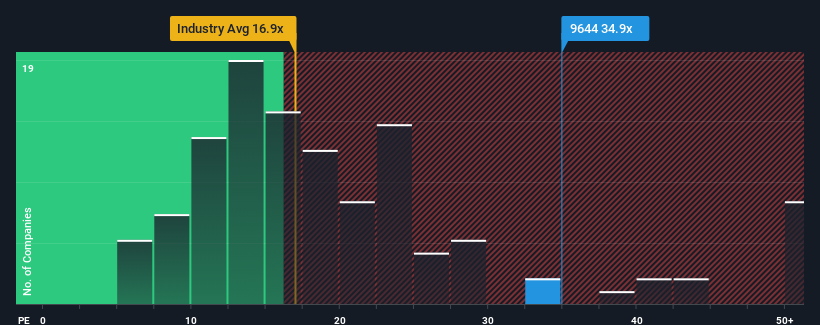

Following the firm bounce in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Tanabe Consulting GroupLtd as a stock to avoid entirely with its 34.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Tanabe Consulting GroupLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Tanabe Consulting GroupLtd

Is There Enough Growth For Tanabe Consulting GroupLtd?

The only time you'd be truly comfortable seeing a P/E as steep as Tanabe Consulting GroupLtd's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 9.7% decrease to the company's bottom line. Even so, admirably EPS has lifted 33% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's about the same on an annualised basis.

In light of this, it's curious that Tanabe Consulting GroupLtd's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Tanabe Consulting GroupLtd's P/E?

Tanabe Consulting GroupLtd's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Tanabe Consulting GroupLtd revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Tanabe Consulting GroupLtd that you should be aware of.

If these risks are making you reconsider your opinion on Tanabe Consulting GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tanabe Consulting GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9644

Tanabe Consulting GroupLtd

Engages in the management and marketing consulting activities.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026