- Japan

- /

- Commercial Services

- /

- TSE:7997

Kurogane Kosakusho Ltd. (TSE:7997) May Have Run Too Fast Too Soon With Recent 31% Price Plummet

Kurogane Kosakusho Ltd. (TSE:7997) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. Longer-term shareholders would now have taken a real hit with the stock declining 3.3% in the last year.

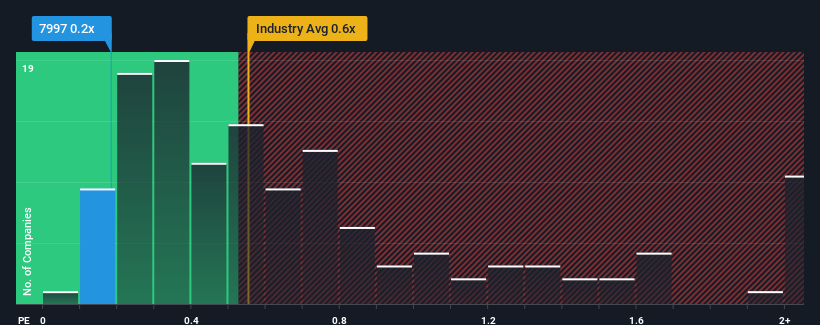

Although its price has dipped substantially, it's still not a stretch to say that Kurogane Kosakusho's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Japan, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Kurogane Kosakusho

What Does Kurogane Kosakusho's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Kurogane Kosakusho's revenue has been unimpressive. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kurogane Kosakusho will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Kurogane Kosakusho would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 15% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 4.2% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Kurogane Kosakusho's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Kurogane Kosakusho's P/S

Kurogane Kosakusho's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Kurogane Kosakusho currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 3 warning signs for Kurogane Kosakusho that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kurogane Kosakusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7997

Adequate balance sheet slight.

Market Insights

Community Narratives