Japanese Exchange Stocks Estimated To Be Undervalued By Up To 46.9%

Reviewed by Simply Wall St

Japan's stock markets have recently experienced a downturn, with the Nikkei 225 Index and TOPIX Index both declining amidst easing domestic inflation and speculation regarding the Bank of Japan's interest rate policies. Despite these challenges, this environment may present opportunities for investors to explore undervalued stocks that could offer potential value in a fluctuating economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Nihon Dempa Kogyo (TSE:6779) | ¥1040.00 | ¥1883.17 | 44.8% |

| Hagiwara Electric Holdings (TSE:7467) | ¥3395.00 | ¥6660.77 | 49% |

| Akatsuki (TSE:3932) | ¥1985.00 | ¥3639.74 | 45.5% |

| Pilot (TSE:7846) | ¥4741.00 | ¥8928.09 | 46.9% |

| Forum Engineering (TSE:7088) | ¥887.00 | ¥1602.50 | 44.6% |

| Adventure (TSE:6030) | ¥3750.00 | ¥7288.32 | 48.5% |

| S-Pool (TSE:2471) | ¥350.00 | ¥683.69 | 48.8% |

| KeePer Technical Laboratory (TSE:6036) | ¥4075.00 | ¥7838.96 | 48% |

| BayCurrent Consulting (TSE:6532) | ¥4849.00 | ¥9293.88 | 47.8% |

| Mercari (TSE:4385) | ¥2277.00 | ¥4259.44 | 46.5% |

Let's uncover some gems from our specialized screener.

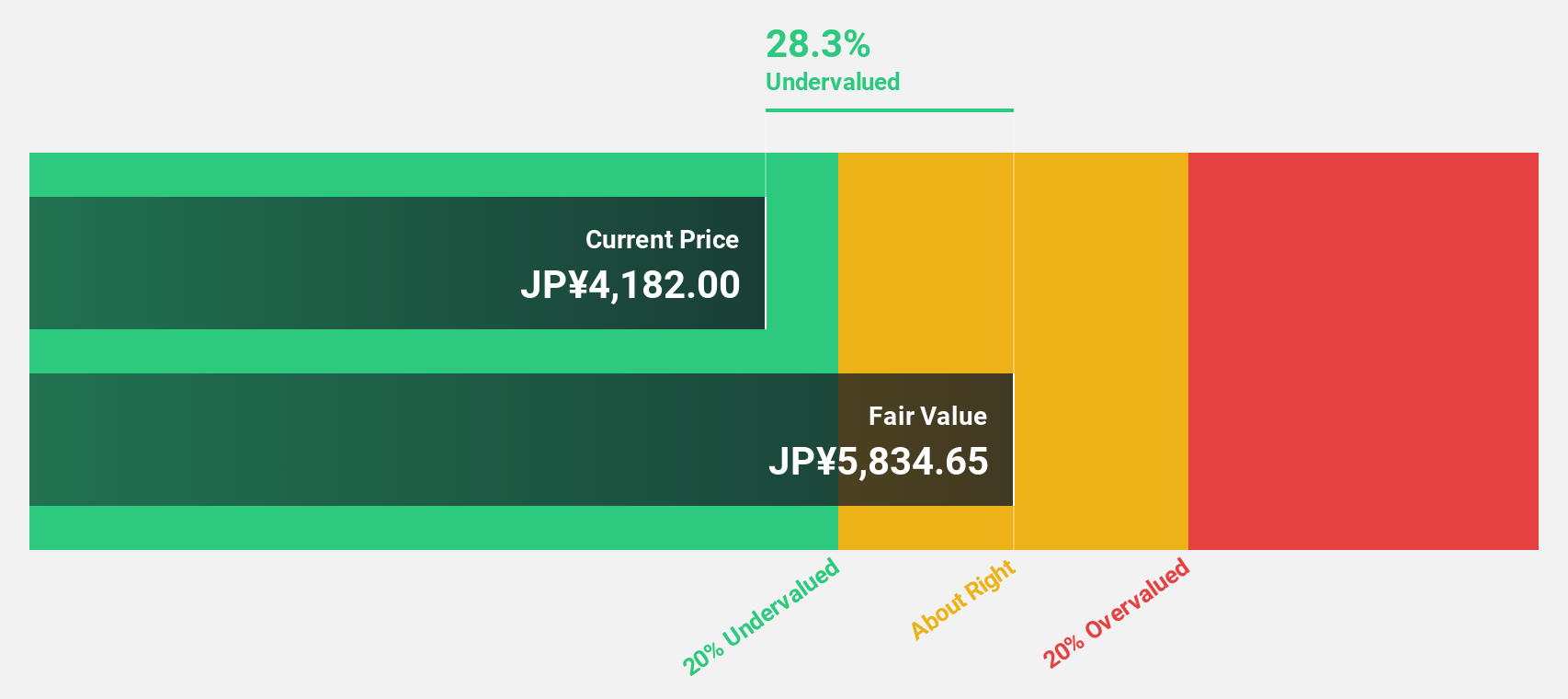

Japan Business Systems (TSE:5036)

Overview: Japan Business Systems, Inc. offers cloud integration and related services with a market cap of ¥44.95 billion.

Operations: Japan Business Systems, Inc.'s revenue is primarily derived from its cloud integration and related services.

Estimated Discount To Fair Value: 29.3%

Japan Business Systems is trading at ¥986, significantly below its estimated fair value of ¥1395.29, suggesting it is undervalued based on cash flows. Earnings are projected to grow rapidly at 45.79% annually, outpacing the broader Japanese market's growth rate of 8.8%. However, the dividend yield of 2.64% isn't well covered by free cash flows and there is a high level of debt present in its financial structure.

- According our earnings growth report, there's an indication that Japan Business Systems might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Japan Business Systems.

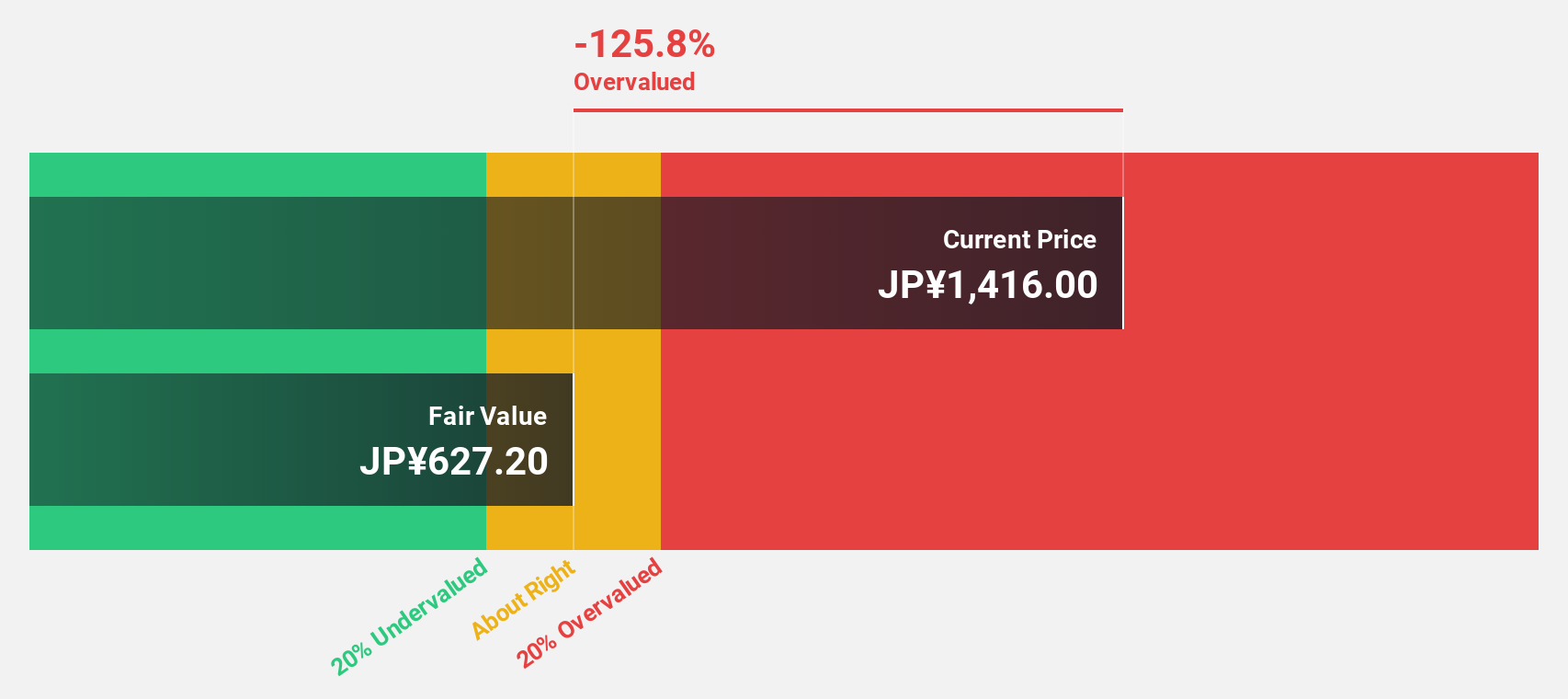

Forum Engineering (TSE:7088)

Overview: Forum Engineering Inc. offers personnel management services for mechanical and electrical engineers in Japan, with a market cap of ¥46.37 billion.

Operations: Revenue Segments (in millions of ¥): Personnel management services for mechanical engineers: ¥5,200; Personnel management services for electrical engineers: ¥3,800.

Estimated Discount To Fair Value: 44.6%

Forum Engineering is trading at ¥887, well below its estimated fair value of ¥1602.5, indicating it is undervalued based on cash flows. Earnings are expected to grow 12% annually, surpassing the Japanese market's 8.8% growth rate. Despite an unstable dividend track record and limited financial data availability, the company's addition to the S&P Global BMI Index highlights its potential for broader investor interest amidst a forecasted high return on equity of 26.9%.

- Our comprehensive growth report raises the possibility that Forum Engineering is poised for substantial financial growth.

- Navigate through the intricacies of Forum Engineering with our comprehensive financial health report here.

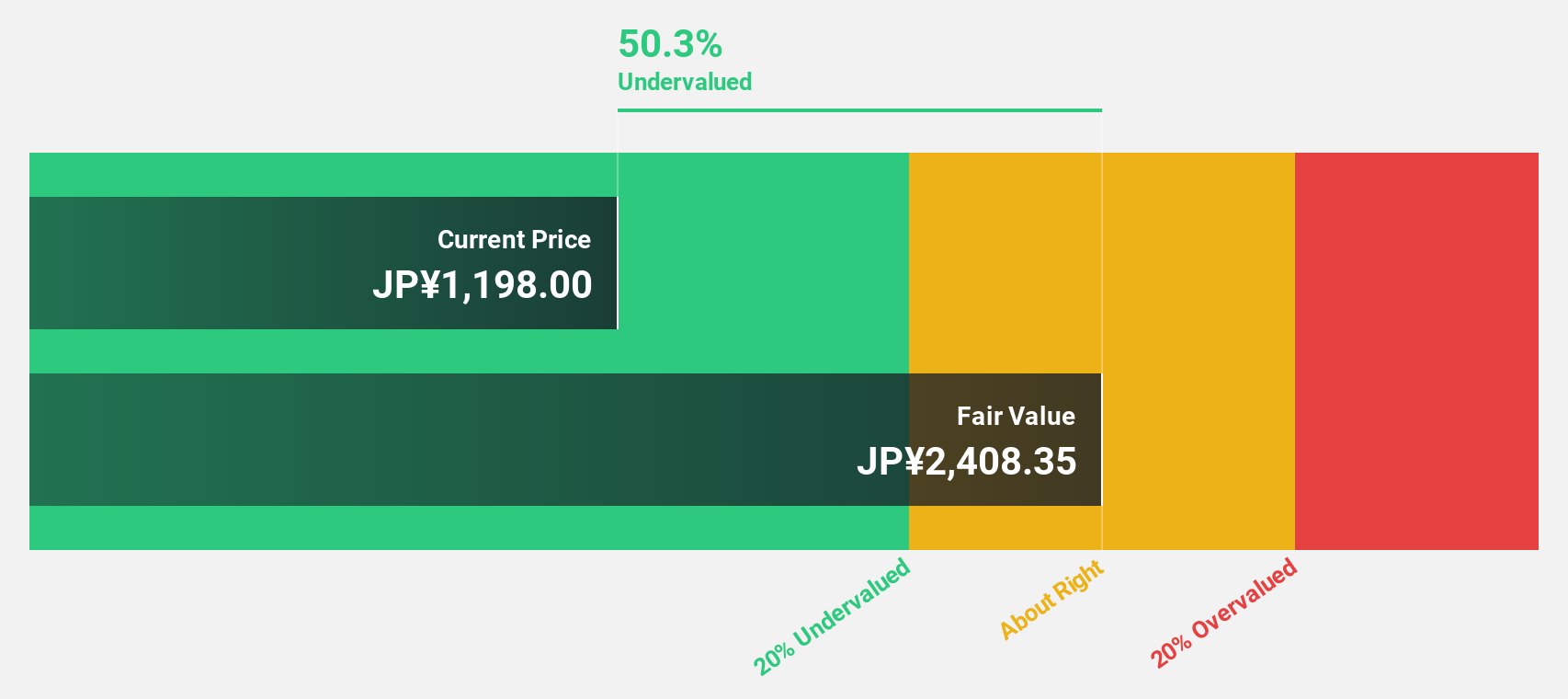

Pilot (TSE:7846)

Overview: Pilot Corporation manufactures, purchases, and sells writing instruments, stationery products, and toys across Japan, the Americas, Europe, and Asia with a market cap of ¥182.72 billion.

Operations: Revenue segments for the company include ¥20.93 billion from Asia, ¥84.15 billion from Japan, ¥25.87 billion from Europe, and ¥37.06 billion from the Americas.

Estimated Discount To Fair Value: 46.9%

Pilot is trading at ¥4,741, significantly below its estimated fair value of ¥8,928.09, highlighting its undervaluation based on cash flows. Earnings are projected to grow 9.7% annually, outpacing the Japanese market's 8.8% growth rate. However, the dividend yield of 2.24% isn't well supported by free cash flows. Recent strategic moves include a completed share buyback totaling ¥3,999.91 million and opening a Middle East office for market expansion research in Dubai.

- Upon reviewing our latest growth report, Pilot's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Pilot's balance sheet health report.

Key Takeaways

- Dive into all 82 of the Undervalued Japanese Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5036

Moderate and fair value.

Market Insights

Community Narratives