- Japan

- /

- Professional Services

- /

- TSE:6578

The Market Lifts CORREC Co., Ltd. (TSE:6578) Shares 28% But It Can Do More

CORREC Co., Ltd. (TSE:6578) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

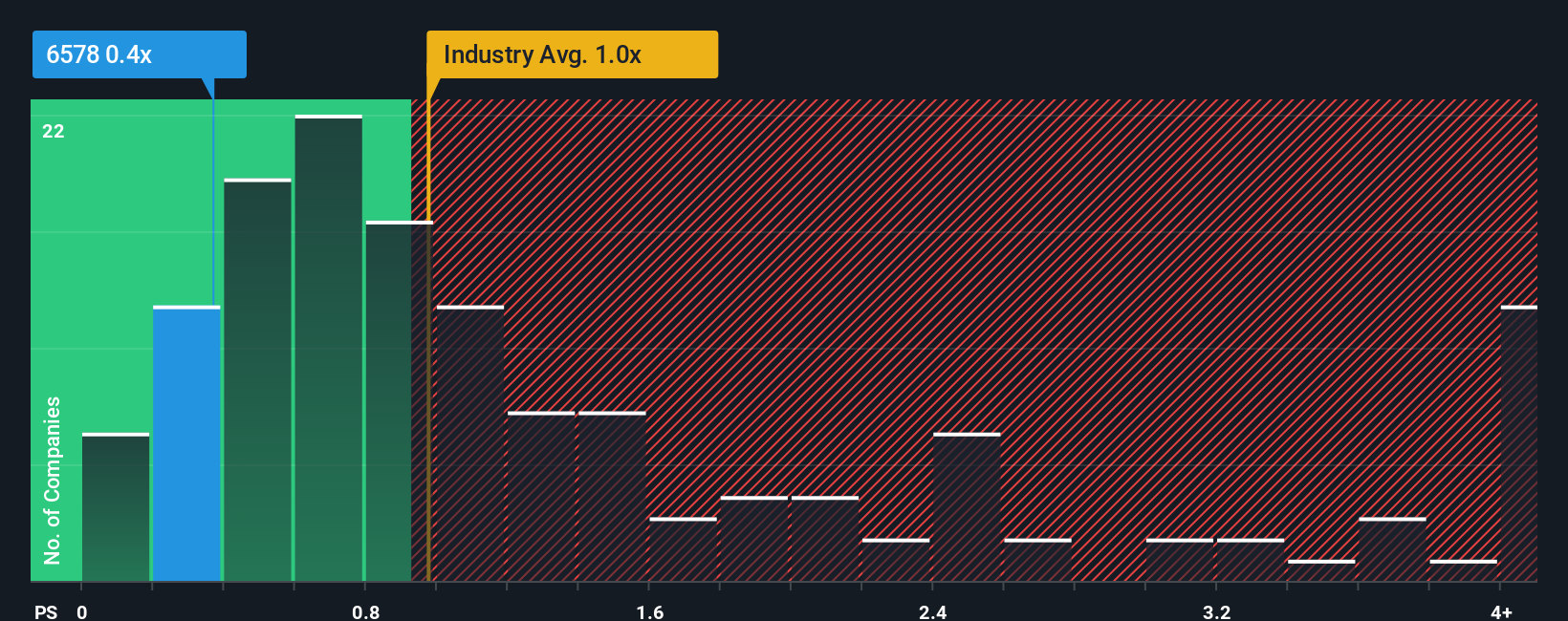

Even after such a large jump in price, considering around half the companies operating in Japan's Professional Services industry have price-to-sales ratios (or "P/S") above 1x, you may still consider CORREC as an solid investment opportunity with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for CORREC

What Does CORREC's P/S Mean For Shareholders?

Recent times have been quite advantageous for CORREC as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on CORREC's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as CORREC's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 50% last year. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 7.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that CORREC's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From CORREC's P/S?

CORREC's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see CORREC currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 4 warning signs we've spotted with CORREC (including 1 which is significant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6578

CORREC

Engages in the sales promotion, media, and application development and operation businesses in Japan.

Excellent balance sheet and good value.

Market Insights

Community Narratives