Stock Analysis

- Japan

- /

- Semiconductors

- /

- TSE:6920

Top Japanese Growth Companies With High Insider Ownership In May 2024

Reviewed by Simply Wall St

Despite some economic challenges, Japanese equities have shown resilience, with the Nikkei 225 Index gaining 1.5% recently. This backdrop provides a compelling context to explore growth companies in Japan, particularly those with high insider ownership which can indicate confidence from those closest to the company's operations and potential.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27.2% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 80.2% |

| Money Forward (TSE:3994) | 21.4% | 63.5% |

| Medley (TSE:4480) | 34% | 24.8% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 82.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Kusuri No Aoki Holdings (TSE:3549)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kusuri No Aoki Holdings Co., Ltd. operates primarily in Japan, focusing on the retail of pharmaceuticals, cosmetics, and daily goods with a market capitalization of approximately ¥297.88 billion.

Operations: The company primarily generates its revenue from the retail sales of pharmaceuticals, cosmetics, and everyday items.

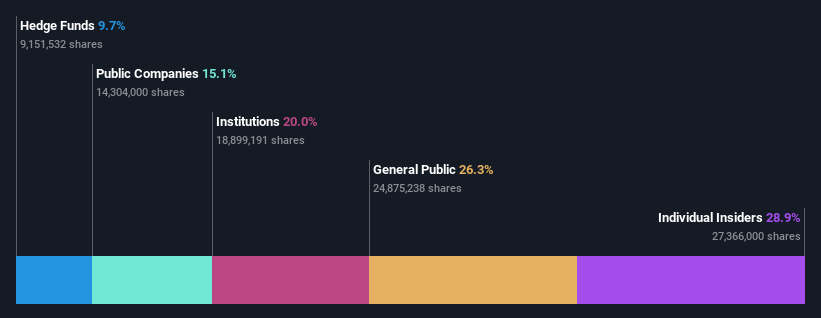

Insider Ownership: 28.9%

Kusuri No Aoki Holdings is trading at a significant discount, priced 18.6% below its estimated fair value. While the company's profit margins have dipped from last year, falling to 2%, it still promises robust growth prospects with earnings expected to rise by 21.83% annually and revenue forecasted to increase by 7% per year—both outpacing the broader Japanese market averages of 8.5% for earnings and 3.9% for revenue growth respectively. However, its Return on Equity is anticipated to remain low at around 14%.

- Click here to discover the nuances of Kusuri No Aoki Holdings with our detailed analytical future growth report.

- According our valuation report, there's an indication that Kusuri No Aoki Holdings' share price might be on the expensive side.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan and has a market capitalization of approximately ¥514.57 billion.

Operations: The firm generates revenue primarily through consulting services across diverse sectors in Japan.

Insider Ownership: 13.8%

BayCurrent Consulting is trading at a significant discount, 41.2% below its estimated fair value, and shows promising growth prospects with earnings expected to grow by 17.8% annually—double the Japanese market average. Despite a highly volatile share price recently, the company's revenue growth also outpaces market forecasts at 18.3% per year. Additionally, a recent share buyback program aims to enhance shareholder returns, demonstrating strong insider confidence despite no major insider trading reported in the last three months.

- Dive into the specifics of BayCurrent Consulting here with our thorough growth forecast report.

- Our valuation report here indicates BayCurrent Consulting may be undervalued.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lasertec Corporation specializes in designing, manufacturing, and selling inspection and measurement equipment both in Japan and globally, with a market capitalization of approximately ¥3.86 trillion.

Operations: The company generates revenue primarily through the design, manufacture, and sale of inspection and measurement equipment across both domestic and international markets.

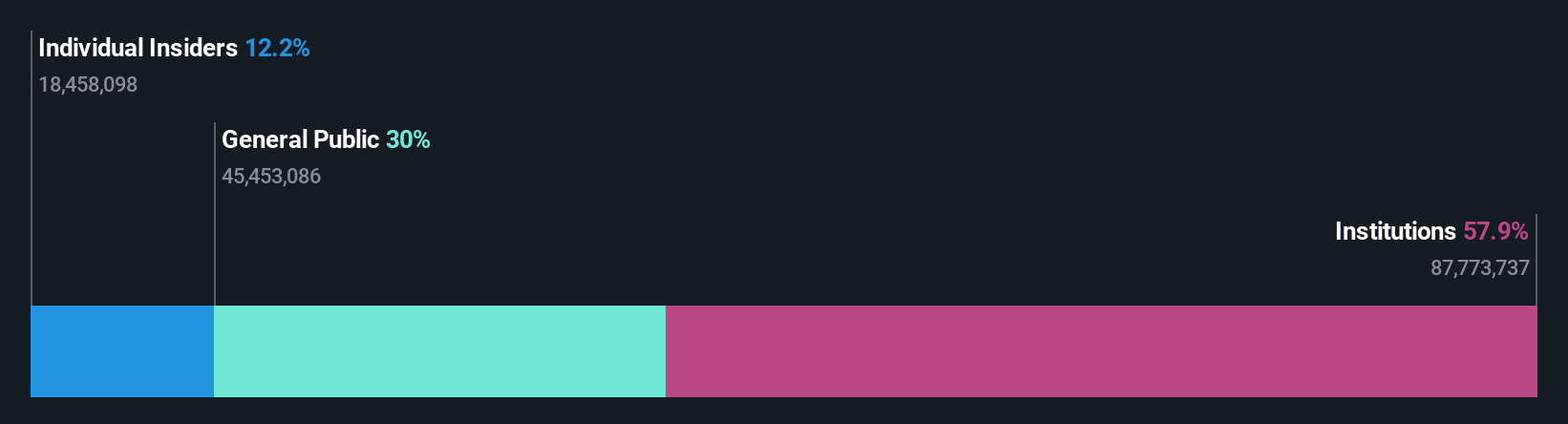

Insider Ownership: 12.1%

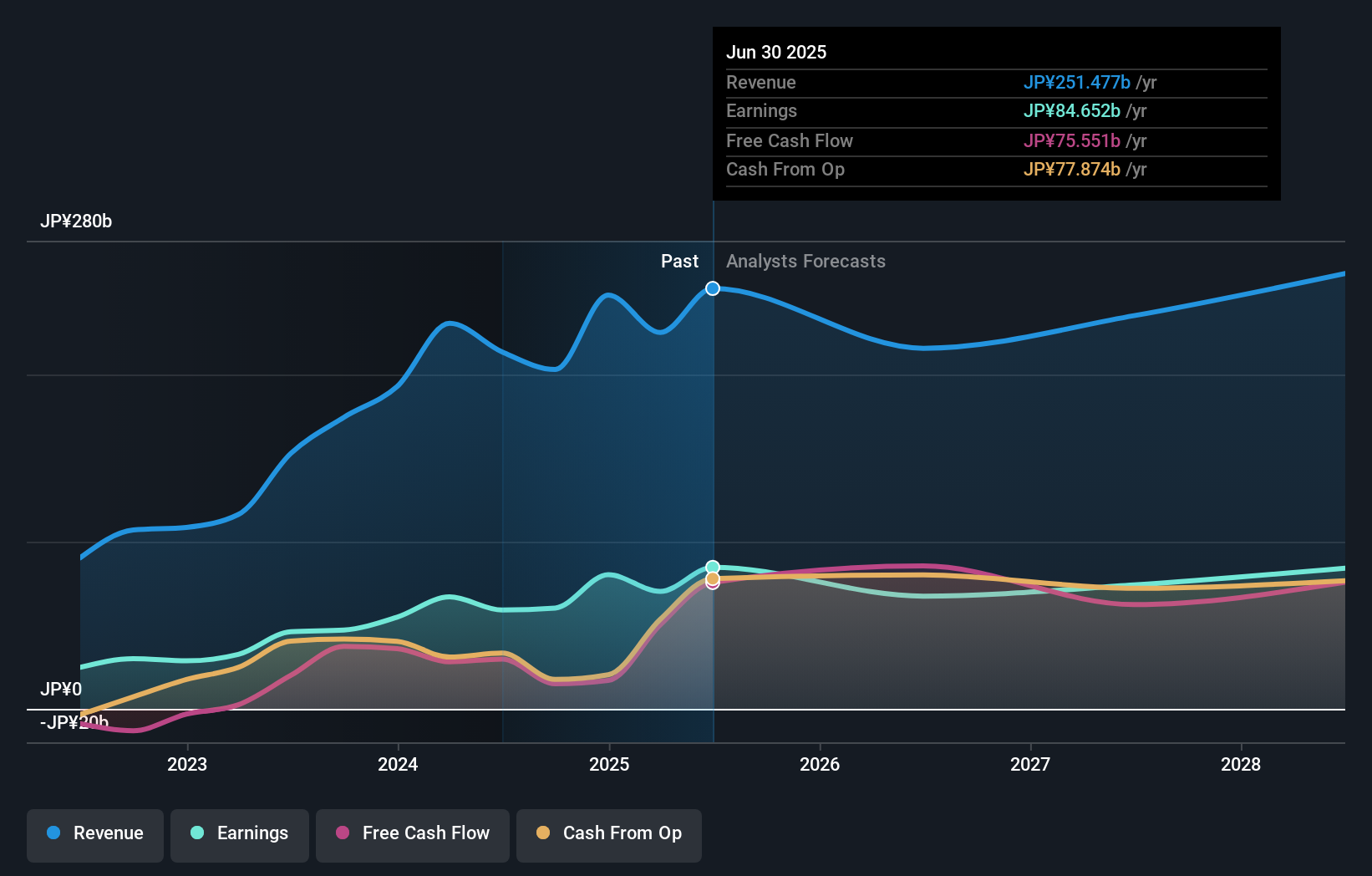

Lasertec, a growth-oriented firm in Japan with high insider ownership, is poised for robust expansion with earnings forecasted to grow by 20.71% annually, outpacing the Japanese market's 8.5%. Despite slower revenue growth projections at 17% per year compared to other high-growth firms, its Return on Equity is expected to be very high at 40.7%. Recent executive reshuffles aim to bolster leadership as it navigates a highly volatile share price environment.

- Click to explore a detailed breakdown of our findings in Lasertec's earnings growth report.

- In light of our recent valuation report, it seems possible that Lasertec is trading beyond its estimated value.

Summing It All Up

- Click here to access our complete index of 108 Fast Growing Japanese Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Lasertec is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Flawless balance sheet with high growth potential.