Stock Analysis

Three Japanese Exchange Growth Companies With Insider Ownership And Up To 83% Earnings Growth

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index climbing by 2.6% over the past week, buoyed by a historically weak yen that favors export-heavy industries. In such an environment, growth companies with high insider ownership can signal strong confidence in future prospects from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.4% | 27% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Hottolink (TSE:3680) | 27% | 57.4% |

| Medley (TSE:4480) | 34% | 28.7% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 44.6% |

| ExaWizards (TSE:4259) | 24.8% | 91.1% |

| Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

| Soracom (TSE:147A) | 17.2% | 54.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

DaikokutenbussanLtd (TSE:2791)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of approximately ¥118.95 billion.

Operations: The company generates its revenue through the operation of discount retail stores.

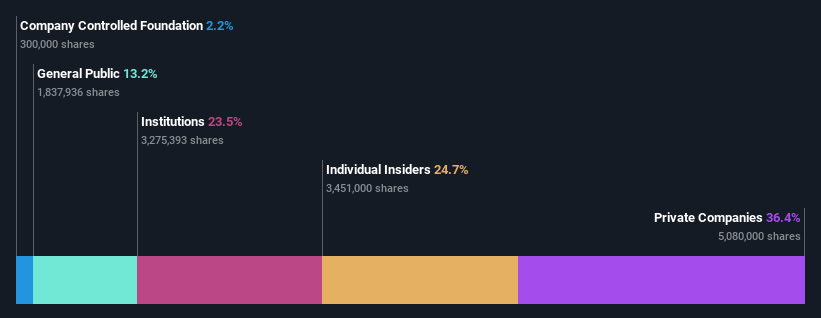

Insider Ownership: 24.7%

Earnings Growth Forecast: 25.5% p.a.

Daikokutenbussan Ltd., a growth-focused company in Japan with high insider ownership, shows promising financial forecasts. The firm's revenue is expected to increase by 7.3% annually, outpacing the Japanese market's 4.2% growth rate. More impressively, its earnings are projected to surge by 25.47% each year, significantly above the market average of 8.9%. Recently, Daikokutenbussan raised its dividend to JPY 33 per share and provided an upbeat earnings guidance for fiscal year ending May 2024, expecting net sales of JPY 270.48 billion and a profit of JPY 6.19 billion.

- Click to explore a detailed breakdown of our findings in DaikokutenbussanLtd's earnings growth report.

- In light of our recent valuation report, it seems possible that DaikokutenbussanLtd is trading beyond its estimated value.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving users globally, with a market capitalization of approximately ¥1.85 trillion.

Operations: The company generates revenue through its operations in e-commerce, fintech, digital content, and communications sectors on a global scale.

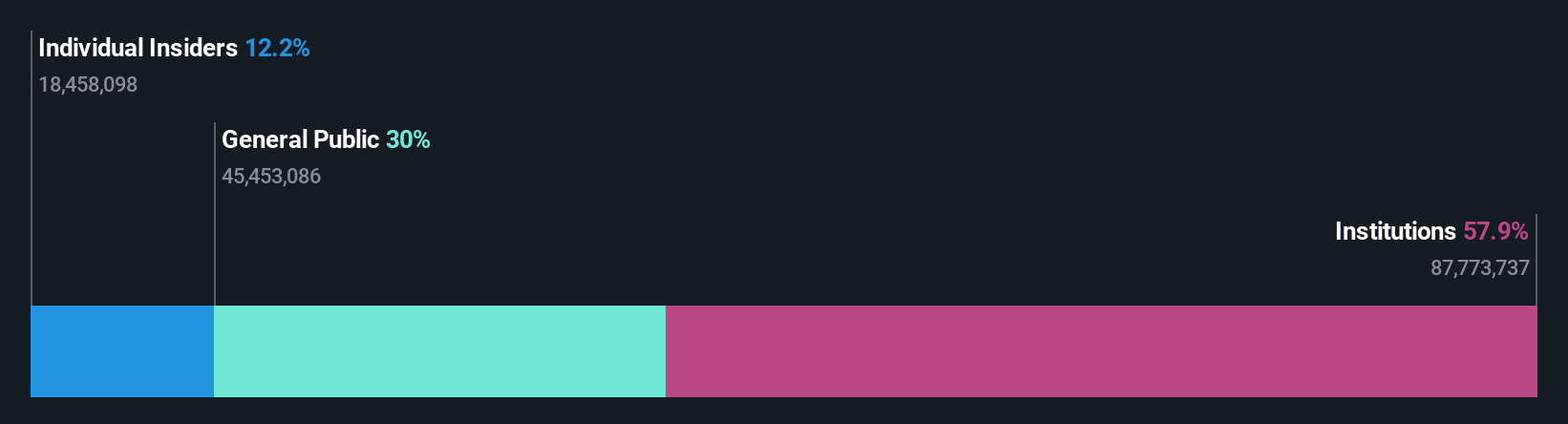

Insider Ownership: 17.3%

Earnings Growth Forecast: 83.2% p.a.

Rakuten Group, a Japanese company with significant insider ownership, is poised for notable growth. While its forecasted revenue growth of 7.7% annually outstrips the Japanese market expectation of 4.2%, its return on equity is expected to remain modest at 9.4%. The company recently guided towards strong double-digit growth in operating results for FY2024, excluding its securities business. Additionally, Rakuten successfully issued $1.99 billion in high-yield bonds, underscoring robust financial activity and expansion efforts.

- Unlock comprehensive insights into our analysis of Rakuten Group stock in this growth report.

- In light of our recent valuation report, it seems possible that Rakuten Group is trading behind its estimated value.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BayCurrent Consulting, Inc. offers consulting services across various sectors in Japan, with a market capitalization of approximately ¥506.75 billion.

Operations: The firm generates revenue through diverse consulting services across multiple sectors in Japan.

Insider Ownership: 13.9%

Earnings Growth Forecast: 18.4% p.a.

BayCurrent Consulting, a Japanese growth company with high insider ownership, has demonstrated robust financial health and strategic shareholder returns. Its earnings grew by 17.2% last year and are expected to increase by 18.36% annually. Recently, BayCurrent completed a share buyback for ¥3.6 billion, underscoring its commitment to capital efficiency and shareholder value enhancement. Despite its strong performance metrics, the stock trades at 54.8% below estimated fair value, presenting a potentially undervalued opportunity in the market.

- Navigate through the intricacies of BayCurrent Consulting with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that BayCurrent Consulting is priced lower than what may be justified by its financials.

Next Steps

- Click here to access our complete index of 98 Fast Growing Japanese Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Rakuten Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.