- Japan

- /

- Professional Services

- /

- TSE:6183

BELLSYSTEM24 Holdings (TSE:6183) Profit Margin Jumps on One-Off Gain, Testing Market Optimism

Reviewed by Simply Wall St

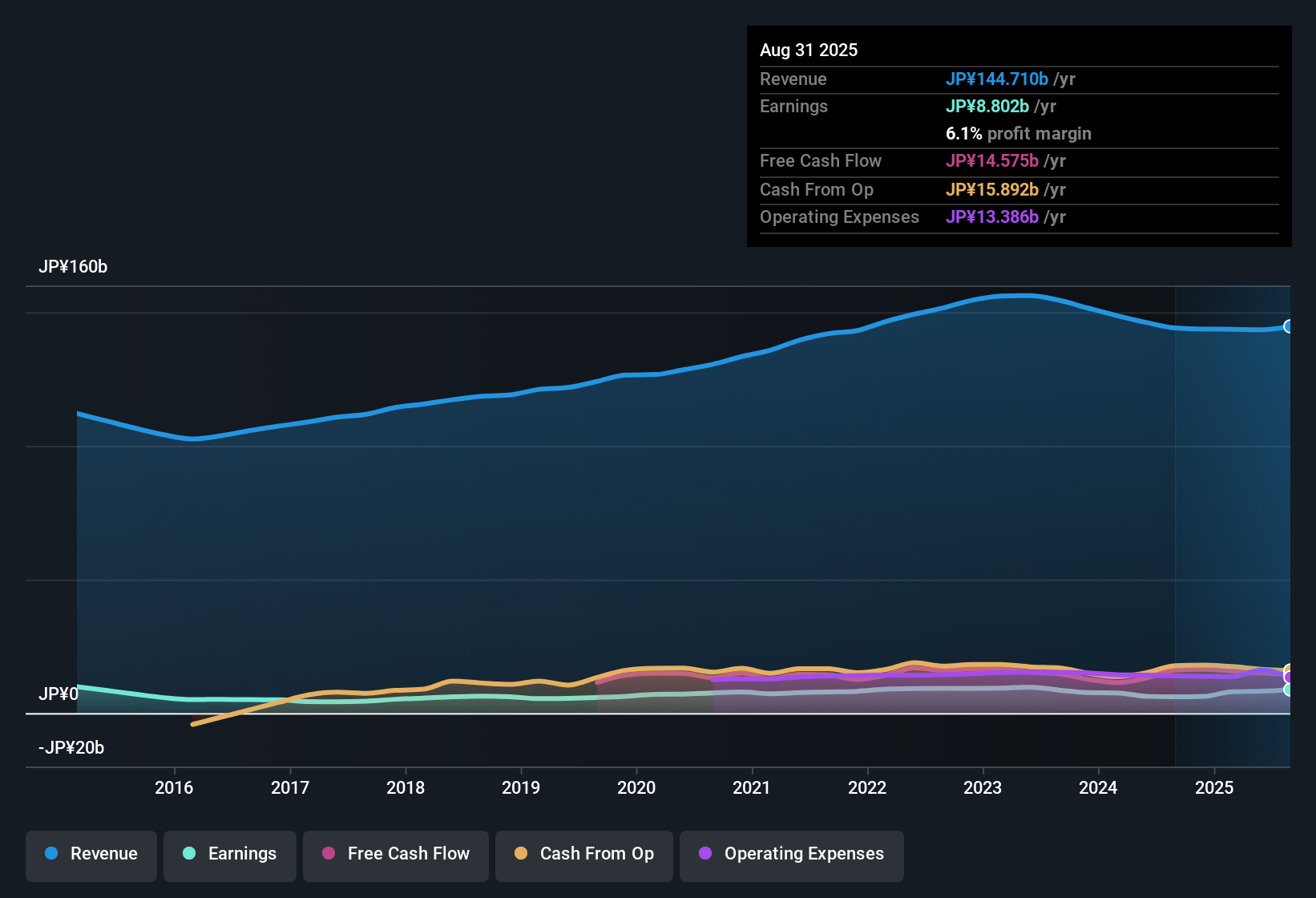

BELLSYSTEM24 Holdings (TSE:6183) posted a net profit margin of 6.1%, up from 4.2% last year, and delivered a 45.1% jump in earnings over the past 12 months, which marks a notable change from the company’s prior five-year record of annual declines averaging 1.3%. Looking ahead, analysts forecast earnings growth of 5.9% per year, which trails the broader Japanese market’s 8.2%. Revenue is projected to grow at 4.5% annually, edging out the market average. The stock trades at a Price-to-Earnings Ratio of 11.1x, well below its industry and peer averages, with the current share price of ¥1,320 significantly under an estimated fair value of ¥3,520.47.

See our full analysis for BELLSYSTEM24 Holdings.The next section will break down how these latest numbers compare with the most widely followed narratives around BELLSYSTEM24 Holdings and where those stories may get a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Skews Recent Profit Margin

- The latest net profit margin of 6.1% includes a significant one-time gain of ¥2.1 billion, which is not part of regular operations and may exaggerate the company’s underlying profitability.

- Many investors would expect robust profit margins to automatically translate into sustainable performance; however, this figure is unusually elevated due to the rare boost from that one-off gain.

- Unlike recurring trends, such non-operational windfalls make it difficult to judge if the business’s margin improvement will persist next year.

- With reported results temporarily enhanced, some may overestimate the true health of the company’s core operations if they do not adjust for this gain.

Revenue Growth Slightly Outpaces Market

- Revenue is projected to expand at 4.5% per year, putting BELLSYSTEM24 just ahead of the Japanese market average rate of 4.4% annually.

- Some investors may believe that outpacing the broader market hints at future upside, but a closer look shows the difference is minimal.

- The edge is slim; this suggests the company is not dramatically outgrowing peers, even as its relative valuation looks appealing in other areas.

- Given this, focusing on incremental growth rather than breakthrough momentum is likely the more realistic approach for now.

Trading Far Below DCF Fair Value

- With shares at ¥1,320, BELLSYSTEM24 trades well below its DCF fair value estimate of ¥3,520.47, as well as below the peer and industry average multiples.

- The gap between current price and DCF value raises questions about whether the market is discounting concerns or simply missing the upside.

- Low valuation multiples could attract value-focused investors; however, recent profits benefitted from one-off gains rather than pure operational strength.

- Those looking for a cheap entry point still need to weigh the clarity and repeatability of future earnings before concluding the market overcorrected.

Want to see how this valuation gap plays out as new narratives develop around BELLSYSTEM24 Holdings? Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on BELLSYSTEM24 Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While BELLSYSTEM24 Holdings trades below fair value, its recent profit margin was lifted by a one-off gain. This raises questions about the consistency of its underlying performance.

If you’re looking to avoid companies where temporary boosts mask true results, consider steadier picks that show consistent expansion through cycles with our stable growth stocks screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BELLSYSTEM24 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6183

BELLSYSTEM24 Holdings

Provides outsourcing, technology, and consulting services related to customer relationship management solutions (CRM) primarily in Japan.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives