3 Japanese Stocks Estimated To Be Up To 36.1% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant declines, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index losing 4.2%. Amid this downturn, investors are increasingly looking for opportunities in undervalued stocks that may offer substantial upside potential once market conditions stabilize. In such a volatile environment, identifying stocks trading below their intrinsic value can be particularly advantageous. These stocks often present an attractive entry point for long-term investors seeking to capitalize on future growth prospects while minimizing downside risk.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3395.00 | ¥6777.77 | 49.9% |

| I-PEX (TSE:6640) | ¥1460.00 | ¥2881.48 | 49.3% |

| Avant Group (TSE:3836) | ¥2042.00 | ¥4003.05 | 49% |

| Pilot (TSE:7846) | ¥4451.00 | ¥8898.73 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥4015.00 | ¥7897.36 | 49.2% |

| Adventure (TSE:6030) | ¥3845.00 | ¥7538.32 | 49% |

| SHIFT (TSE:3697) | ¥11820.00 | ¥23367.79 | 49.4% |

| CIRCULATIONLtd (TSE:7379) | ¥651.00 | ¥1283.63 | 49.3% |

| TORIDOLL Holdings (TSE:3397) | ¥3392.00 | ¥6653.32 | 49% |

| BayCurrent Consulting (TSE:6532) | ¥4891.00 | ¥9520.59 | 48.6% |

Let's explore several standout options from the results in the screener.

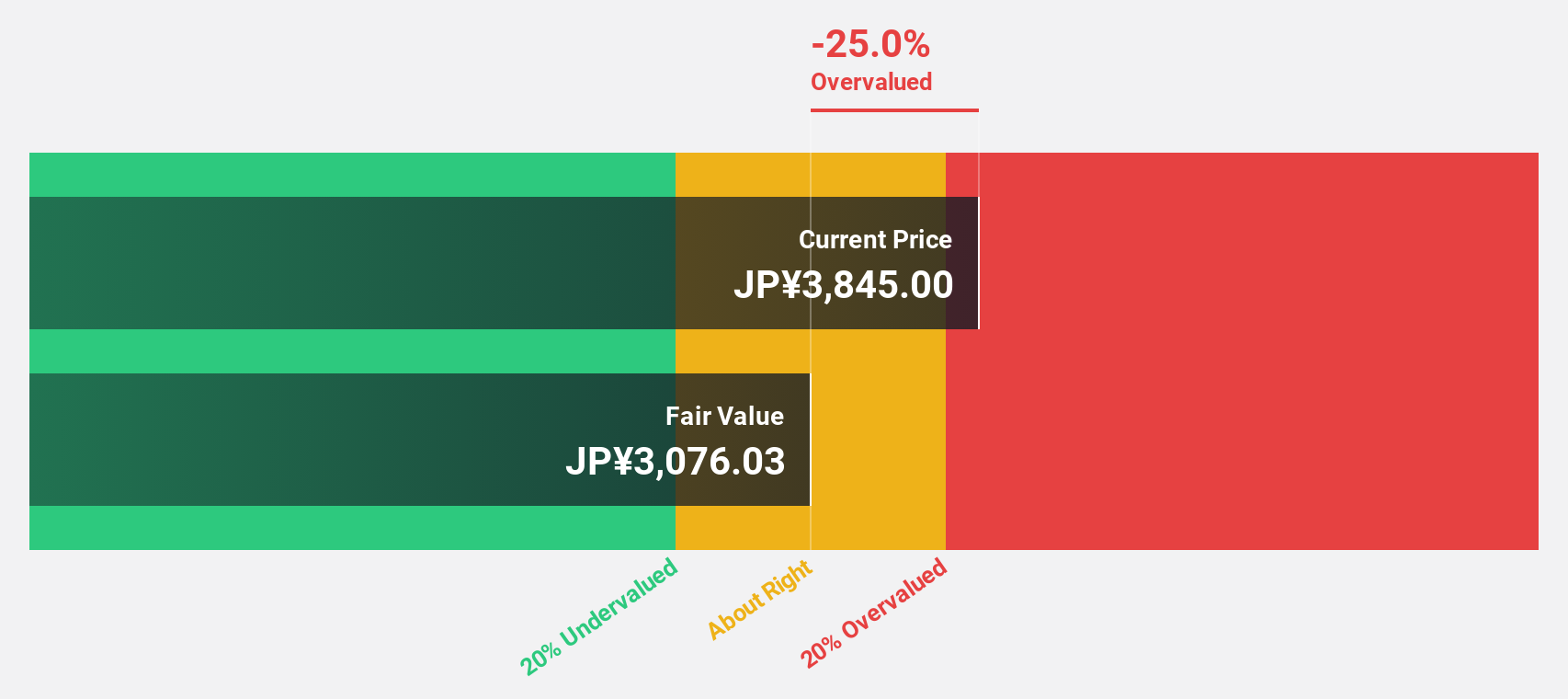

Simplex Holdings (TSE:4373)

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥142.94 billion.

Operations: Revenue from the provision of IT solutions amounted to ¥42.26 billion.

Estimated Discount To Fair Value: 36.1%

Simplex Holdings is trading 36.1% below its estimated fair value of ¥3847.16, with current earnings growing at 26.6% annually over the past five years and projected to grow by 20.2% per year, outpacing the Japanese market's average growth of 8.5%. Despite a highly volatile share price recently, analysts agree on a potential price rise of 34.4%, supported by forecasted revenue growth of 12.8% annually, faster than the market's average rate of 4.2%.

- According our earnings growth report, there's an indication that Simplex Holdings might be ready to expand.

- Click here to discover the nuances of Simplex Holdings with our detailed financial health report.

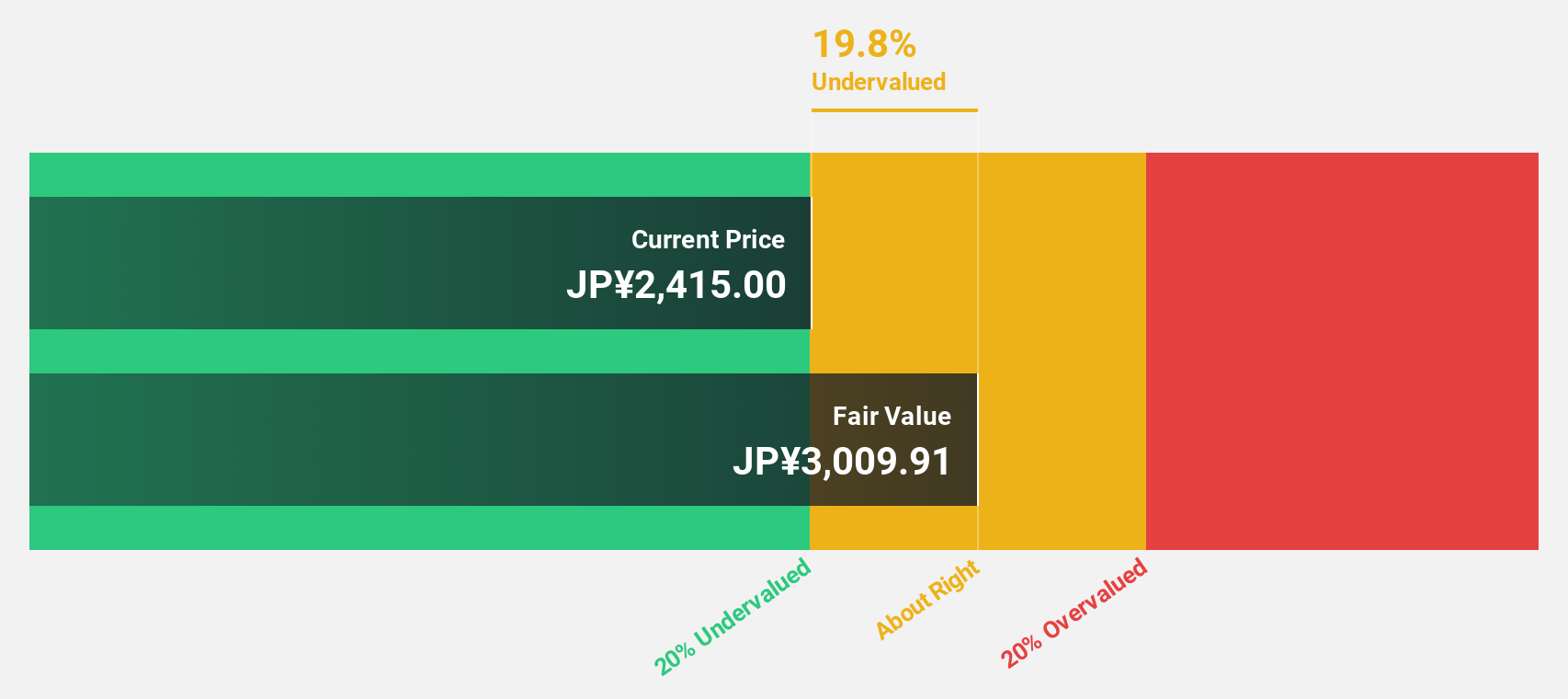

Shiseido Company (TSE:4911)

Overview: Shiseido Company, Limited is a global cosmetics manufacturer and retailer based in Japan with a market cap of ¥1.28 trillion.

Operations: Shiseido's revenue segments include ¥279.41 billion from Japan, ¥253.08 billion from China, ¥134.42 billion from EMEA, ¥120.34 billion from the Americas, ¥122.20 billion from Travel Retail, and ¥76.29 billion from Asia-Pacific operations.

Estimated Discount To Fair Value: 24.8%

Shiseido Company is trading at ¥3121, significantly below its estimated fair value of ¥4148.59. Despite a recent buyback of 300,000 shares for ¥1.04 billion and a dividend payout of JPY 30 per share, profit margins have declined from 2.8% to 1%. However, earnings are forecasted to grow by 35.5% annually over the next three years, outpacing the market's average growth rate of 8.5%, indicating strong future cash flows despite current challenges in profitability and dividend coverage.

- The growth report we've compiled suggests that Shiseido Company's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Shiseido Company.

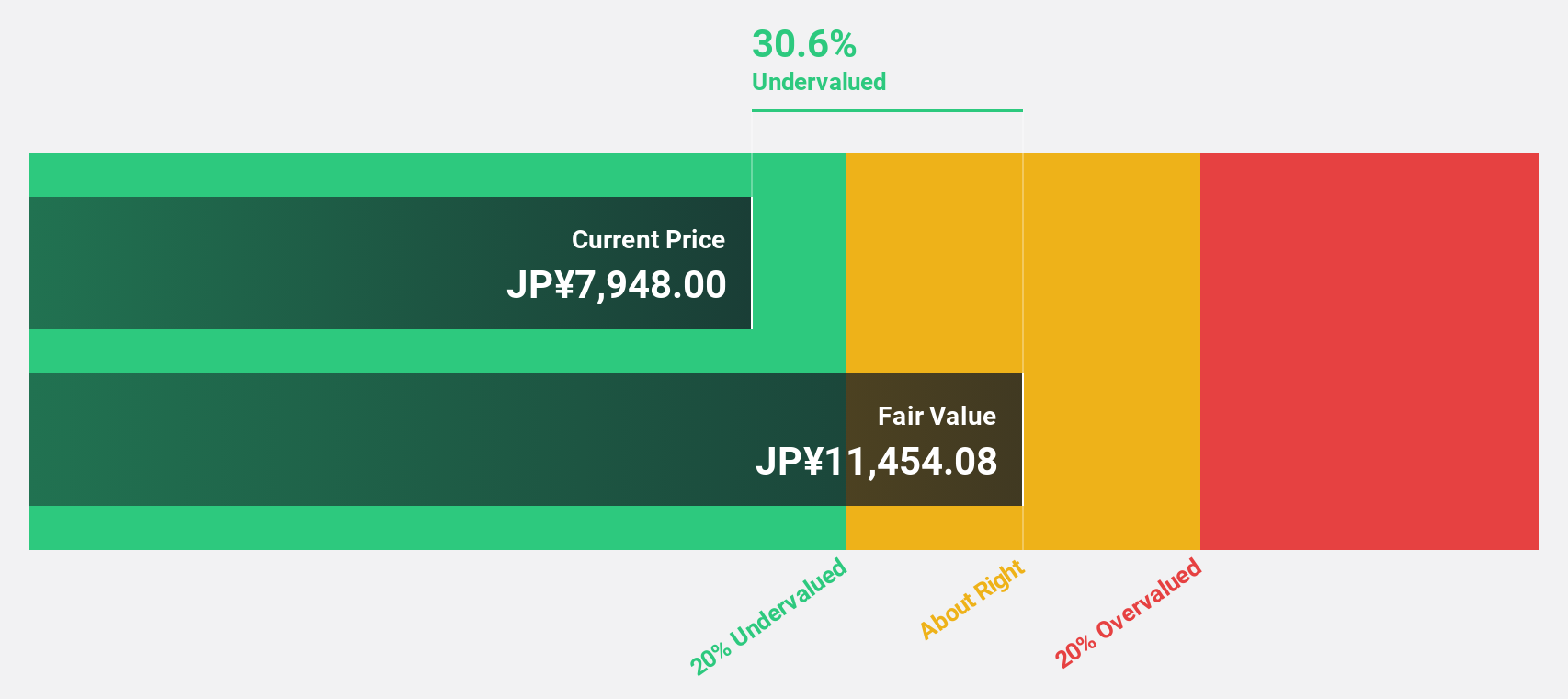

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. provides HR technology and business solutions that transform the world of work, with a market cap of ¥12.55 trillion.

Operations: The company generates revenue from three main segments: Staffing (¥1.66 billion), HR Technology (¥1.04 billion), and Matching & Solutions (¥0.81 billion).

Estimated Discount To Fair Value: 17%

Recruit Holdings is trading at ¥8425, below its estimated fair value of ¥10145.04. The company's earnings grew by 27.7% over the past year and are forecast to grow 9.31% annually, outpacing the Japanese market's average growth rate of 8.5%. Recent buyback programs aim to enhance shareholder returns using existing cash reserves, further supporting its undervaluation based on cash flows despite moderate revenue growth projections of 4.6% annually.

- Our comprehensive growth report raises the possibility that Recruit Holdings is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Recruit Holdings stock in this financial health report.

Where To Now?

- Unlock our comprehensive list of 80 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4373

Simplex Holdings

Provides strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and the public sectors worldwide.

Good value with reasonable growth potential.