Exploring Appier Group And 2 Other High Growth Tech Stocks In Japan

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced a downturn, with the Nikkei 225 Index and the broader TOPIX Index both registering significant losses. This market sentiment, driven by factors such as semiconductor stocks tracking a U.S.-led sell-off and yen strength impacting export-oriented companies, has created an environment where identifying high-growth tech stocks requires careful consideration of their resilience and potential for innovation. In this context, we will explore Appier Group and two other high-growth tech stocks in Japan that stand out due to their strong fundamentals and strategic positioning within the industry.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

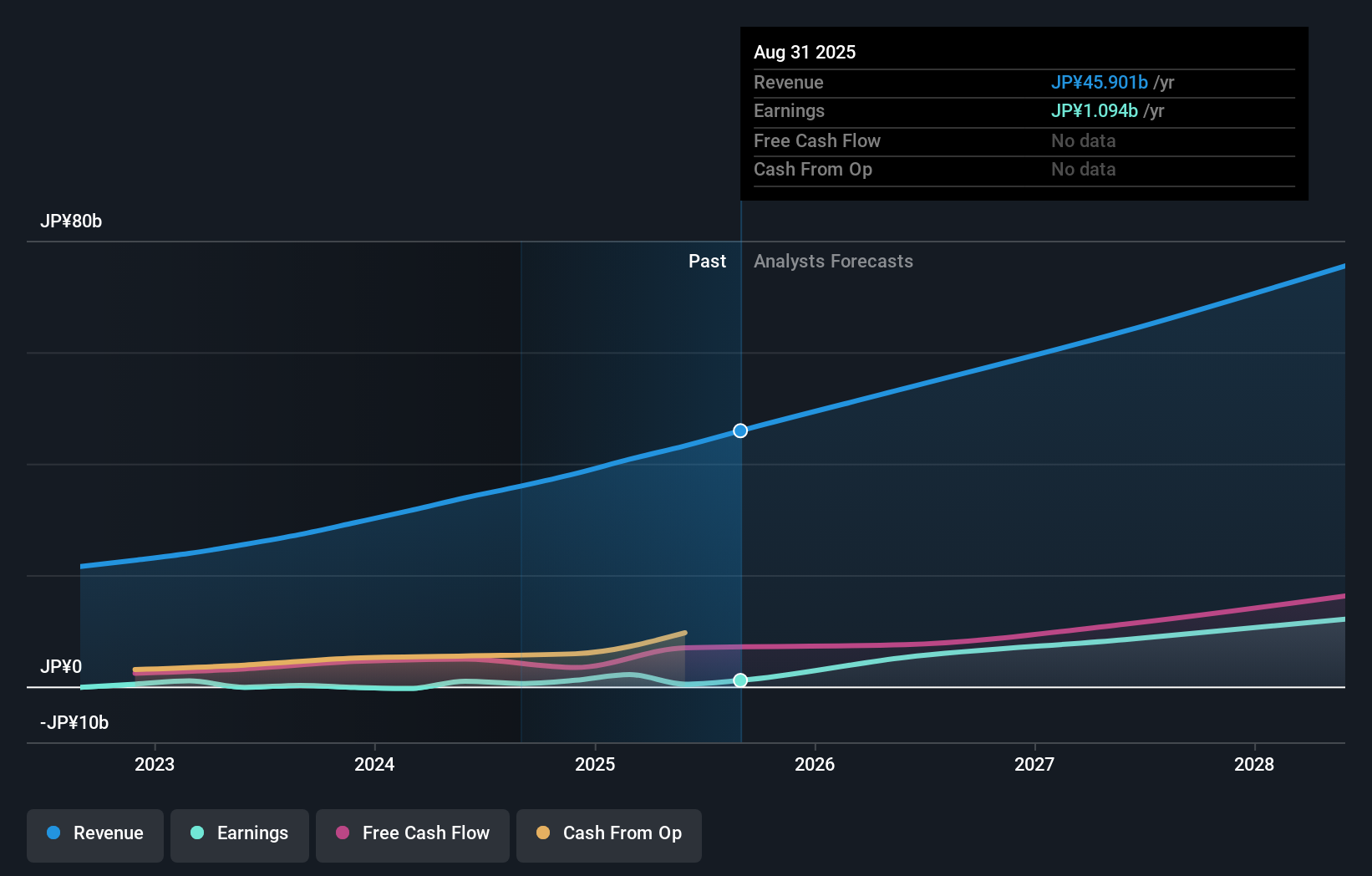

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions in Japan and internationally, with a market cap of ¥173.06 billion.

Operations: Appier Group, Inc. generates revenue primarily through its AI SaaS business, which reported ¥14.70 billion in revenue. The company focuses on providing AI-driven platforms for enterprise decision-making across various markets.

Appier Group's recent partnership with Huy Thanh Jewelry exemplifies its AI-driven personalization capabilities, boosting the client's ROI by 6.2 times. The company forecasts a 19.9% annual revenue growth and a significant 38.6% earnings increase per year, outpacing the Japanese market's average growth rates of 4.2% and 8.5%, respectively. With ¥1 billion allocated for share repurchases to enhance shareholder returns, Appier continues to invest in innovation, as evidenced by their robust R&D expenditure aimed at sustaining competitive advantages in AI technology.

- Click here and access our complete health analysis report to understand the dynamics of Appier Group.

Gain insights into Appier Group's past trends and performance with our Past report.

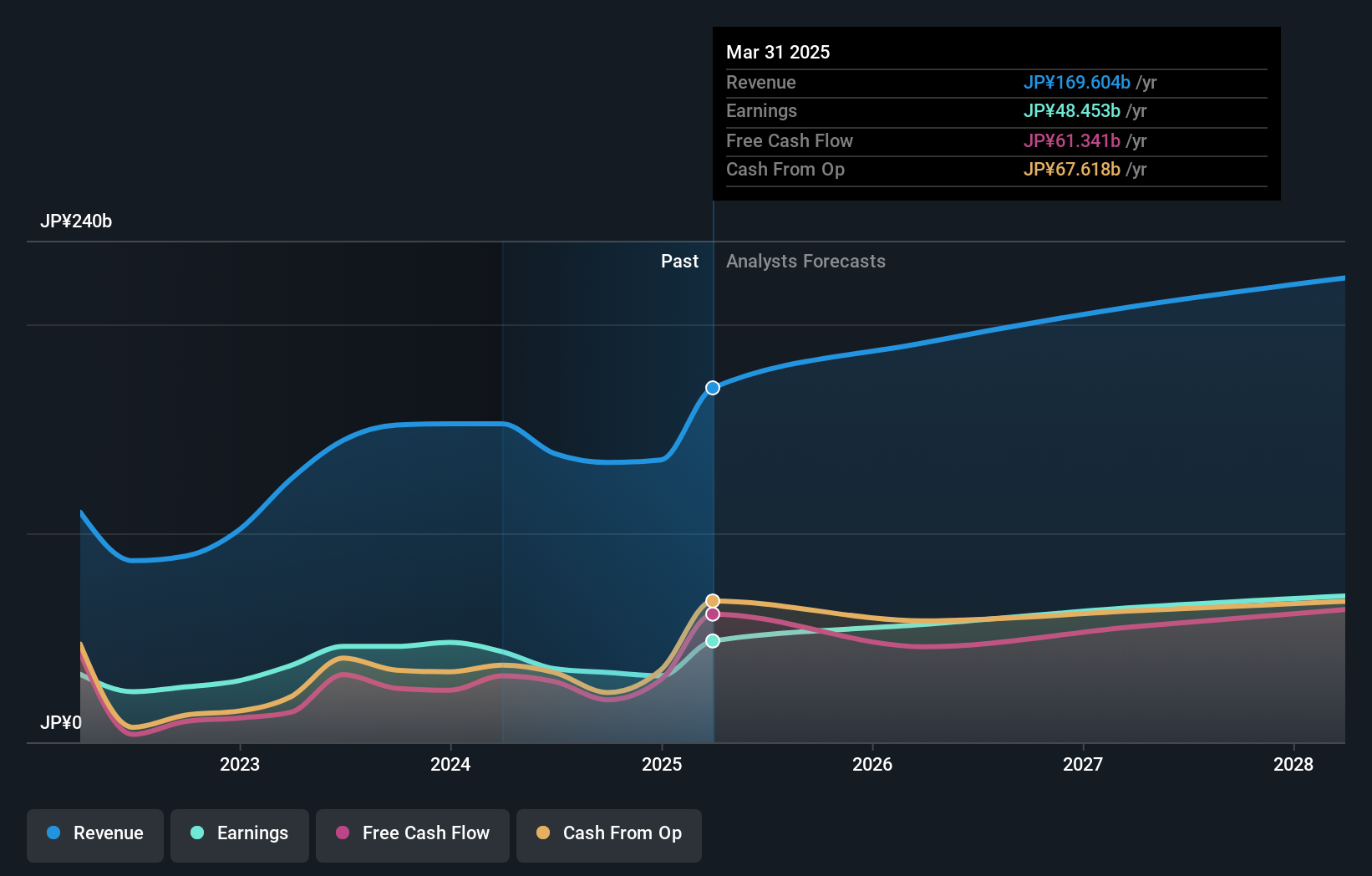

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. engages in the planning, development, and selling of cloud-based solutions in Japan and has a market cap of ¥294.88 billion.

Operations: Sansan, Inc. focuses on developing and selling cloud-based solutions in Japan. The company generates revenue primarily through its cloud services, targeting business card management and contact management solutions for enterprises.

Sansan's revenue is forecasted to grow at 16.2% annually, outpacing the Japanese market's average of 4.2%. The company's earnings are expected to surge by 35.6% per year, significantly higher than the market average of 8.5%. With a robust R&D expenditure that has historically been a key driver for innovation, Sansan continues to invest heavily in this area, ensuring sustained competitive advantages in its software offerings. Recently, the company repurchased 141,700 shares for ¥299.95 million as part of its shareholder return strategy.

- Click to explore a detailed breakdown of our findings in Sansan's health report.

Examine Sansan's past performance report to understand how it has performed in the past.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. plans, develops, manufactures, sells, and distributes home video games, online games, mobile games, and arcade games in Japan and internationally with a market cap of ¥1.34 trillion.

Operations: Capcom generates revenue primarily from Digital Content (¥103.38 billion), Amusement Facilities (¥20.09 billion), and Amusement Equipment (¥10.34 billion). The company operates in both domestic and international markets, focusing on various gaming segments including home video games, online games, mobile games, and arcade games.

Capcom's earnings are forecast to grow at 14.5% annually, outpacing the Japanese market's average of 8.5%. Despite a recent negative earnings growth of -23.3%, the company's revenue is expected to increase by 9.5% per year, highlighting its resilience and potential for recovery. The company has also been actively investing in R&D, with expenditures contributing significantly to its innovative game development pipeline, ensuring sustained competitive advantages in the entertainment industry.

- Click here to discover the nuances of Capcom with our detailed analytical health report.

Understand Capcom's track record by examining our Past report.

Where To Now?

- Explore the 125 names from our Japanese High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

A software-as-a-service company, provides artificial intelligence (AI) platforms for enterprises to make data-driven decisions in Japan and internationally.

Flawless balance sheet with reasonable growth potential.