- Japan

- /

- Electrical

- /

- TSE:6643

3 Japanese Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

Japan’s stock markets have recently experienced a downturn, with the Nikkei 225 Index falling by 5.8% and the broader TOPIX Index losing 4.2%, driven in part by a sell-off in semiconductor stocks and yen strength affecting export-oriented companies. Despite these challenges, dividend stocks can offer stability and income potential, making them an attractive option for investors seeking reliable returns. In this article, we will explore three Japanese dividend stocks yielding up to 4.1%, highlighting their potential benefits in the current market environment.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.35% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.94% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 4.01% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.12% | ★★★★★★ |

| Innotech (TSE:9880) | 4.94% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.71% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.85% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

Click here to see the full list of 490 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Max (TSE:6454)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Max Co., Ltd., along with its subsidiaries, manufactures and sells industrial and office equipment both in Japan and internationally, with a market cap of ¥165.60 billion.

Operations: Max Co., Ltd. generates revenue from three main segments: Office Equipment (¥21.15 billion), Industrial Equipment (¥63.64 billion), and Home Care & Rehabilitation Equipment (¥3.23 billion).

Dividend Yield: 3%

Max Co., Ltd. offers a reliable dividend yield of 3.02%, though it is lower than the top 25% of dividend payers in Japan. The company's dividends are well covered by earnings (Payout Ratio: 43.4%) and cash flows (Cash Payout Ratio: 49.6%). Dividends have been stable and growing over the past decade, supported by strong earnings growth of 30.5% last year. Recent guidance revisions indicate improved financial performance, further bolstering its dividend sustainability.

- Take a closer look at Max's potential here in our dividend report.

- Our valuation report here indicates Max may be overvalued.

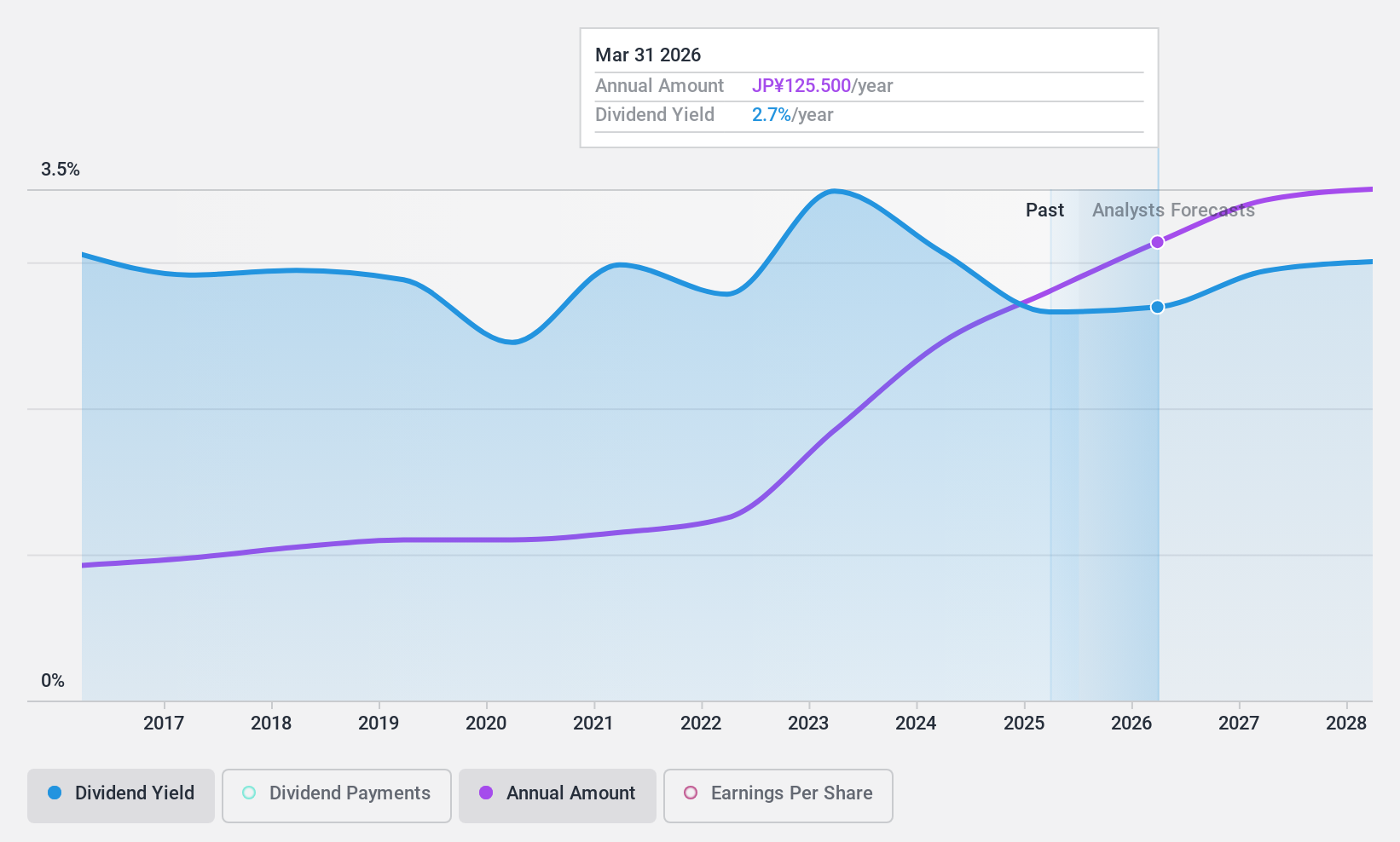

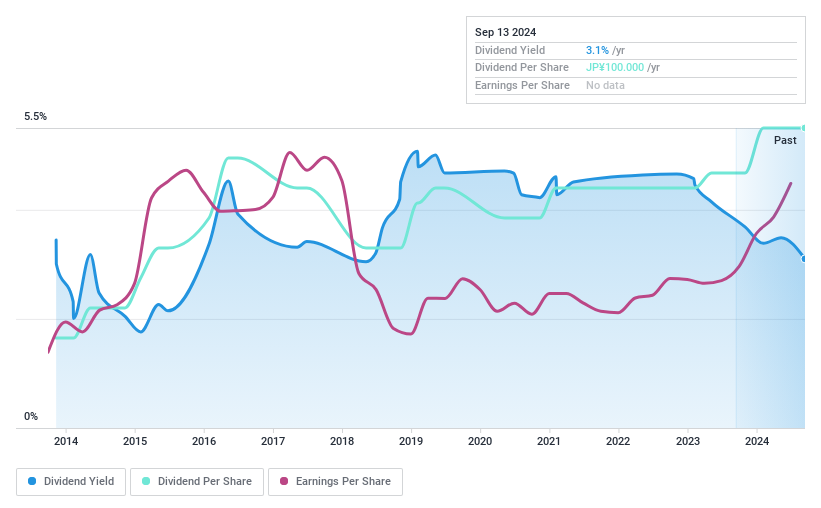

Togami Electric Mfg (TSE:6643)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Togami Electric Mfg. Co., Ltd. manufactures and sells power distribution and control equipment in Japan, with a market cap of ¥16.05 billion.

Operations: Togami Electric Mfg. Co., Ltd.'s revenue segments include the manufacturing and sale of power distribution and control equipment in Japan.

Dividend Yield: 3.1%

Togami Electric Mfg. Co., Ltd. recently announced a share repurchase program worth ¥400 million to enhance shareholder returns and improve capital efficiency. The company's dividend payments, covered by both earnings (Payout Ratio: 22.5%) and cash flows (Cash Payout Ratio: 76.7%), have increased over the past decade but remain volatile. Trading at 26% below its estimated fair value, it offers a dividend yield of 3.07%, lower than Japan's top quartile payers (3.8%).

- Navigate through the intricacies of Togami Electric Mfg with our comprehensive dividend report here.

- The analysis detailed in our Togami Electric Mfg valuation report hints at an deflated share price compared to its estimated value.

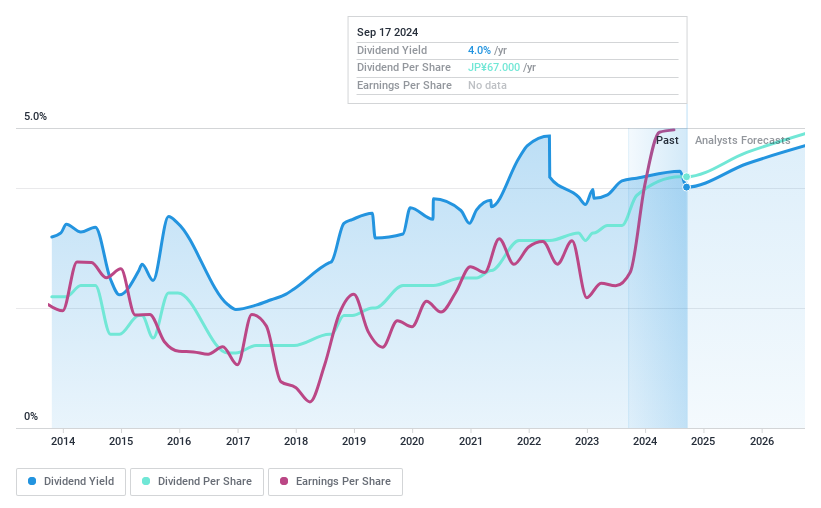

TOYO (TSE:8151)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TOYO Corporation offers measurement solutions in Japan with a market cap of ¥35.50 billion.

Operations: TOYO Corporation's revenue segments include Life Science (¥940.16 million), Physics / Energies (¥9.03 billion), EMC / Antenna Systems (¥4.64 billion), Marine/Special Aircraft (¥1.82 billion), Mechatronics / Noise & Vibration (¥7.23 billion), Software Quality and Productivity (¥2.14 billion) and Telecommunications/Information Security (¥7.14 billion).

Dividend Yield: 4.1%

TOYO Corporation's dividend yield of 4.12% is among the top 25% in Japan but isn't well covered by free cash flows. Despite a low payout ratio (44.1%), dividends have been volatile over the past decade, though they have increased recently, with guidance for JPY 42.00 per share this fiscal year, up from JPY 32.00 last year. The company has also authorized a buyback plan to enhance shareholder returns and improve capital efficiency.

- Click to explore a detailed breakdown of our findings in TOYO's dividend report.

- Upon reviewing our latest valuation report, TOYO's share price might be too optimistic.

Summing It All Up

- Delve into our full catalog of 490 Top Japanese Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Togami Electric Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6643

Togami Electric Mfg

Engages in manufacturing and sale of power distribution and control equipment in Japan.

Flawless balance sheet with solid track record and pays a dividend.