- Japan

- /

- Professional Services

- /

- TSE:4746

Toukei Computer (TSE:4746) sheds 9.4% this week, as yearly returns fall more in line with earnings growth

It hasn't been the best quarter for Toukei Computer Co., Ltd. (TSE:4746) shareholders, since the share price has fallen 13% in that time. But in stark contrast, the returns over the last half decade have impressed. Indeed, the share price is up an impressive 111% in that time. We think it's more important to dwell on the long term returns than the short term returns. Ultimately business performance will determine whether the stock price continues the positive long term trend.

In light of the stock dropping 9.4% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

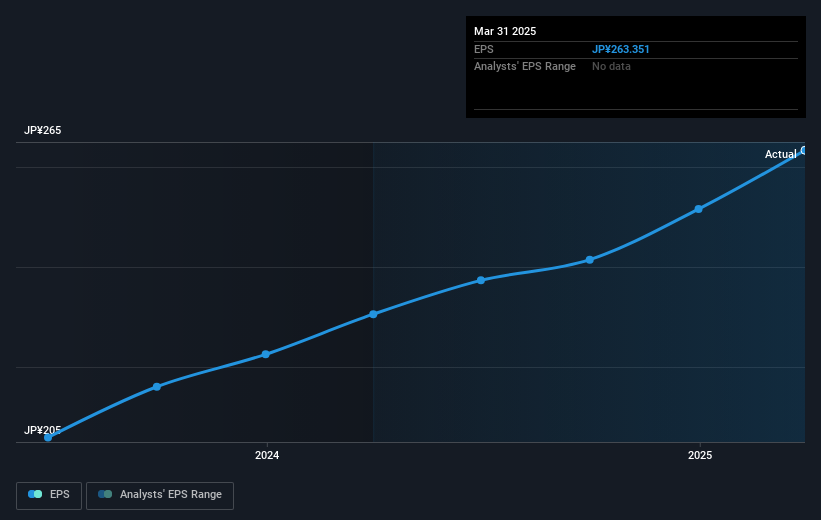

During five years of share price growth, Toukei Computer achieved compound earnings per share (EPS) growth of 13% per year. So the EPS growth rate is rather close to the annualized share price gain of 16% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Toukei Computer's key metrics by checking this interactive graph of Toukei Computer's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Toukei Computer the TSR over the last 5 years was 147%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Toukei Computer shareholders have received returns of 2.5% over twelve months (even including dividends), which isn't far from the general market return. It has to be noted that the recent return falls short of the 20% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Toukei Computer a stock worth watching. Before forming an opinion on Toukei Computer you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

If you're looking to trade Toukei Computer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toukei Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4746

Toukei Computer

Engages in the system design, development, and operation of solutions for various industries and businesses in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives