In the current global market landscape, uncertainty surrounding policy changes and economic indicators has led to fluctuating sector performances, with financials and energy benefiting from potential deregulation while healthcare faces challenges. Amidst these dynamics, dividend stocks can offer investors a degree of stability through regular income streams. A good dividend stock typically combines a reliable payout history with resilience in diverse market conditions, making it an appealing choice for those seeking consistent returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Petronet LNG (NSEI:PETRONET)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Petronet LNG Limited is involved in the import, storage, regasification, and supply of liquefied natural gas (LNG) in India, with a market cap of ₹4.85 trillion.

Operations: Petronet LNG Limited generates its revenue primarily from the import and processing of liquefied natural gas, amounting to ₹549.80 billion.

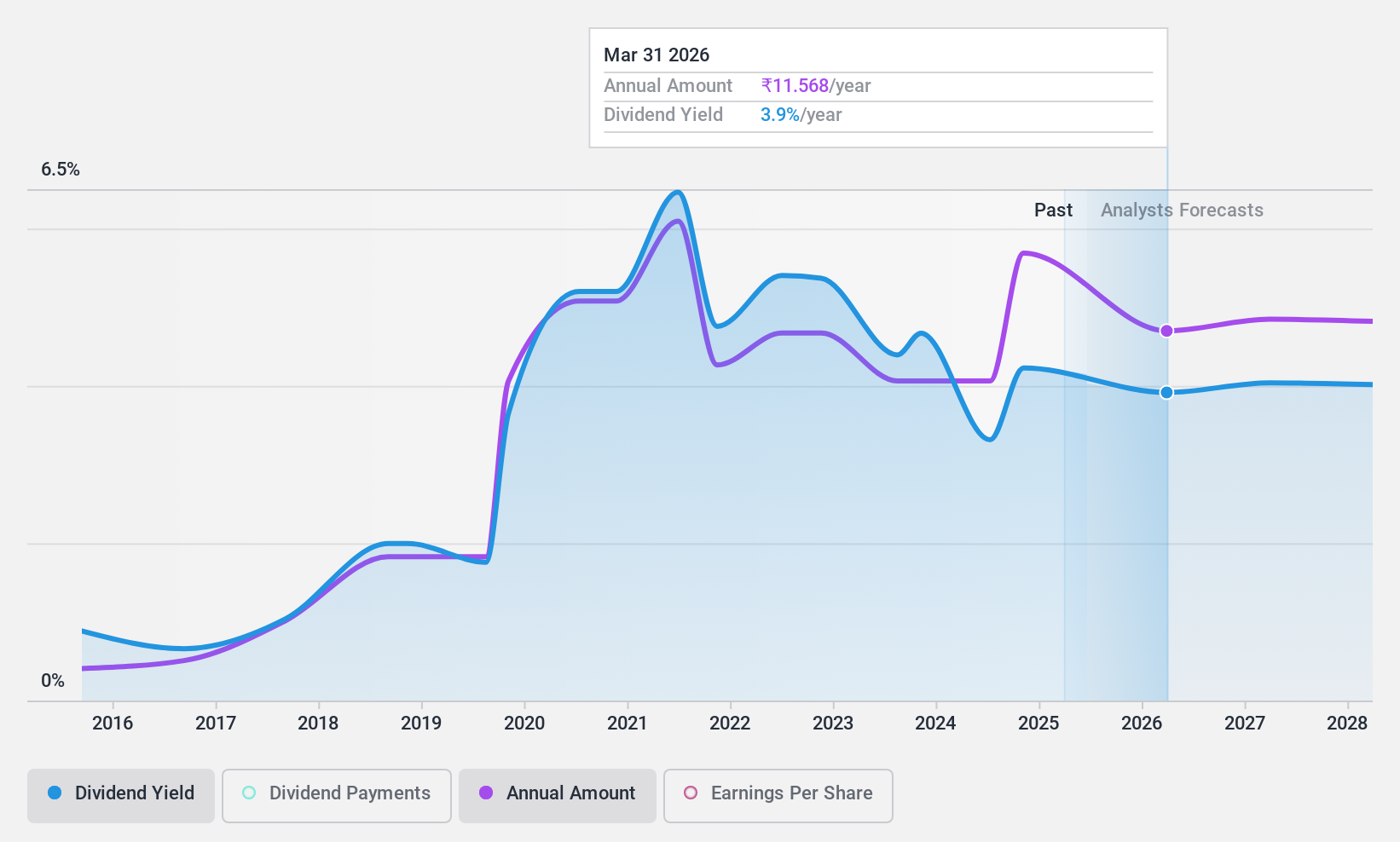

Dividend Yield: 3.1%

Petronet LNG's dividend payments have grown over the past decade, yet they remain volatile and unreliable. Despite this, the company offers a compelling dividend yield of 3.09%, placing it in the top 25% of Indian market payers. The payout ratios are low, with earnings covering dividends at 11.4% and cash flows at 39.9%, indicating sustainability. Recent agreements to supply propylene and hydrogen may support future earnings stability.

- Click here to discover the nuances of Petronet LNG with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Petronet LNG is trading beyond its estimated value.

Prestige International (TSE:4290)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prestige International Inc. offers business process outsourcing services both in Japan and internationally, with a market cap of ¥86.47 billion.

Operations: Prestige International Inc.'s revenue is derived from its business process outsourcing services provided both domestically and internationally.

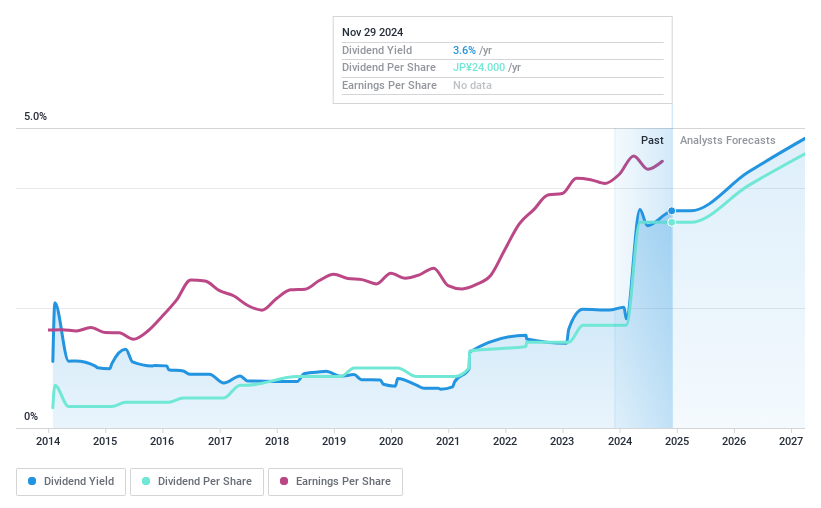

Dividend Yield: 3.5%

Prestige International's dividend payments are well-covered by earnings with a payout ratio of 40.5%, though cash flow coverage is tighter at 84.5%. Despite past volatility, dividends have grown over the last decade. The company trades at a significant discount to its estimated fair value, and recent share buyback plans aim to enhance shareholder returns. However, its dividend yield of 3.54% remains below Japan's top quartile payers, highlighting potential limitations for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Prestige International.

- Upon reviewing our latest valuation report, Prestige International's share price might be too pessimistic.

Sanyo Shokai (TSE:8011)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanyo Shokai Ltd. is a Japanese company involved in the manufacture and sale of men's and women's clothing and accessories, with a market cap of ¥31.19 billion.

Operations: Sanyo Shokai Ltd. generates its revenue through the production and distribution of apparel and accessories for both men and women within Japan.

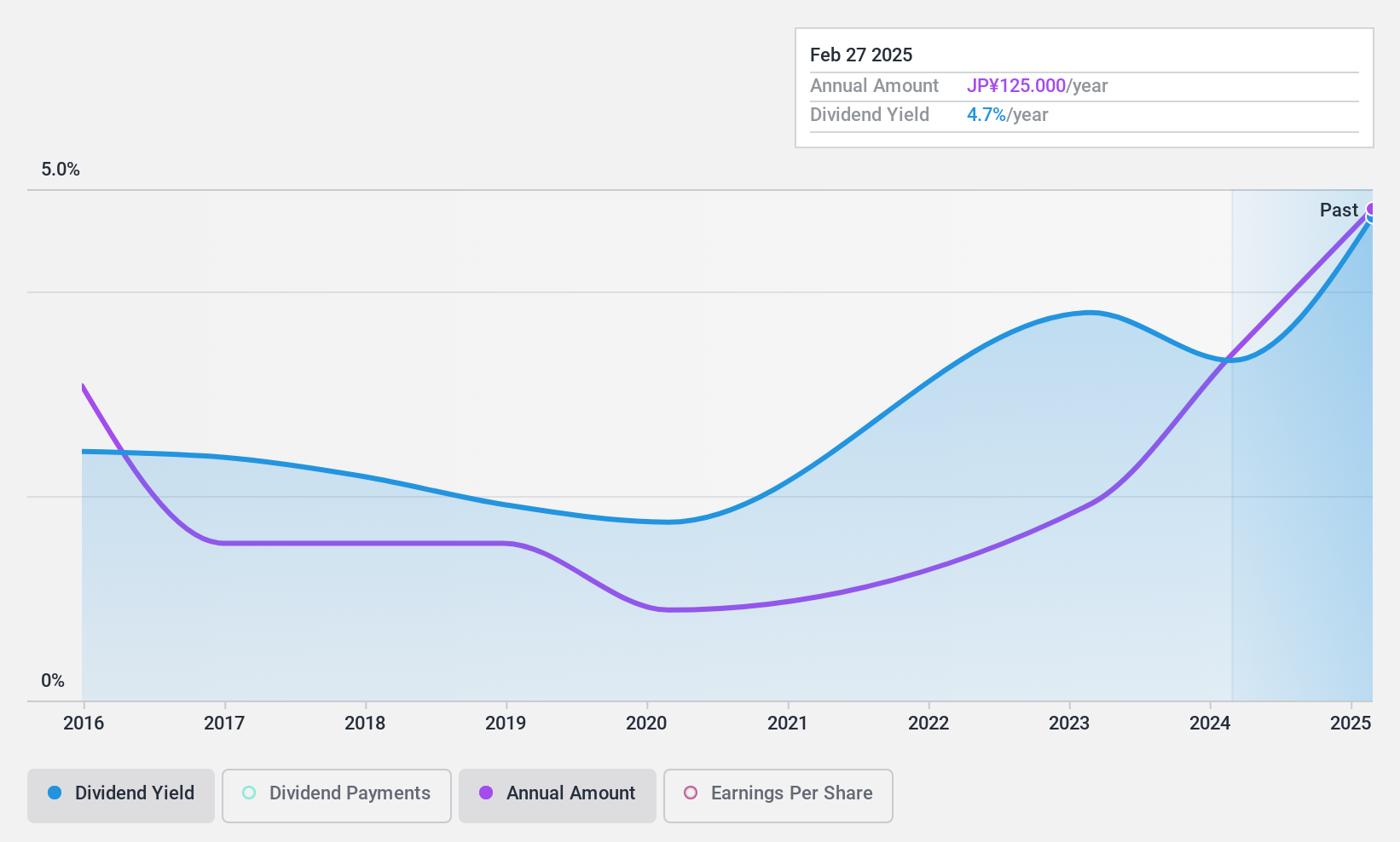

Dividend Yield: 4.7%

Sanyo Shokai's dividends, covered by a low payout ratio of 41.1% and cash payout ratio of 36.8%, are supported by earnings and cash flows, yet have been volatile over the past decade. Despite this instability, dividend payments have increased in the same period. The stock trades at a significant discount to its estimated fair value and offers a competitive yield within Japan's top quartile. A recent ¥3 billion share buyback program aims to enhance shareholder returns and capital efficiency.

- Get an in-depth perspective on Sanyo Shokai's performance by reading our dividend report here.

- Our valuation report unveils the possibility Sanyo Shokai's shares may be trading at a discount.

Summing It All Up

- Reveal the 1950 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8011

Sanyo Shokai

Engages in the manufacture and sale of men's and women's clothes and accessories in Japan.

Flawless balance sheet established dividend payer.