- Japan

- /

- Professional Services

- /

- TSE:4177

The Market Lifts i-plug,Inc. (TSE:4177) Shares 27% But It Can Do More

The i-plug,Inc. (TSE:4177) share price has done very well over the last month, posting an excellent gain of 27%. Unfortunately, despite the strong performance over the last month, the full year gain of 3.2% isn't as attractive.

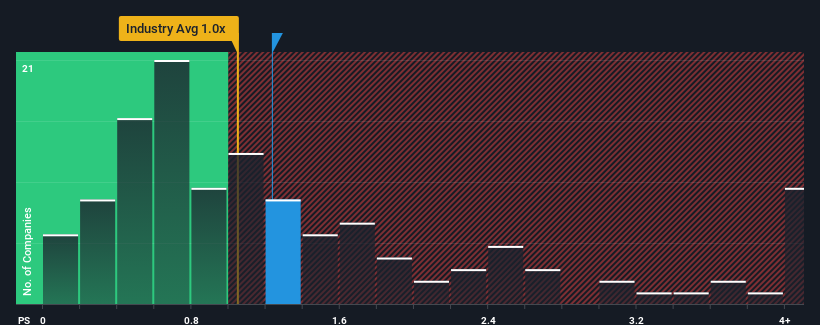

Even after such a large jump in price, it's still not a stretch to say that i-plugInc's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Professional Services industry in Japan, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for i-plugInc

What Does i-plugInc's P/S Mean For Shareholders?

Recent times have been advantageous for i-plugInc as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on i-plugInc.How Is i-plugInc's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like i-plugInc's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an excellent 114% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.6% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that i-plugInc's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On i-plugInc's P/S

i-plugInc's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that i-plugInc currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with i-plugInc, and understanding them should be part of your investment process.

If you're unsure about the strength of i-plugInc's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade i-plugInc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if i-plugInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4177

Flawless balance sheet and fair value.

Market Insights

Community Narratives