- Japan

- /

- Commercial Services

- /

- TSE:3286

TRUST Holdings Inc. (TSE:3286) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

TRUST Holdings Inc. (TSE:3286) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 115%.

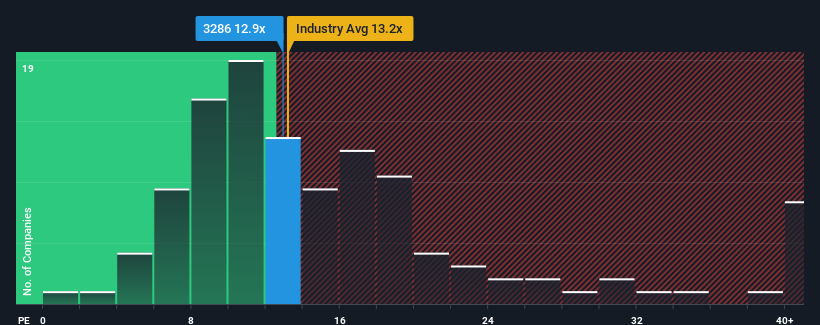

In spite of the heavy fall in price, there still wouldn't be many who think TRUST Holdings' price-to-earnings (or "P/E") ratio of 12.9x is worth a mention when the median P/E in Japan is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

TRUST Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for TRUST Holdings

How Is TRUST Holdings' Growth Trending?

TRUST Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 66% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.7% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that TRUST Holdings' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

With its share price falling into a hole, the P/E for TRUST Holdings looks quite average now. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that TRUST Holdings currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 5 warning signs for TRUST Holdings (1 doesn't sit too well with us!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade TRUST Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TRUST Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3286

TRUST Holdings

Engages in the parking lot and real estate businesses in Japan.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives