- Japan

- /

- Professional Services

- /

- TSE:2492

Infomart Corporation's (TSE:2492) 34% Cheaper Price Remains In Tune With Revenues

Infomart Corporation (TSE:2492) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

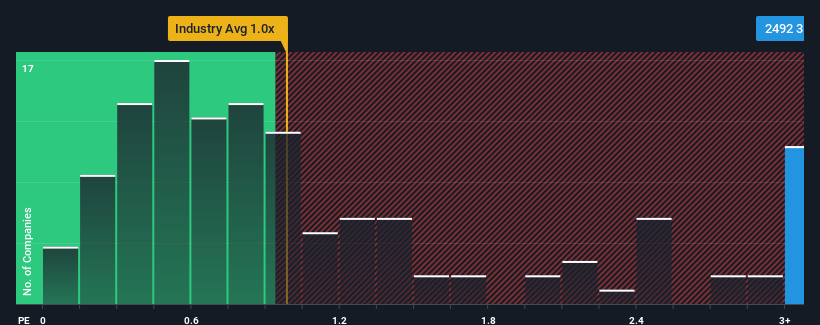

In spite of the heavy fall in price, given around half the companies in Japan's Professional Services industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Infomart as a stock to avoid entirely with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Infomart

How Infomart Has Been Performing

With revenue growth that's superior to most other companies of late, Infomart has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Infomart.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Infomart's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 54% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 15% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.2% per year, which is noticeably less attractive.

With this information, we can see why Infomart is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Infomart's P/S

Infomart's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Infomart's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Infomart that you should be aware of.

If you're unsure about the strength of Infomart's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2492

Infomart

Operates an online business-to-business (BtoB) electronic commerce platform in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives