- Japan

- /

- Professional Services

- /

- TSE:2475

Global Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of easing trade tensions and mixed economic signals, investors are closely monitoring indices like the S&P 500, which has shown resilience with consecutive weeks of gains. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, making them a compelling consideration for those looking to balance growth and stability in an uncertain environment.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Daito Trust ConstructionLtd (TSE:1878) | 4.19% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.72% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.41% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.06% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.39% | ★★★★★★ |

Click here to see the full list of 1530 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nitto Fuji Flour MillingLtd (TSE:2003)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Nitto Fuji Flour Milling Co., Ltd. manufactures and sells flour products in Japan, with a market cap of ¥63.83 billion.

Operations: Nitto Fuji Flour Milling Co., Ltd. generates revenue through the manufacturing and sale of flour products within Japan.

Dividend Yield: 3.7%

Nitto Fuji Flour Milling Ltd. offers a dividend yield of 3.72%, which is lower than the top 25% of dividend payers in Japan at 3.92%. The dividends are not well covered by free cash flows, with a high cash payout ratio of 107.7%, though they are covered by earnings with a payout ratio of 60.2%. Despite an increase over the past decade, dividends have been volatile and unreliable, experiencing annual drops exceeding 20%.

- Click here to discover the nuances of Nitto Fuji Flour MillingLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Nitto Fuji Flour MillingLtd is trading beyond its estimated value.

WDB Holdings (TSE:2475)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WDB Holdings Co., Ltd. operates in Japan, focusing on human resources, CRO, and platform businesses, with a market cap of ¥38.53 billion.

Operations: WDB Holdings Co., Ltd.'s revenue is primarily derived from its Human Resource Services Business, generating ¥42.88 billion, and its CRO Business, contributing ¥8 billion.

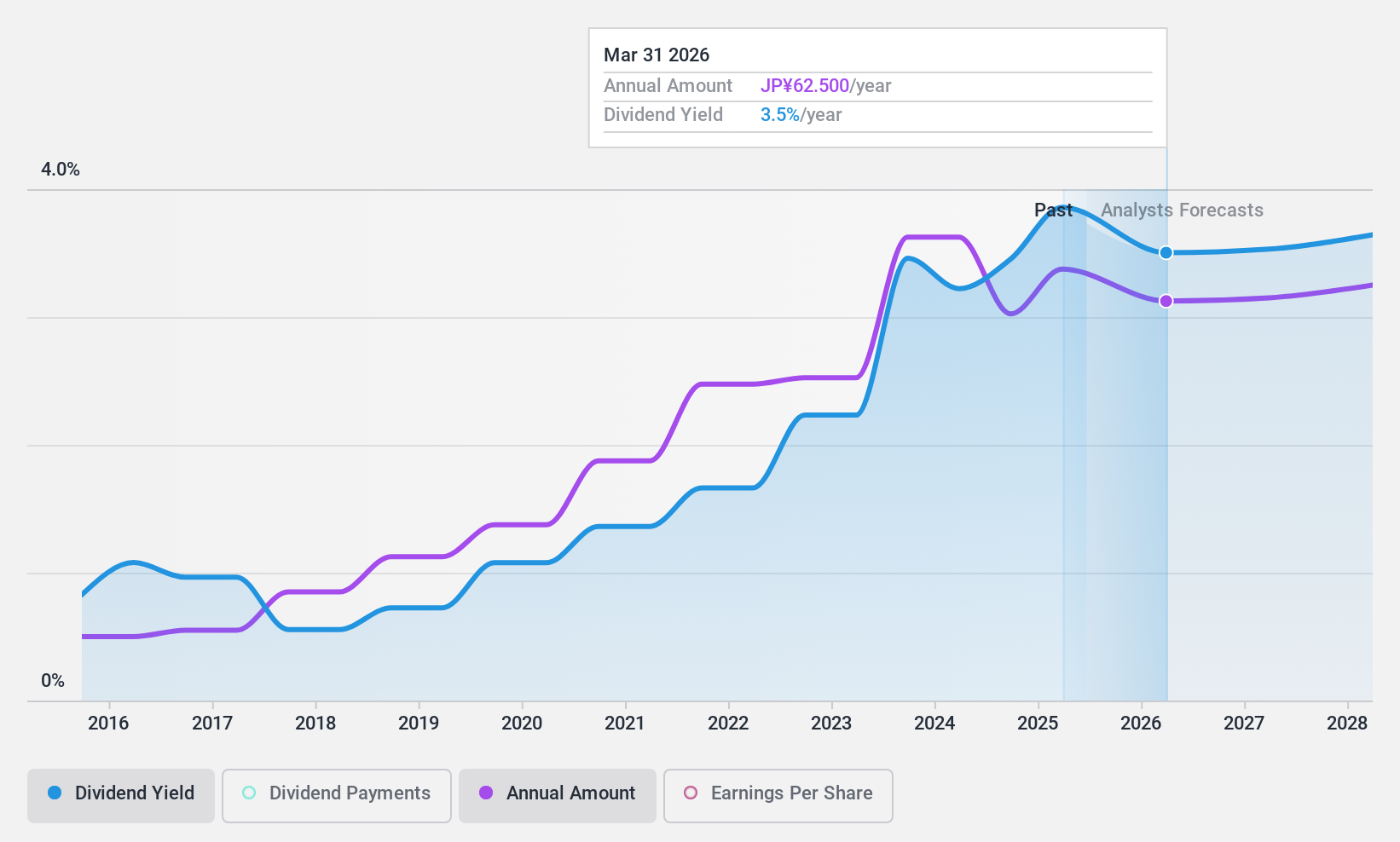

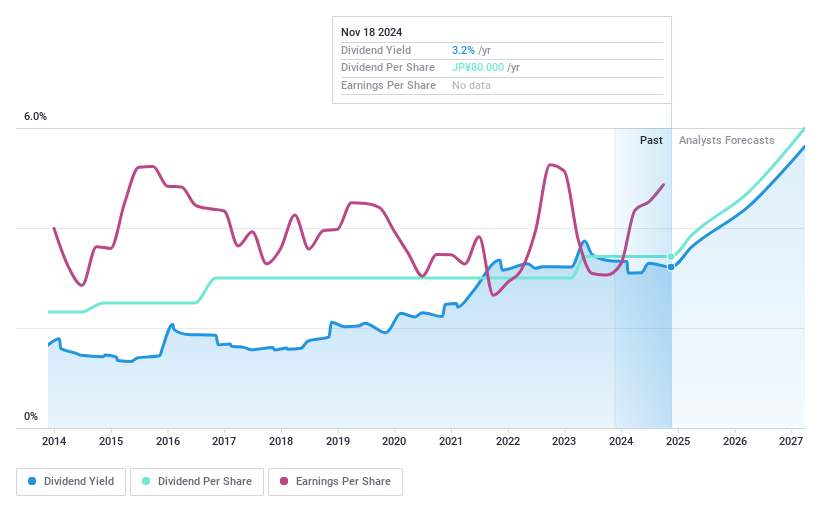

Dividend Yield: 3.2%

WDB Holdings' dividend payments are well-supported by earnings, with a payout ratio of 41.4%, and cash flows, at a cash payout ratio of 61.8%. Despite growth over the past decade, dividends have been volatile and unreliable, experiencing significant annual declines. Trading at 30% below its estimated fair value, WDB Holdings presents potential value for investors; however, its current dividend yield of 3.18% is lower than the top quartile in Japan's market (3.92%).

- Delve into the full analysis dividend report here for a deeper understanding of WDB Holdings.

- Our expertly prepared valuation report WDB Holdings implies its share price may be lower than expected.

Okinawa Financial Group (TSE:7350)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okinawa Financial Group, Inc. offers a range of financial services and has a market cap of ¥50.79 billion.

Operations: Okinawa Financial Group, Inc. generates revenue through its Banking Segment, which contributes ¥38.54 billion, and its Leasing Business, which adds ¥11.32 billion.

Dividend Yield: 3.3%

Okinawa Financial Group's dividends have been stable and growing over the past decade, supported by a low payout ratio of 25.7%. Despite trading at 40.6% below its estimated fair value, its dividend yield of 3.28% is lower than the top quartile in Japan (3.92%). Recent board discussions on dividends highlight ongoing commitment to shareholder returns, though future sustainability remains uncertain due to insufficient data on long-term coverage by earnings or cash flows.

- Take a closer look at Okinawa Financial Group's potential here in our dividend report.

- Our valuation report unveils the possibility Okinawa Financial Group's shares may be trading at a discount.

Taking Advantage

- Click here to access our complete index of 1530 Top Global Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WDB Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2475

WDB Holdings

Operates human resource, CRO, and platform and other business in Japan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives