- Japan

- /

- Professional Services

- /

- TSE:2471

Is It Worth Considering S-Pool, Inc. (TSE:2471) For Its Upcoming Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see S-Pool, Inc. (TSE:2471) is about to trade ex-dividend in the next 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase S-Pool's shares on or after the 28th of November, you won't be eligible to receive the dividend, when it is paid on the 28th of February.

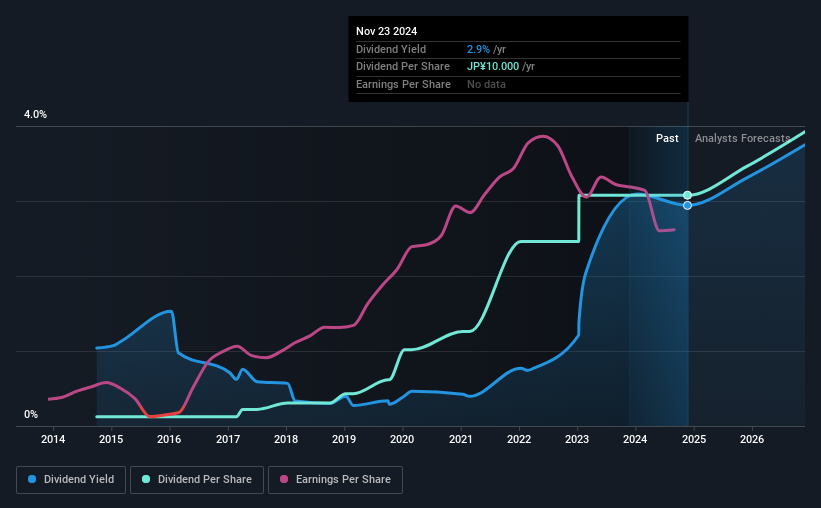

The company's next dividend payment will be JP¥10.00 per share, on the back of last year when the company paid a total of JP¥10.00 to shareholders. Looking at the last 12 months of distributions, S-Pool has a trailing yield of approximately 2.9% on its current stock price of JP¥340.00. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether S-Pool can afford its dividend, and if the dividend could grow.

See our latest analysis for S-Pool

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. S-Pool is paying out an acceptable 57% of its profit, a common payout level among most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Over the last year it paid out 51% of its free cash flow as dividends, within the usual range for most companies.

It's positive to see that S-Pool's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see S-Pool's earnings per share have risen 18% per annum over the last five years. S-Pool has an average payout ratio which suggests a balance between growing earnings and rewarding shareholders. This is a reasonable combination that could hint at some further dividend increases in the future.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. S-Pool has delivered an average of 38% per year annual increase in its dividend, based on the past 10 years of dividend payments. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

Final Takeaway

Is S-Pool worth buying for its dividend? It's good to see earnings are growing, since all of the best dividend stocks grow their earnings meaningfully over the long run. However, we'd also note that S-Pool is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

While it's tempting to invest in S-Pool for the dividends alone, you should always be mindful of the risks involved. For example, we've found 2 warning signs for S-Pool that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2471

Solid track record established dividend payer.

Market Insights

Community Narratives