- Japan

- /

- Professional Services

- /

- TSE:2415

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a surge with U.S. stocks reaching record highs, driven by optimism around tariff policies and AI investments, investors are keenly observing opportunities to enhance their portfolios amidst these dynamic conditions. In such an environment, dividend stocks can offer stability and income potential; selecting those with a solid track record of payouts and resilience in fluctuating markets is crucial for building a robust investment strategy.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Qingdao Port International (SEHK:6198)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Port International Co., Ltd. operates the Port of Qingdao and has a market cap of HK$60.06 billion.

Operations: Qingdao Port International Co., Ltd. generates revenue from its operations at the Port of Qingdao.

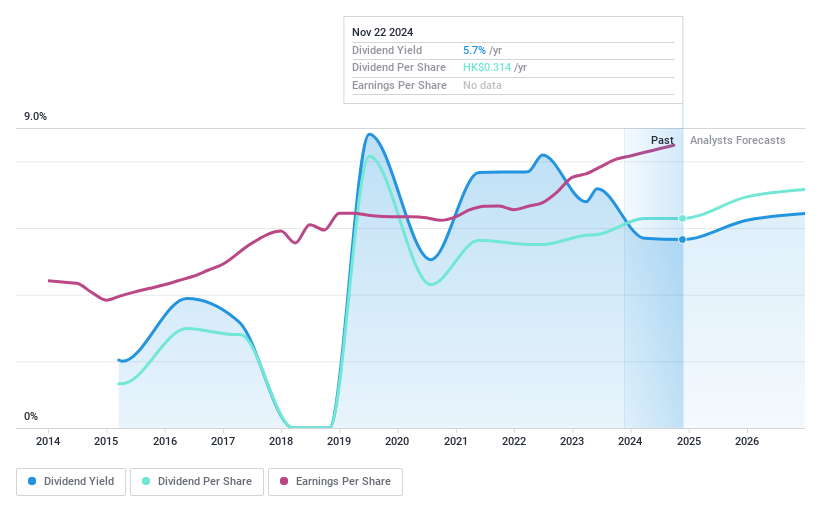

Dividend Yield: 5.1%

Qingdao Port International's dividend yield of 5.13% is lower than the top 25% in Hong Kong, and its dividend history has been volatile over the past decade. However, dividends are well-covered by earnings with a payout ratio of 37.1%, and cash flows also support payments despite a higher cash payout ratio of 77.8%. Recent earnings show growth, with net income rising to ¥3.93 billion for the first nine months of 2024, indicating potential stability in future payouts.

- Unlock comprehensive insights into our analysis of Qingdao Port International stock in this dividend report.

- In light of our recent valuation report, it seems possible that Qingdao Port International is trading behind its estimated value.

Human Holdings (TSE:2415)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Human Holdings Co., Ltd. operates in the human resource, education, and nursing care sectors both in Japan and internationally, with a market cap of ¥17.01 billion.

Operations: Human Holdings Co., Ltd.'s revenue is primarily derived from the Human Resources Related Business at ¥57.25 billion, followed by the Education Business at ¥25.87 billion and the Nursing Care Business at ¥12.00 billion.

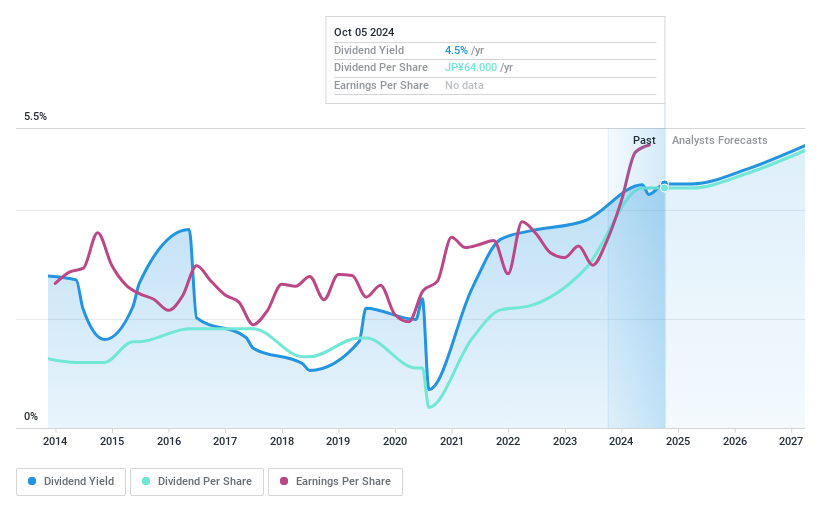

Dividend Yield: 3.9%

Human Holdings' dividend yield of 3.9% ranks in the top 25% of Japan's market, yet its history is marked by volatility and unreliable payments over the past decade. Despite a low payout ratio of 30.2%, dividends are not supported by free cash flows, raising sustainability concerns. However, recent earnings growth of 44.4% suggests potential for future stability. The stock trades at a favorable price-to-earnings ratio of 7.9x compared to the market average.

- Take a closer look at Human Holdings' potential here in our dividend report.

- Our expertly prepared valuation report Human Holdings implies its share price may be lower than expected.

Kawada Technologies (TSE:3443)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kawada Technologies, Inc. operates in Japan's steel, civil engineering, architecture, and IT service sectors with a market cap of ¥45.66 billion.

Operations: Kawada Technologies, Inc.'s revenue is primarily derived from its Steel Structure segment at ¥65.22 billion, followed by Civil Engineering at ¥38.23 billion, Architecture at ¥12.78 billion, and the Solution Shon segment contributing ¥7.63 billion.

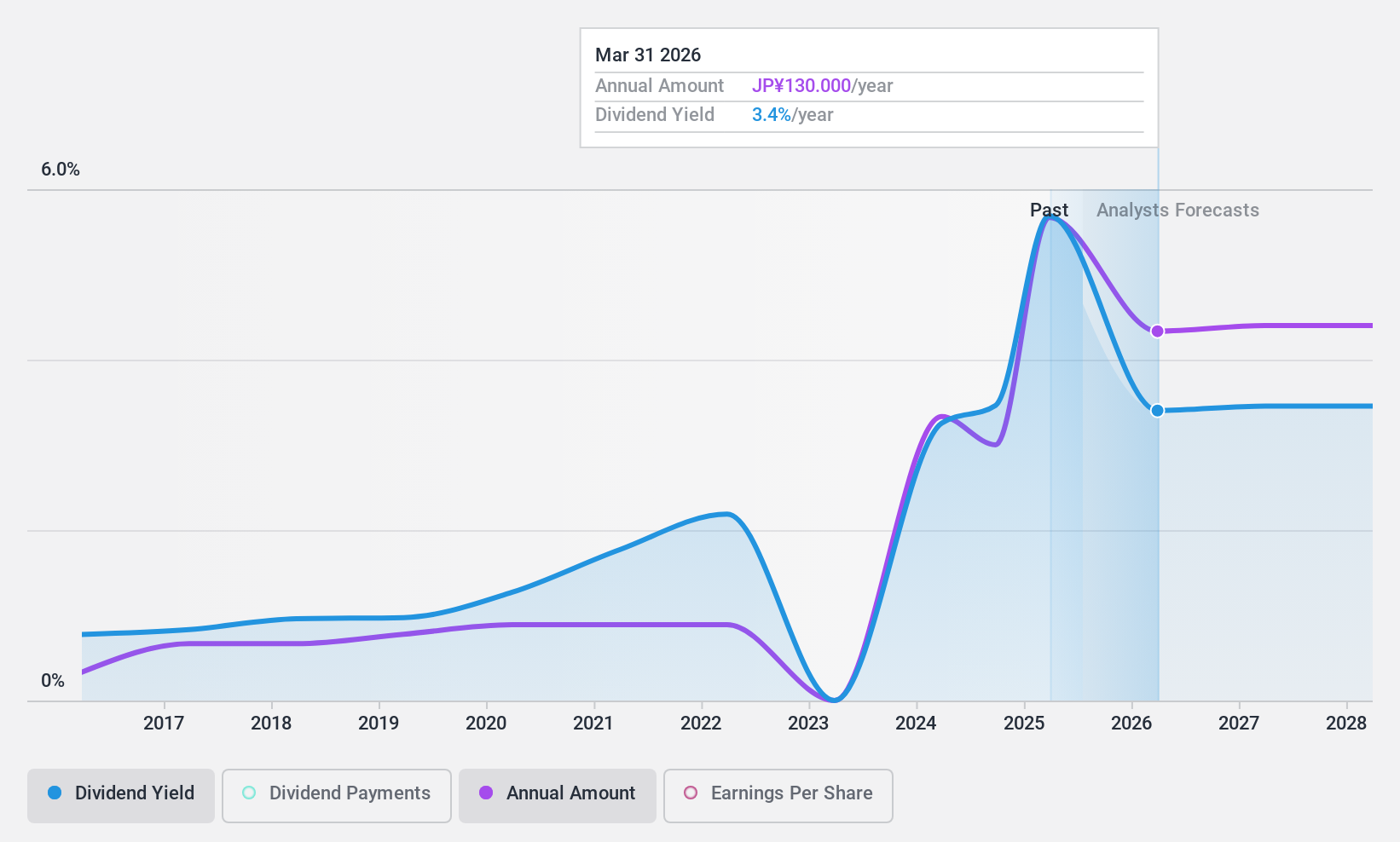

Dividend Yield: 4.2%

Kawada Technologies' dividend yield of 4.17% is among the top 25% in Japan, but its sustainability is questionable due to lack of free cash flow coverage despite a low payout ratio of 30.4%. Dividends have been volatile, with a significant reduction from ¥393 to ¥55 per share for fiscal year ending March 2025. The company introduced an interim dividend policy, aiming to enhance shareholder returns amidst expected earnings declines over the next three years.

- Dive into the specifics of Kawada Technologies here with our thorough dividend report.

- Our valuation report unveils the possibility Kawada Technologies' shares may be trading at a discount.

Key Takeaways

- Discover the full array of 1964 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Human Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2415

Human Holdings

Engages in the human resource, education, nursing care, and other businesses in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives