- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6644

Top Asian Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

Amidst a backdrop of strong corporate earnings and favorable trade developments, Asian stock markets have shown resilience, with indices in Japan and China posting gains. As investors navigate these dynamic conditions, dividend stocks present an appealing option for those seeking steady income streams alongside potential capital appreciation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.11% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.74% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.05% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.06% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

Click here to see the full list of 1113 stocks from our Top Asian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CMC (TSE:2185)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CMC Corporation, along with its subsidiaries, offers services in manual creation, business process management, training, translation, and interpretation within Japan and has a market cap of approximately ¥21.84 billion.

Operations: CMC Corporation generates revenue through its diverse offerings in manual creation, business process management, training, translation, and interpretation services within Japan.

Dividend Yield: 3.3%

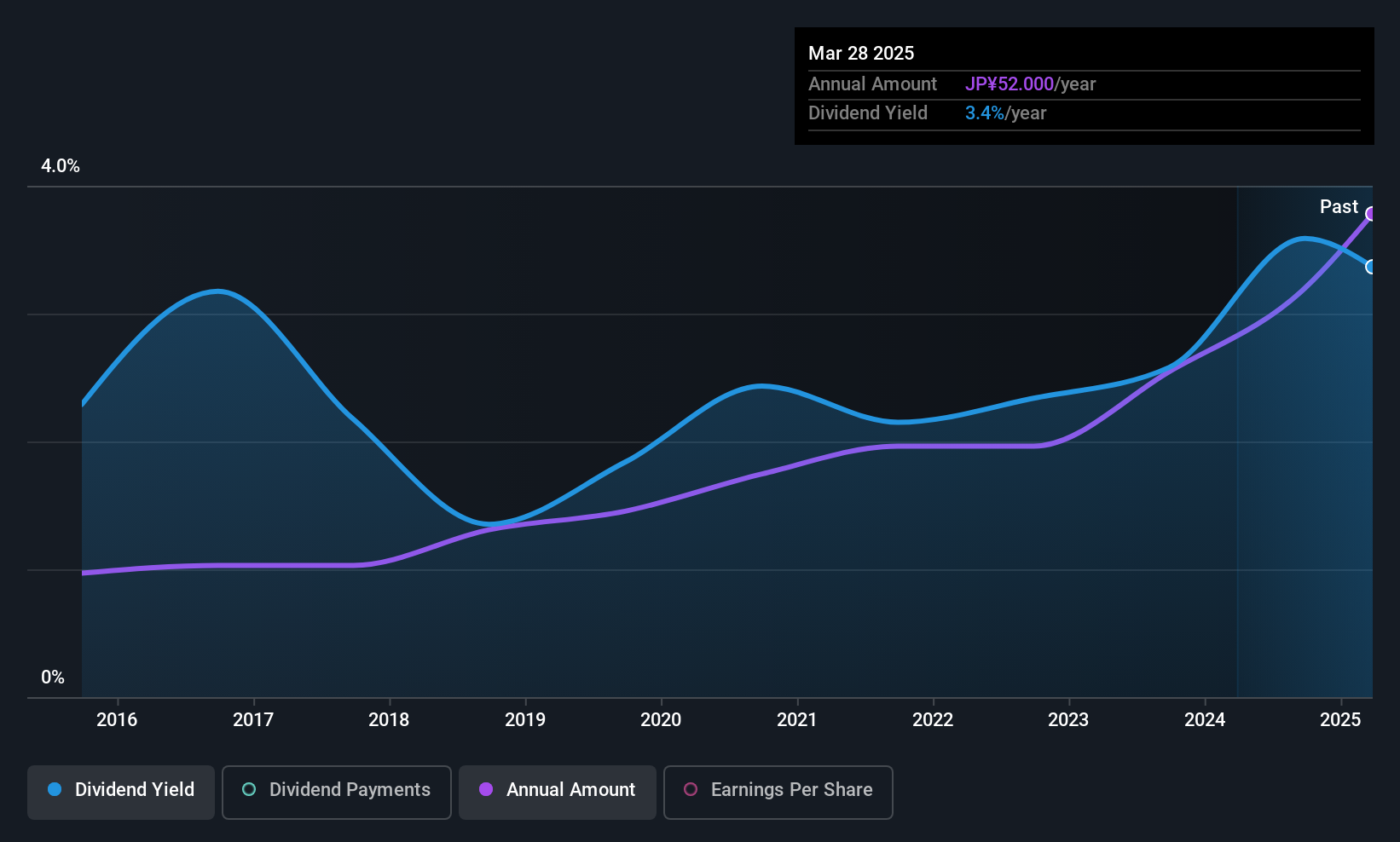

CMC Corporation's dividend profile presents mixed signals. While the company has a stable 10-year history of reliable dividend payments and a low payout ratio of 27.2%, its current yield of 3.34% falls short compared to top-tier Japanese payers. Recent buybacks, totaling ¥821.36 million, indicate shareholder value efforts but highlight cash flow concerns as dividends aren't covered by free cash flows. Earnings have grown significantly by 34% year-on-year, suggesting potential future stability amidst share price volatility.

- Navigate through the intricacies of CMC with our comprehensive dividend report here.

- Our expertly prepared valuation report CMC implies its share price may be lower than expected.

Maezawa Kyuso IndustriesLtd (TSE:6485)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Maezawa Kyuso Industries Co., Ltd. designs, manufactures, and sells water supply equipment in Japan with a market cap of ¥28.85 billion.

Operations: Maezawa Kyuso Industries Co., Ltd. generates revenue from its Product Sales Business at ¥2.57 billion, Water Supply Equipment Business at ¥17.07 billion, and Housing/Construction Equipment Business at ¥12.32 billion.

Dividend Yield: 3.6%

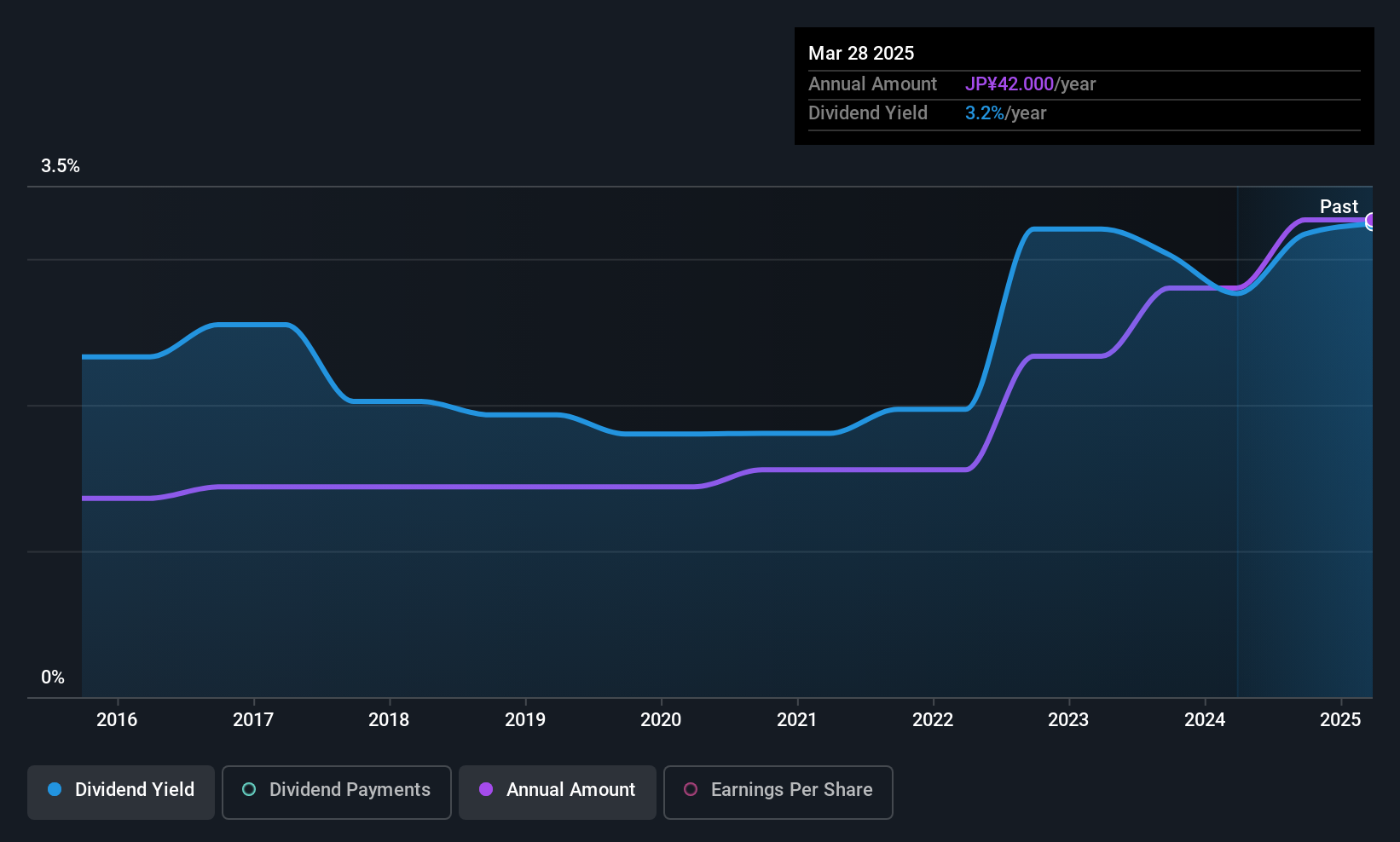

Maezawa Kyuso Industries demonstrates a stable dividend history with consistent growth over the past decade. Its dividends are well-covered by earnings (payout ratio: 50.2%) and cash flows (cash payout ratio: 76.4%). Although its yield of 3.59% is slightly below Japan's top-tier payers, recent share buybacks totaling ¥526 million aim to enhance shareholder returns and capital efficiency. Despite a projected dividend decrease for fiscal year ending March 2026, the company maintains reliable payouts amidst strong earnings growth of 41.5%.

- Click to explore a detailed breakdown of our findings in Maezawa Kyuso IndustriesLtd's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Maezawa Kyuso IndustriesLtd shares in the market.

Osaki Electric (TSE:6644)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Osaki Electric Co., Ltd. is engaged in the development, manufacturing, sale, and installation of meters across Japan, Asia, Oceania, Europe, and internationally with a market cap of ¥50.64 billion.

Operations: Osaki Electric Co., Ltd.'s revenue segments consist of Smart Meters & Solutions in Japan at ¥57.05 billion, Smart Meters & Solutions Overseas at ¥41.40 billion, and Real Estate at ¥551 million.

Dividend Yield: 3.1%

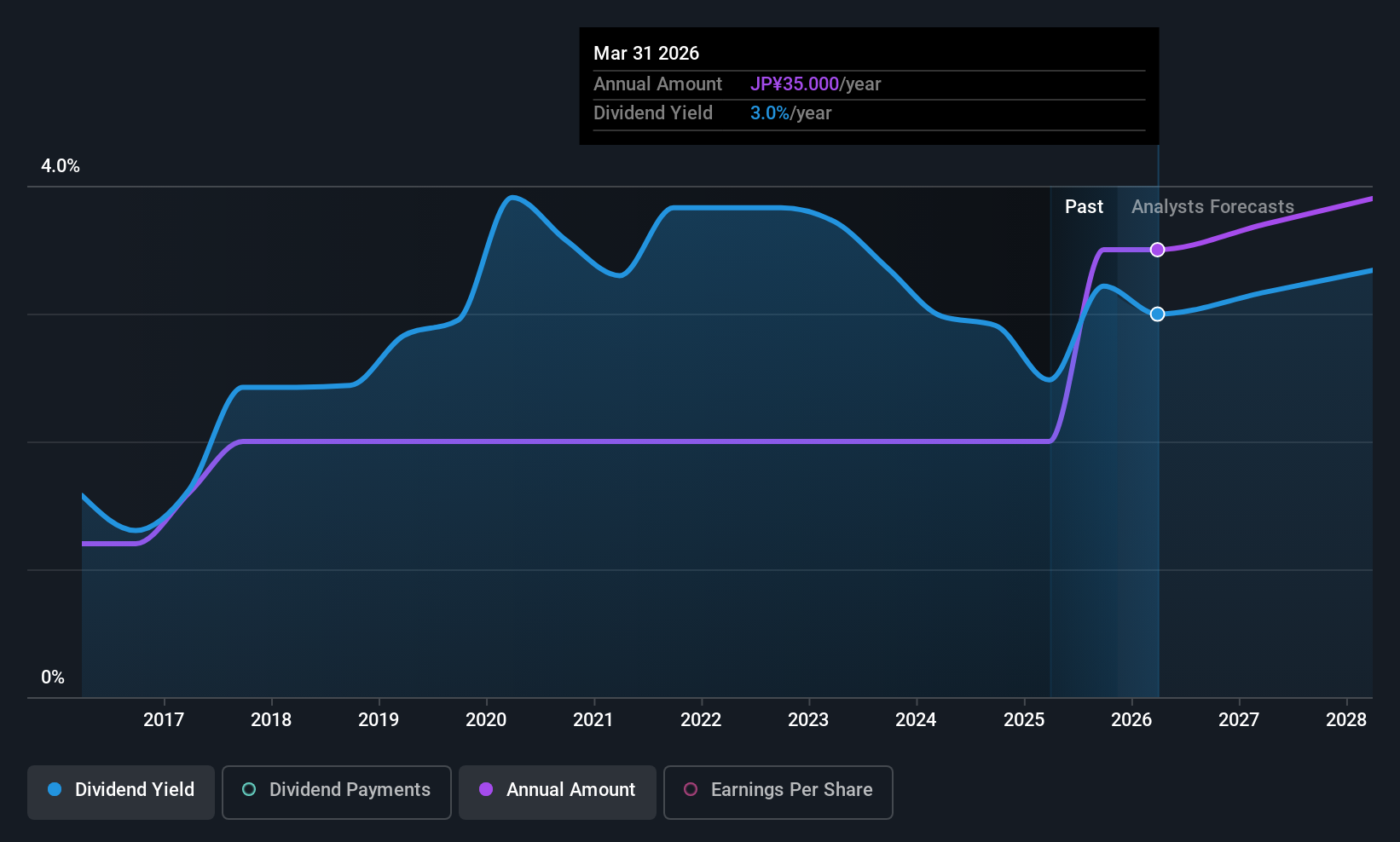

Osaki Electric maintains a robust dividend profile with stable and growing payouts over the past decade. The dividends are well-covered by earnings (payout ratio: 28.8%) and cash flows (cash payout ratio: 38.5%). Although its yield of 3.08% is below Japan's top-tier, recent share buybacks totaling ¥1.99 billion enhance shareholder value. The company raised its earnings guidance, reflecting strong financial performance, while revising its dividend policy to further improve shareholder returns through a higher Dividend on Equity benchmark.

- Get an in-depth perspective on Osaki Electric's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Osaki Electric is priced higher than what may be justified by its financials.

Summing It All Up

- Discover the full array of 1113 Top Asian Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6644

Osaki Electric

Develops, manufactures, sells, and installs meters in Japan, rest of Asia, Oceania, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives