- Japan

- /

- Professional Services

- /

- TSE:2181

We Think Persol HoldingsLtd (TSE:2181) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Persol Holdings Co.,Ltd. (TSE:2181) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Persol HoldingsLtd

What Is Persol HoldingsLtd's Net Debt?

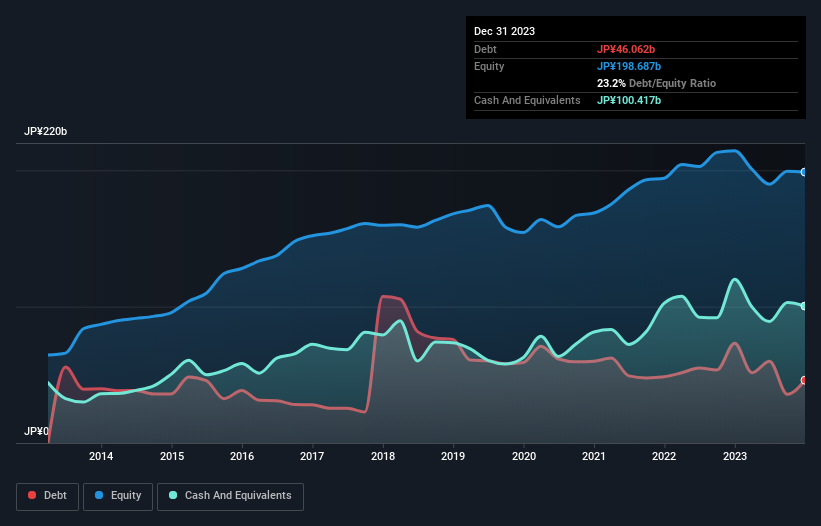

As you can see below, Persol HoldingsLtd had JP¥46.1b of debt at December 2023, down from JP¥73.2b a year prior. However, its balance sheet shows it holds JP¥100.4b in cash, so it actually has JP¥54.4b net cash.

A Look At Persol HoldingsLtd's Liabilities

Zooming in on the latest balance sheet data, we can see that Persol HoldingsLtd had liabilities of JP¥253.4b due within 12 months and liabilities of JP¥50.6b due beyond that. Offsetting these obligations, it had cash of JP¥100.4b as well as receivables valued at JP¥161.9b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥41.7b.

Since publicly traded Persol HoldingsLtd shares are worth a total of JP¥460.4b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Persol HoldingsLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Persol HoldingsLtd saw its EBIT drop by 8.0% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Persol HoldingsLtd's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Persol HoldingsLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Persol HoldingsLtd generated free cash flow amounting to a very robust 91% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Persol HoldingsLtd has JP¥54.4b in net cash. And it impressed us with free cash flow of JP¥59b, being 91% of its EBIT. So we don't think Persol HoldingsLtd's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example - Persol HoldingsLtd has 3 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2181

Persol HoldingsLtd

Provides human resource services under the PERSOL brand worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026