- Japan

- /

- Professional Services

- /

- TSE:2124

Undiscovered Gems And 3 Small Caps With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of record highs in major indices, including the S&P 600 for small-cap stocks, global markets are navigating through a mix of geopolitical developments and economic indicators. With U.S. small-caps reaching new peaks and investor sentiment buoyed by domestic policy shifts, the search for promising investments continues to be a focal point. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial as investors seek opportunities that align with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.48% | -1.12% | 8.28% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Thai Steel Cable | NA | 2.46% | 16.55% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningbo Gaofa Automotive Control System (SHSE:603788)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Gaofa Automotive Control System Co., Ltd. is engaged in the production and sale of automotive parts, with a market cap of CN¥3.51 billion.

Operations: Gaofa's revenue is primarily derived from its automotive parts segment, totaling CN¥1.47 billion.

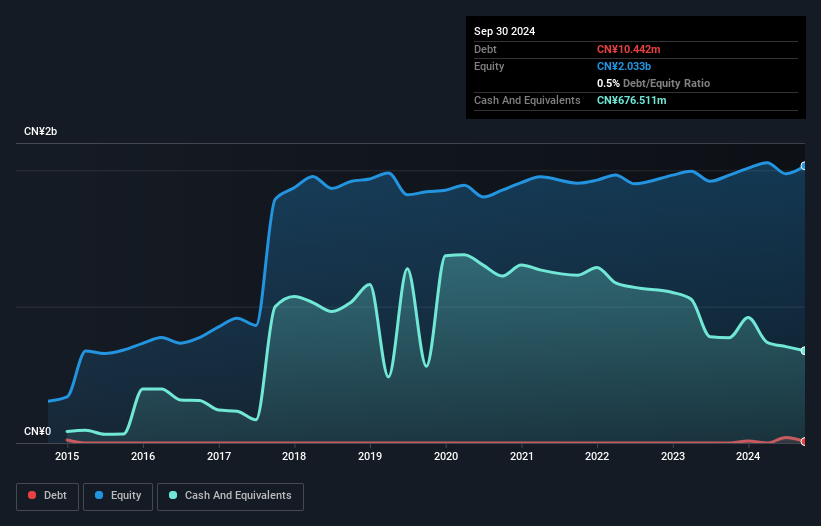

Ningbo Gaofa, a smaller player in the auto components sector, has shown impressive growth with earnings increasing by 61.9% over the past year, outpacing the industry average of 10.5%. The company's price-to-earnings ratio stands at 17.2x, significantly lower than the CN market's 36.1x, suggesting potential undervaluation. Despite a slight increase in its debt to equity ratio from 0% to 0.5% over five years, Ningbo Gaofa has more cash than total debt and reports high-quality earnings. Recent financials reveal sales of CNY 1 billion and net income of CNY 152 million for nine months ended September 2024.

Shaanxi Sirui Advanced Materials (SHSE:688102)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shaanxi Sirui Advanced Materials Co., Ltd. is engaged in the development and production of advanced materials, with a market capitalization of approximately CN¥6.91 billion.

Operations: Shaanxi Sirui Advanced Materials generates revenue primarily from the sale of advanced materials. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management strategies over time.

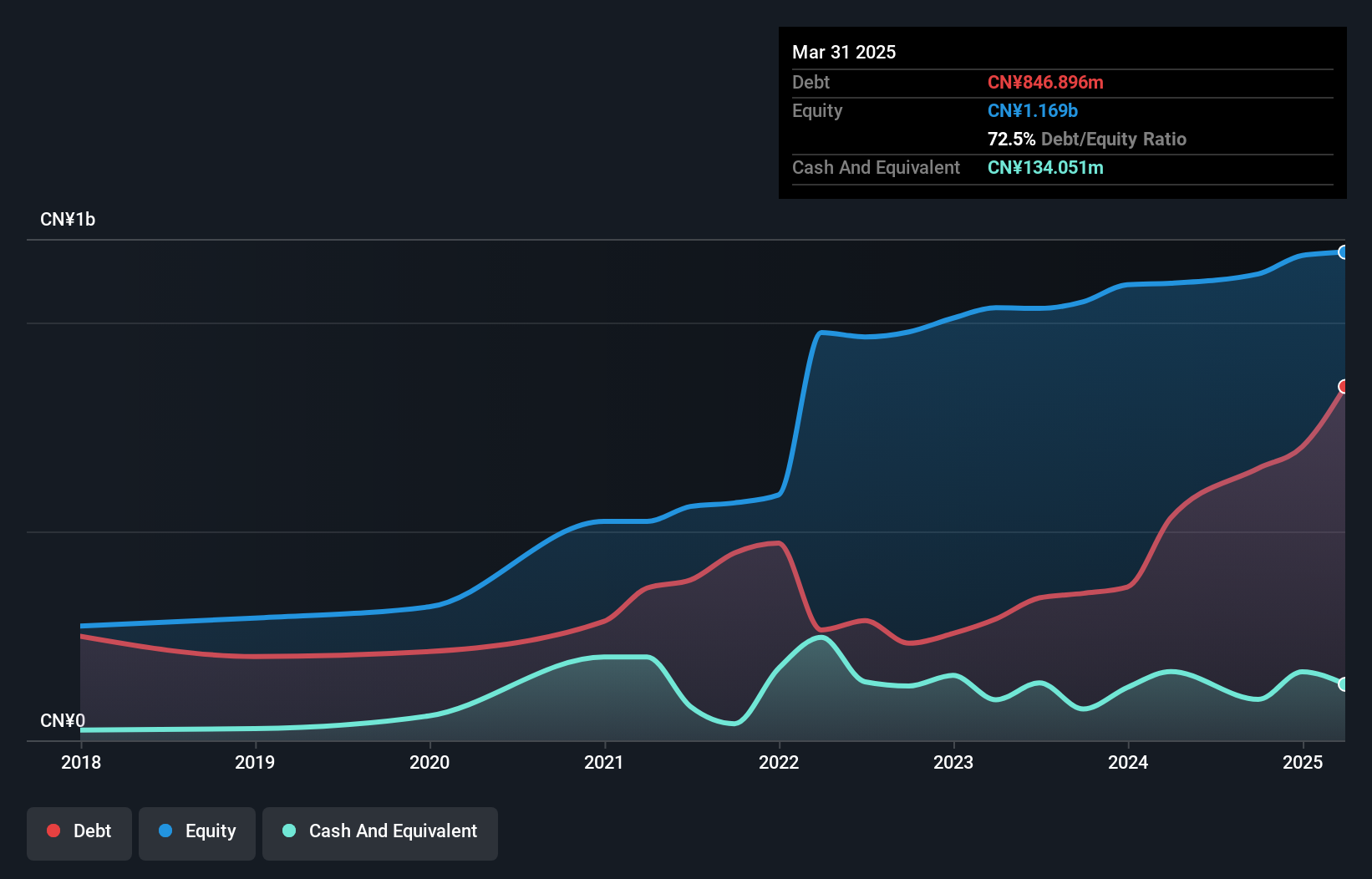

Shaanxi Sirui Advanced Materials, a smaller player in the metals and mining sector, has shown impressive earnings growth of 22.8% over the past year, significantly outpacing the industry's -2.3%. Despite its high debt level with a net debt to equity ratio of 49.6%, interest payments are well covered by EBIT at 8.8 times coverage. Revenue for the first nine months of 2024 reached CNY964 million, up from CNY869 million last year, while net income rose to CNY78 million from CNY68 million. A notable CN¥23 million one-off gain impacted recent financial results, suggesting potential volatility in earnings quality.

JAC Recruitment (TSE:2124)

Simply Wall St Value Rating: ★★★★★★

Overview: JAC Recruitment Co., Ltd. is a recruitment consultancy company based in Japan with a market capitalization of ¥116.07 billion.

Operations: JAC Recruitment generates revenue primarily from its Domestic Recruitment Business, contributing ¥33.46 billion, and its Overseas Business, adding ¥3.74 billion. The Domestic Job Offer Advertising Business provides an additional revenue stream of ¥390 million.

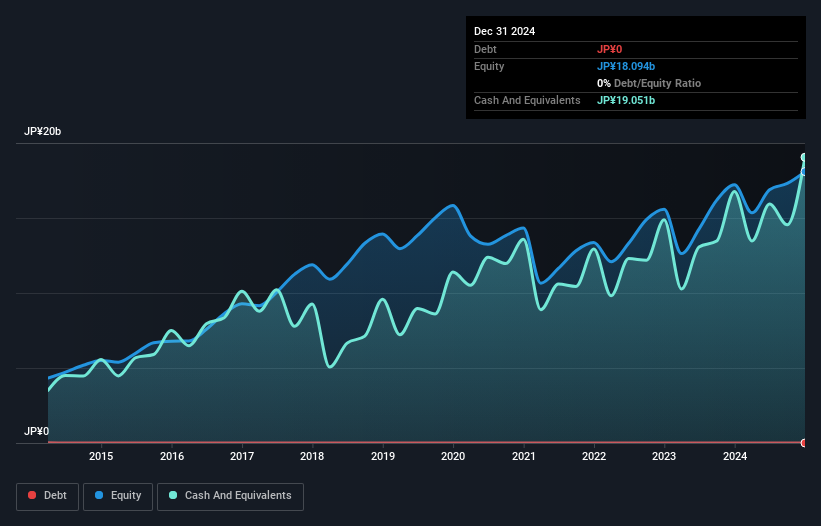

JAC Recruitment, a nimble player in the recruitment sector, has been showcasing robust financial health. The company operates debt-free and boasts high-quality earnings. Over the past five years, its earnings have grown at a solid 15% annually. Despite not outpacing the professional services industry recently with a 4% growth rate, it trades at approximately 31% below estimated fair value, suggesting potential upside for investors. Recently, JAC completed a share buyback of 2 million shares for ¥1.49 billion, indicating confidence in its valuation and future prospects as it forecasts an impressive 19% annual earnings growth ahead.

Turning Ideas Into Actions

- Discover the full array of 4633 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2124

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives