Three Intriguing Stocks That Might Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets experienced fluctuations, with U.S. stocks ending lower despite strong earnings reports from many companies. As investors navigate these turbulent waters, identifying stocks that may be undervalued becomes particularly intriguing, offering potential opportunities for those who are vigilant in assessing the true worth of a company amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| KG Mobilians (KOSDAQ:A046440) | ₩4420.00 | ₩8861.85 | 50.1% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Aoshikang Technology (SZSE:002913) | CN¥28.82 | CN¥57.92 | 50.2% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Medy-Tox (KOSDAQ:A086900) | ₩120800.00 | ₩235297.06 | 48.7% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

Let's uncover some gems from our specialized screener.

Peric Special Gases (SHSE:688146)

Overview: Peric Special Gases Co., Ltd. focuses on the R&D, production, and sale of electronic special gases and trifluoromethanesulfonic acid series products in China, with a market cap of CN¥15.25 billion.

Operations: The company's revenue is primarily derived from the electronic special gases and trifluoromethanesulfonic acid series products segments in China.

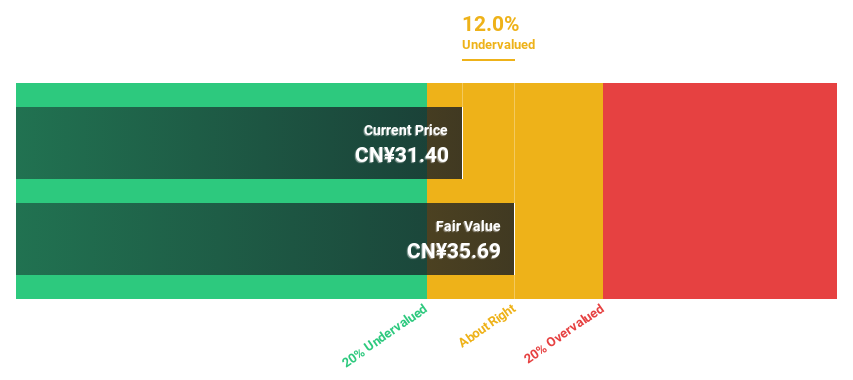

Estimated Discount To Fair Value: 10.9%

Peric Special Gases is trading at CN¥29.75, approximately 10.9% below its estimated fair value of CN¥33.39, offering potential for investors seeking undervalued cash flow opportunities. Despite a low dividend yield of 0.64% not being well covered by free cash flows, the company's earnings and revenue are expected to grow significantly over the next three years at rates of 24.13% and 22.1%, respectively, although large one-off items have impacted recent financial results.

- The analysis detailed in our Peric Special Gases growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Peric Special Gases.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Overview: Suzhou Zelgen Biopharmaceuticals Ltd (SHSE:688266) is a company engaged in the research, development, and commercialization of innovative drugs with a market cap of CN¥17.42 billion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, which generated CN¥488.45 million.

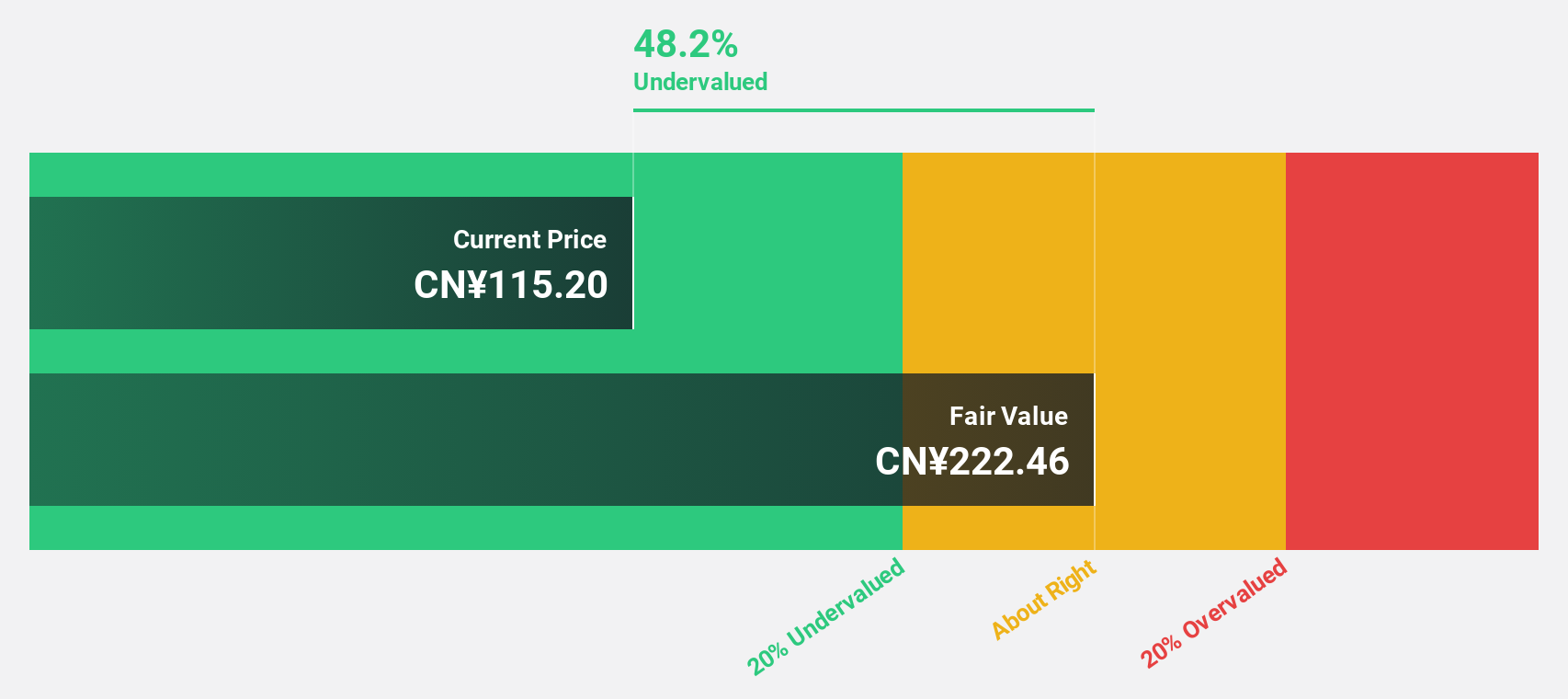

Estimated Discount To Fair Value: 47.8%

Suzhou Zelgen Biopharmaceuticals Ltd. trades at CN¥66.71, significantly undervalued by 47.8% compared to its estimated fair value of CN¥127.83, presenting a compelling opportunity for investors focused on cash flow valuation. The company's revenue is expected to grow rapidly at 61.5% annually, outpacing the Chinese market average of 13.5%, with profitability anticipated within three years, suggesting robust future cash flow potential despite a forecasted low return on equity of 16.1%.

- Our expertly prepared growth report on Suzhou Zelgen BiopharmaceuticalsLtd implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Suzhou Zelgen BiopharmaceuticalsLtd.

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. is a company that offers recruitment consultancy services in Japan, with a market cap of ¥105.16 billion.

Operations: The company's revenue is derived from its Domestic Recruitment Business, which generates ¥33.46 billion, its Overseas Business contributing ¥3.74 billion, and its Domestic Job Offer Advertising Business adding ¥390 million.

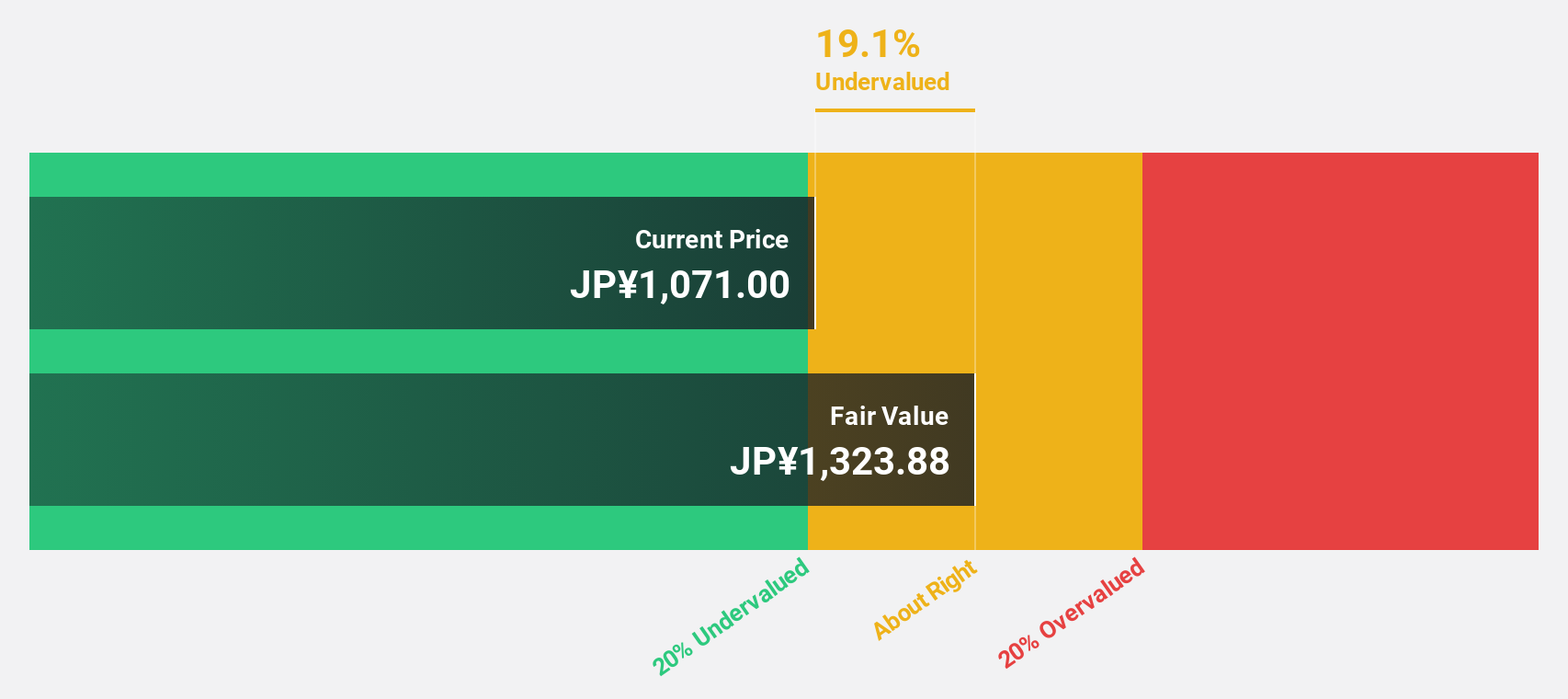

Estimated Discount To Fair Value: 24.5%

JAC Recruitment is trading at ¥765, undervalued by more than 20% against its estimated fair value of ¥1013.57. The company is poised for solid growth, with earnings projected to rise 19.2% annually, outpacing the Japanese market's 7.7%. Revenue growth is expected at 16.2% per year, surpassing the market average of 4.3%. Recent discussions on performance-linked stock remuneration plans could align executive incentives with shareholder interests.

- The growth report we've compiled suggests that JAC Recruitment's future prospects could be on the up.

- Navigate through the intricacies of JAC Recruitment with our comprehensive financial health report here.

Where To Now?

- Embark on your investment journey to our 916 Undervalued Stocks Based On Cash Flows selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives