- Japan

- /

- Professional Services

- /

- TSE:2124

Global's Top 3 Stocks Estimated Below Intrinsic Value In September 2025

Reviewed by Simply Wall St

As global markets experience record highs following the Federal Reserve's first interest rate cut of the year, investors are closely monitoring economic indicators and trade developments that could influence future market dynamics. Amidst these shifts, identifying undervalued stocks becomes increasingly crucial, as they offer potential opportunities to capitalize on discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Saudi Pharmaceutical Industries and Medical Appliances (SASE:2070) | SAR29.10 | SAR57.06 | 49% |

| Pansoft (SZSE:300996) | CN¥17.19 | CN¥33.86 | 49.2% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| Meitu (SEHK:1357) | HK$9.06 | HK$18.02 | 49.7% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.30 | NOK59.69 | 49.2% |

| Kolmar Korea (KOSE:A161890) | ₩77700.00 | ₩155323.47 | 50% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.29 | CN¥77.91 | 49.6% |

| FP Partner (TSE:7388) | ¥2225.00 | ¥4425.25 | 49.7% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €25.90 | €50.67 | 48.9% |

| Atea (OB:ATEA) | NOK141.80 | NOK280.40 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

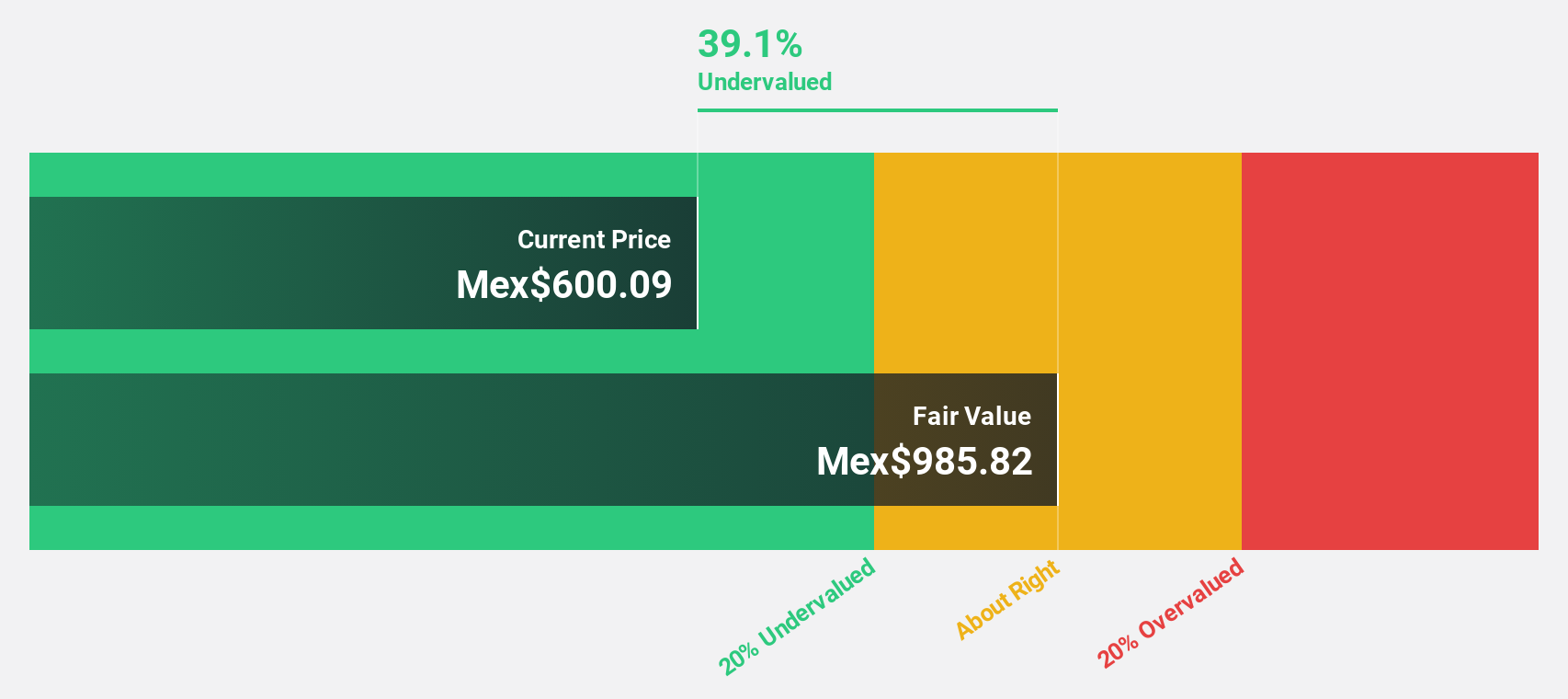

Corporativo Fragua. de (BMV:FRAGUA B)

Overview: Corporativo Fragua, S.A.B. de C.V. operates pharmacy stores under the Superfarmacia name in Mexico and has a market cap of MX$57.09 billion.

Operations: The company's revenue is primarily generated from its retail segment, specifically through the sale of drugs, which amounts to MX$125.95 billion.

Estimated Discount To Fair Value: 43.7%

Corporativo Fragua is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on undervalued stocks based on cash flows. Despite a dividend not well covered by free cash flows, the company shows strong revenue growth prospects at 8.5% annually, outpacing the Mexican market average. Recent earnings reports highlight steady sales and income growth, reinforcing its position as an attractive option relative to peers and industry standards.

- According our earnings growth report, there's an indication that Corporativo Fragua. de might be ready to expand.

- Unlock comprehensive insights into our analysis of Corporativo Fragua. de stock in this financial health report.

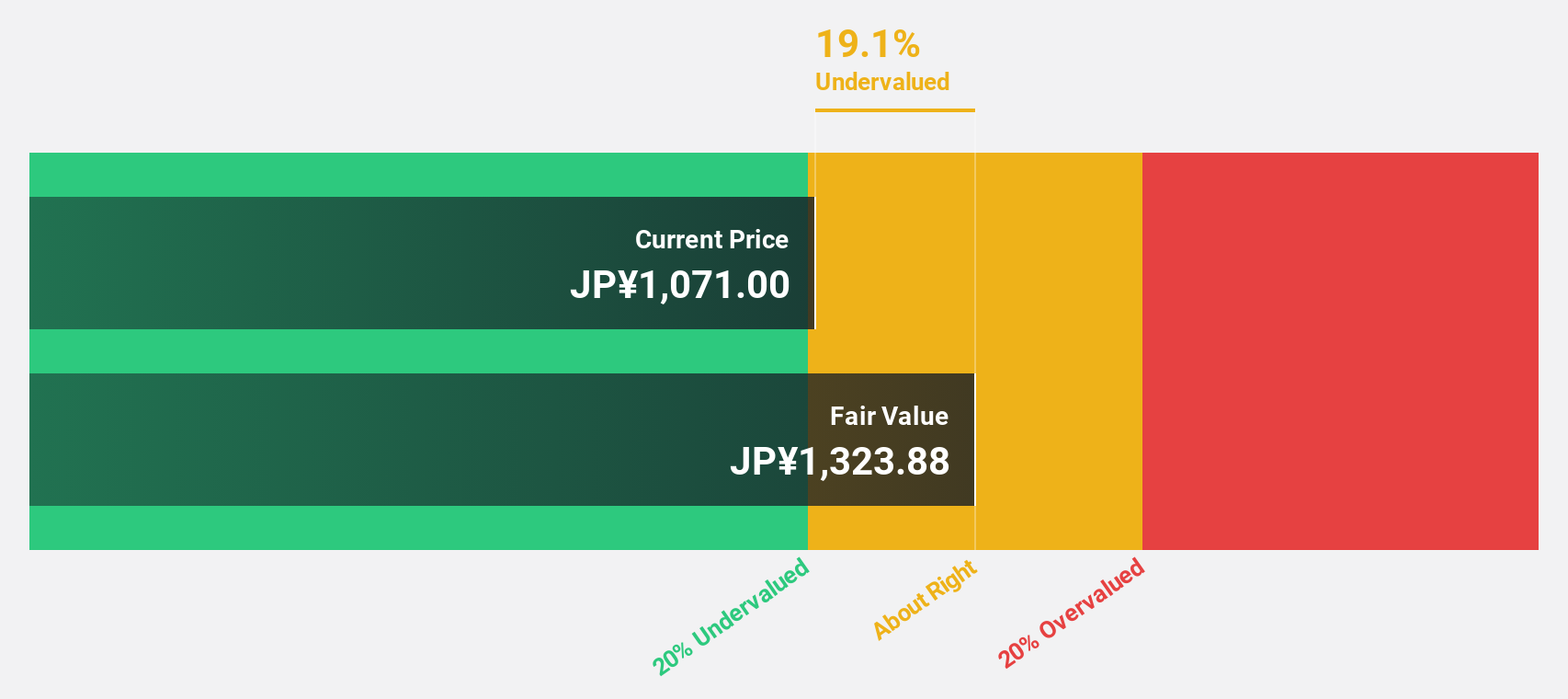

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. offers recruitment consultancy services in Japan and has a market cap of ¥174.93 billion.

Operations: The company's revenue segments include an Overseas Business generating ¥3.76 billion.

Estimated Discount To Fair Value: 28.3%

JAC Recruitment is trading at a substantial discount to its estimated fair value, offering potential for investors interested in undervalued stocks based on cash flows. The company has revised its earnings guidance upward, with expected net sales of ¥46.3 billion and operating income of ¥11.2 billion for 2025. Despite recent executive changes due to misconduct issues, JAC's robust profit growth forecast and reliable dividends enhance its appeal as an investment option amidst strong revenue expansion projections.

- Our earnings growth report unveils the potential for significant increases in JAC Recruitment's future results.

- Navigate through the intricacies of JAC Recruitment with our comprehensive financial health report here.

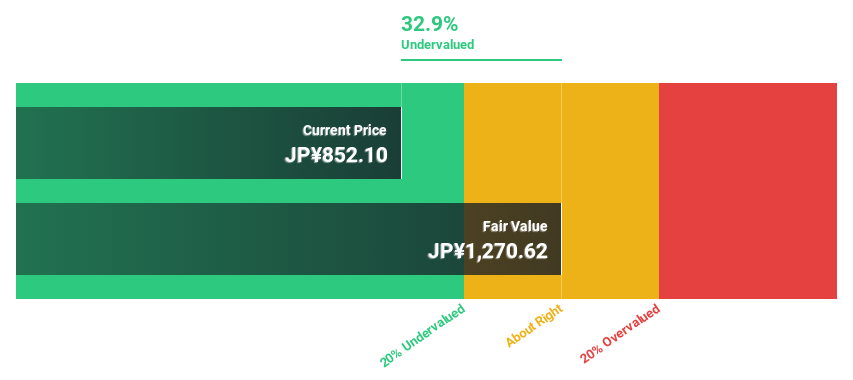

Tokai Carbon (TSE:5301)

Overview: Tokai Carbon Co., Ltd. manufactures and sells carbon-related products and services in Japan, with a market cap of ¥223.54 billion.

Operations: The company's revenue is primarily derived from its Carbon Black segment at ¥152.81 billion, followed by Smelting and Lining at ¥61.91 billion, Fine Carbon at ¥55.31 billion, Graphite Electrodes at ¥43.08 billion, and Industrial Furnaces and Related Products contributing ¥15.95 billion.

Estimated Discount To Fair Value: 38.3%

Tokai Carbon is trading significantly below its estimated fair value, presenting an opportunity for those focused on undervalued stocks based on cash flows. Analysts anticipate the company will achieve profitability within three years, with earnings and revenue growth outpacing the market. Recent executive changes aim to enhance restructuring efforts, while a stable dividend of ¥15 per share underscores financial consistency despite low return on equity forecasts and modest dividend coverage by earnings.

- The growth report we've compiled suggests that Tokai Carbon's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Tokai Carbon.

Key Takeaways

- Access the full spectrum of 517 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2124

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives