- Japan

- /

- Commercial Services

- /

- TSE:4351

Here's Why Yamada Servicer Synthetic OfficeLtd (TYO:4351) Can Afford Some Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Yamada Servicer Synthetic Office Co.,Ltd (TYO:4351) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Yamada Servicer Synthetic OfficeLtd

What Is Yamada Servicer Synthetic OfficeLtd's Debt?

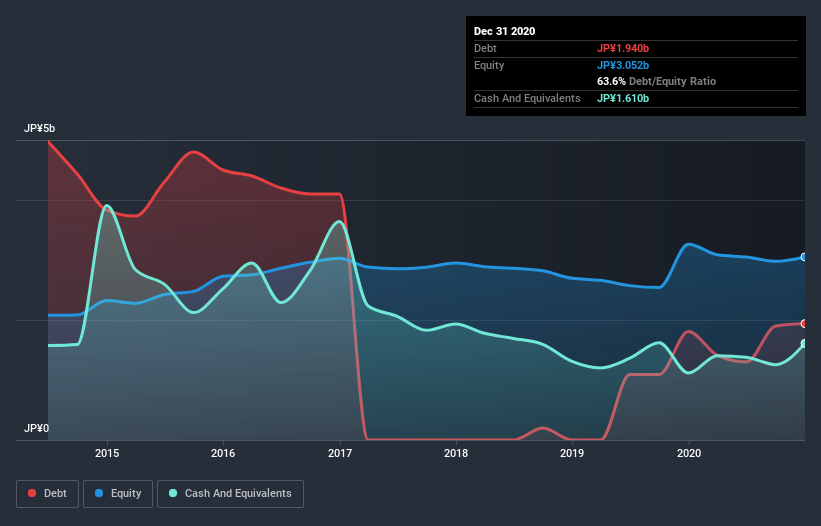

The image below, which you can click on for greater detail, shows that at December 2020 Yamada Servicer Synthetic OfficeLtd had debt of JP¥1.94b, up from JP¥1.81b in one year. However, because it has a cash reserve of JP¥1.61b, its net debt is less, at about JP¥330.0m.

How Strong Is Yamada Servicer Synthetic OfficeLtd's Balance Sheet?

We can see from the most recent balance sheet that Yamada Servicer Synthetic OfficeLtd had liabilities of JP¥2.16b falling due within a year, and liabilities of JP¥969.0m due beyond that. Offsetting these obligations, it had cash of JP¥1.61b as well as receivables valued at JP¥3.14b due within 12 months. So it can boast JP¥1.62b more liquid assets than total liabilities.

This surplus strongly suggests that Yamada Servicer Synthetic OfficeLtd has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity. When analysing debt levels, the balance sheet is the obvious place to start. But it is Yamada Servicer Synthetic OfficeLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Yamada Servicer Synthetic OfficeLtd had a loss before interest and tax, and actually shrunk its revenue by 2.7%, to JP¥2.1b. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Yamada Servicer Synthetic OfficeLtd produced an earnings before interest and tax (EBIT) loss. To be specific the EBIT loss came in at JP¥201m. That said, we're impressed with the strong balance sheet liquidity. That will give the company some time and space to grow and develop its business as need be. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Yamada Servicer Synthetic OfficeLtd has 4 warning signs (and 2 which are concerning) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Yamada Servicer Synthetic OfficeLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Yamada Servicer Synthetic Office, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:4351

Yamada Servicer Synthetic Office

Operates as a servicer company in Japan.

Adequate balance sheet low.

Market Insights

Community Narratives