- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6957

Discovering MarkLines And Two Other Hidden Small Cap Gems In Japan

Reviewed by Simply Wall St

As global markets face heightened volatility and economic uncertainties, Japan's stock market has experienced significant fluctuations, with the Nikkei 225 Index recently suffering heavy losses. Despite these challenges, opportunities remain for discerning investors willing to explore lesser-known small-cap companies that may offer unique growth potential. In this article, we will highlight three such hidden gems in Japan's small-cap sector, starting with MarkLines. A good stock in today's market often combines strong fundamentals with a clear growth strategy and resilience amid broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| QuickLtd | 0.73% | 9.61% | 14.56% | ★★★★★★ |

| Toukei Computer | NA | 5.46% | 12.14% | ★★★★★★ |

| Nihon Parkerizing | 0.32% | -0.14% | 1.92% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| Yashima Denki | 2.93% | -2.38% | 13.99% | ★★★★★★ |

| Toho | 82.16% | 1.83% | 47.38% | ★★★★★☆ |

| Pharma Foods International | 191.14% | 33.83% | 23.46% | ★★★★★☆ |

| GakkyushaLtd | 22.47% | 5.11% | 19.19% | ★★★★★☆ |

| YagiLtd | 32.86% | -9.57% | -0.12% | ★★★★☆☆ |

| Hakuto | 56.93% | 8.02% | 27.72% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

MarkLines (TSE:3901)

Simply Wall St Value Rating: ★★★★★★

Overview: MarkLines Co., Ltd. operates an automotive industry portal in Japan and has a market cap of ¥37.04 billion.

Operations: MarkLines generates revenue primarily through its automotive industry portal in Japan. The company has a market cap of ¥37.04 billion.

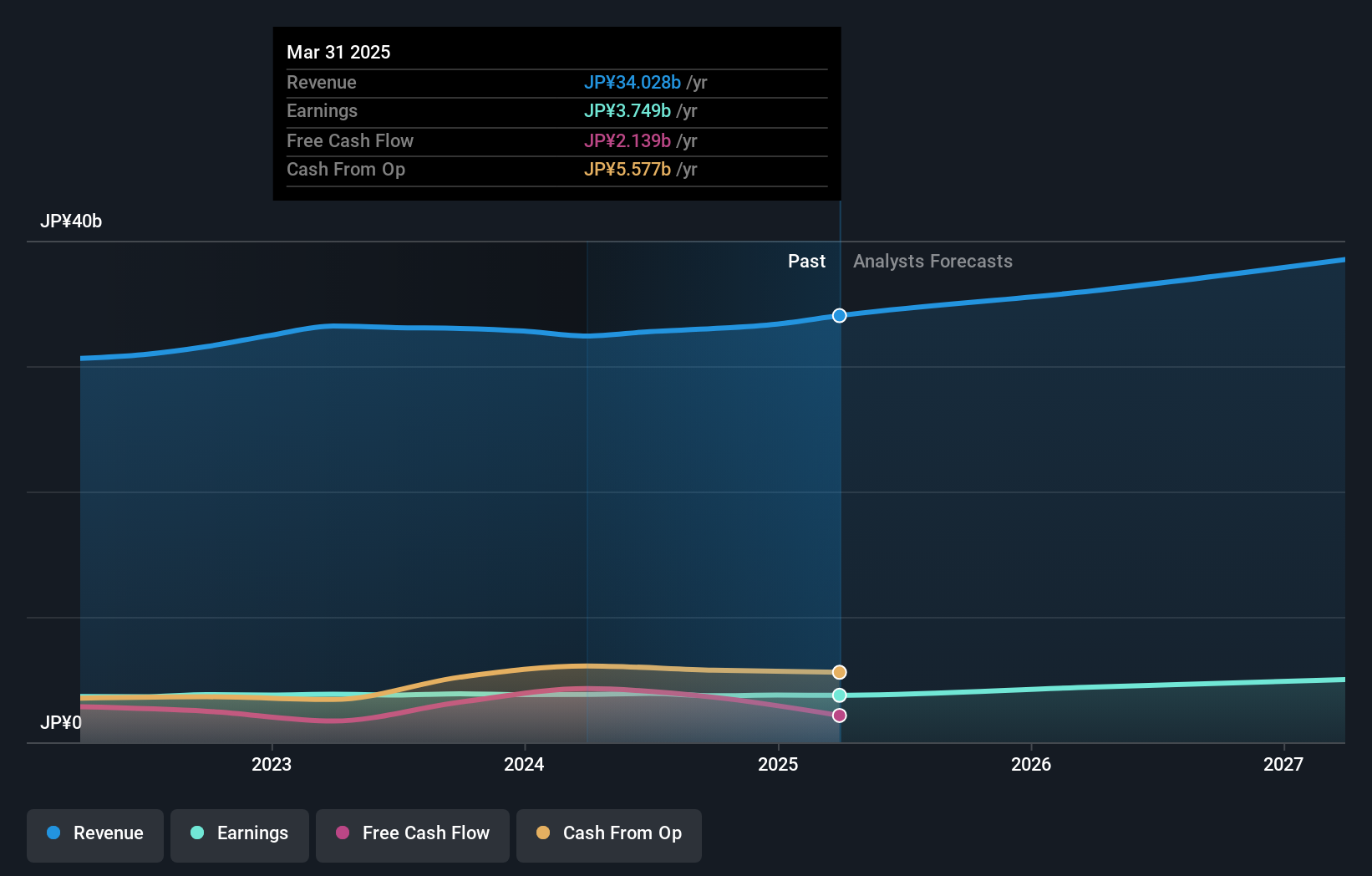

MarkLines, a promising small-cap in Japan's interactive media sector, has shown robust growth with earnings increasing by 18.8% over the past year and outpacing the industry average of 14.2%. The company is debt-free and boasts high-quality earnings, ensuring financial stability. Looking ahead, earnings are projected to grow at an impressive rate of 20.94% annually. Recently, MarkLines announced its Q2 results will be released on August 5, 2024—an event to watch closely for further insights into its performance trajectory.

- Delve into the full analysis health report here for a deeper understanding of MarkLines.

Review our historical performance report to gain insights into MarkLines''s past performance.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Value Rating: ★★★★★★

Overview: Shibaura Electronics Co., Ltd. (TSE:6957) manufactures and sells thermistor elements and related products in Japan, with a market cap of ¥42.49 billion.

Operations: Shibaura Electronics Co., Ltd. generates revenue primarily from the sale of thermistor elements and related products in Japan. The company has a market cap of ¥42.49 billion.

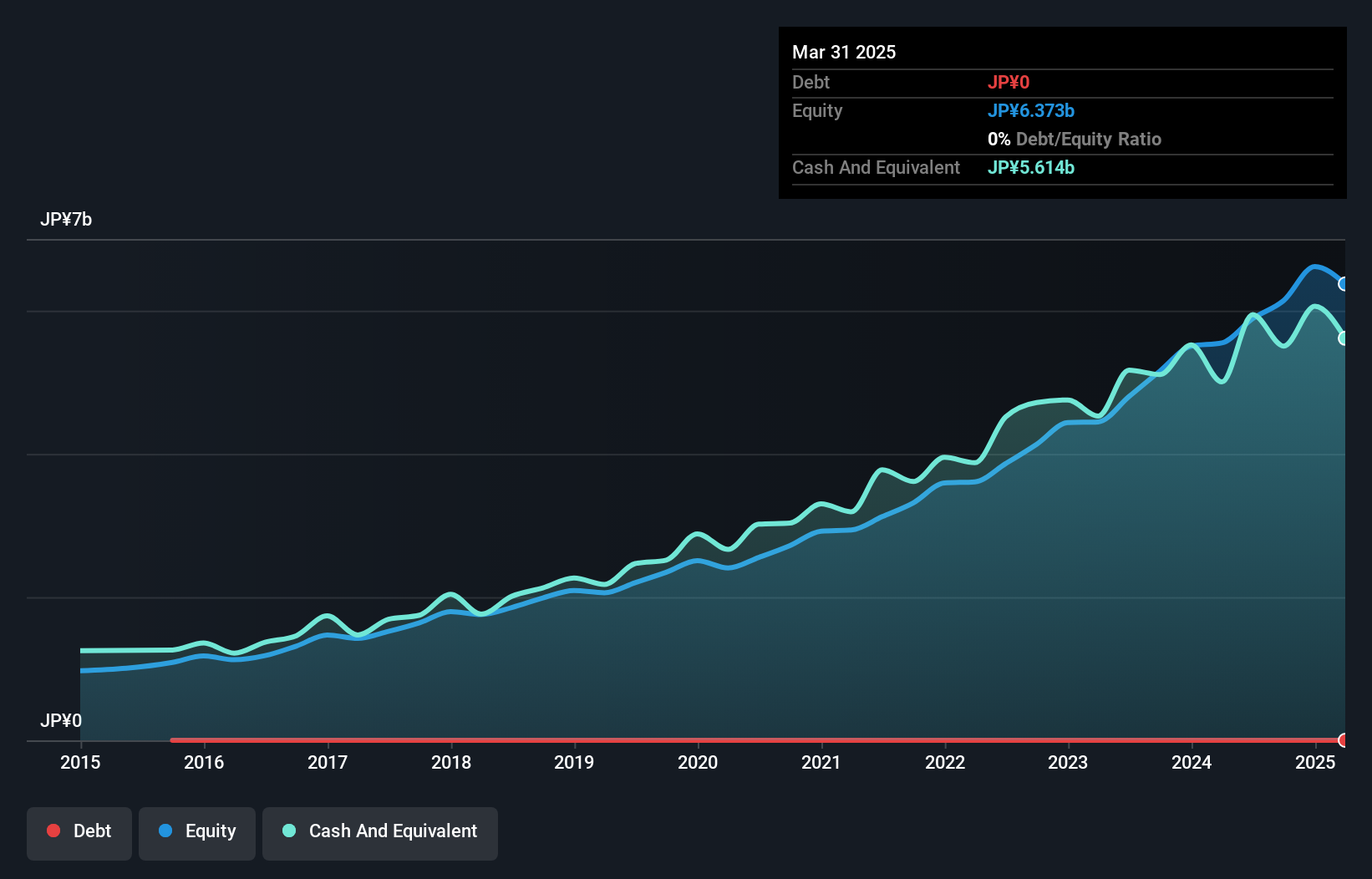

Shibaura Electronics, a small cap player in Japan's electronics industry, has seen its debt to equity ratio drop from 16.4% to 2.6% over five years. Trading at 51.2% below fair value estimates, it offers significant potential for value investors. Despite a slight earnings dip of -0.2%, the company forecasts annual growth of 6.76%. Recently, Shibaura repurchased 200,000 shares for ¥637 million and executed a stock split effective July 1, 2024.

- Unlock comprehensive insights into our analysis of Shibaura ElectronicsLtd stock in this health report.

Learn about Shibaura ElectronicsLtd's historical performance.

NICHIDEN (TSE:9902)

Simply Wall St Value Rating: ★★★★★★

Overview: NICHIDEN Corporation operates as a trading company in Japan with a market cap of ¥101.84 billion.

Operations: NICHIDEN Corporation generates revenue primarily through its trading operations. The company reported a gross profit margin of 22.5% in the latest fiscal year, reflecting its ability to manage cost of goods sold effectively. Operating expenses and other costs are factored into net income calculations, impacting overall profitability.

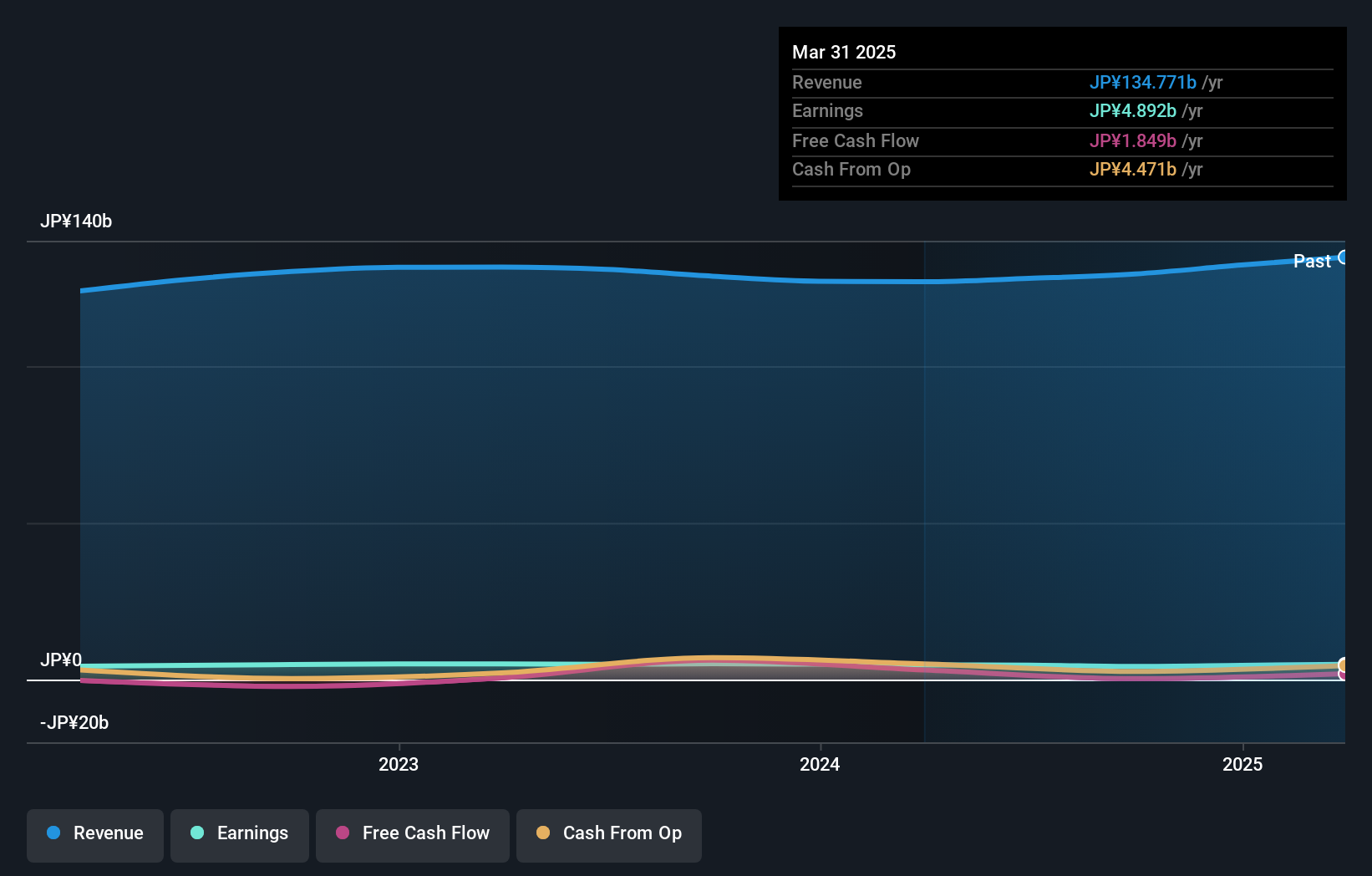

NICHIDEN, a small cap in Japan's trade distribution sector, has shown mixed performance recently. The company repurchased 406,000 shares for ¥1.33 billion between May and June 2024. Despite no debt over the past five years and high-quality earnings, it reported negative earnings growth of -1.3% last year against the industry average of 5.8%. Upcoming Q1 results on Aug 2, 2024 will provide further insights into its financial health.

- Click here and access our complete health analysis report to understand the dynamics of NICHIDEN.

Gain insights into NICHIDEN's past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 708 Japanese Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6957

Shibaura ElectronicsLtd

Manufactures and sells thermistor elements, and products utilizing thermistor elements in Japan.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives