- Japan

- /

- Construction

- /

- TSE:1762

Discovering Undiscovered Gems In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape shaped by recent policy changes and economic indicators, major indices like the S&P 500 have reached record highs, driven by optimism around trade policies and advancements in artificial intelligence. While large-cap stocks have generally outperformed smaller peers, small-cap stocks still present unique opportunities for investors willing to explore beyond the well-trodden paths. In this context of market dynamics, identifying promising small-cap companies requires a focus on those with innovative business models and potential for growth amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITE Tech | NA | 8.91% | 16.50% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Donpon Precision | 35.22% | -2.30% | 36.96% | ★★★★★★ |

| Jiin Ming Industry | 9.39% | -8.97% | -9.24% | ★★★★☆☆ |

| ILSEUNG | 39.02% | -4.46% | 33.48% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Takamatsu Construction Group (TSE:1762)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Takamatsu Construction Group Co., Ltd. operates within the construction industry in Japan and has a market capitalization of approximately ¥93.91 billion.

Operations: Takamatsu Construction Group derives its revenue primarily from the construction business, generating ¥159.86 billion, followed by civil engineering at ¥99.59 billion and real estate at ¥74.07 billion. The company's net profit margin is a crucial metric to consider when evaluating its financial performance over time.

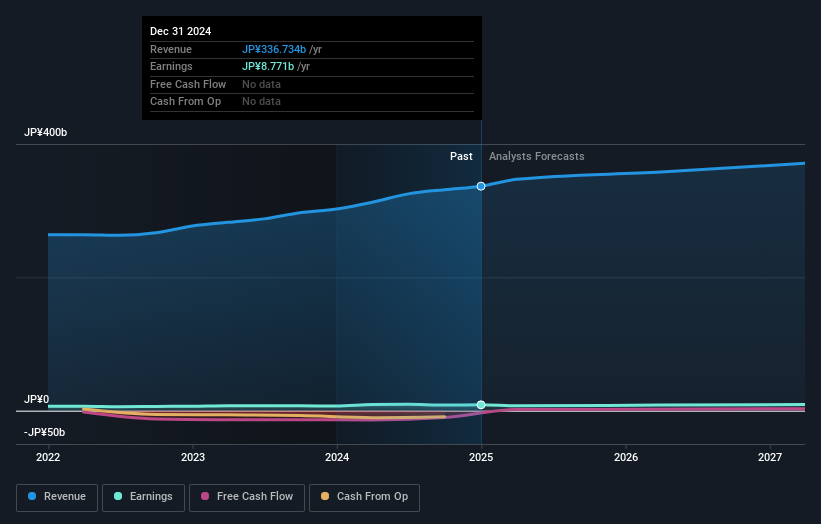

Takamatsu Construction, a notable player in the construction sector, has seen its debt to equity ratio climb from 10.4% to 21% over five years, reflecting increased leverage. Despite a price-to-earnings ratio of 11.2x that is attractive compared to the JP market's 13.7x, its recent earnings growth of 16.9% lagged behind the industry’s 20.8%. The company faces challenges with free cash flow being negative and revised earnings guidance indicating reduced profit expectations due to rising costs and lower civil engineering orders; however, interest payments are well-covered by EBIT at an impressive 112 times coverage.

- Get an in-depth perspective on Takamatsu Construction Group's performance by reading our health report here.

Gain insights into Takamatsu Construction Group's past trends and performance with our Past report.

Konishi (TSE:4956)

Simply Wall St Value Rating: ★★★★★★

Overview: Konishi Co., Ltd. is a Japanese company that specializes in the manufacturing and sale of synthetic adhesives, with a market capitalization of ¥83.29 billion.

Operations: Konishi generates revenue primarily from its Bond segment, which contributed ¥72.87 billion, followed by Chemical Products at ¥38.26 billion and the Construction Business at ¥23.22 billion. The company focuses on these core segments to drive its sales in the Japanese market.

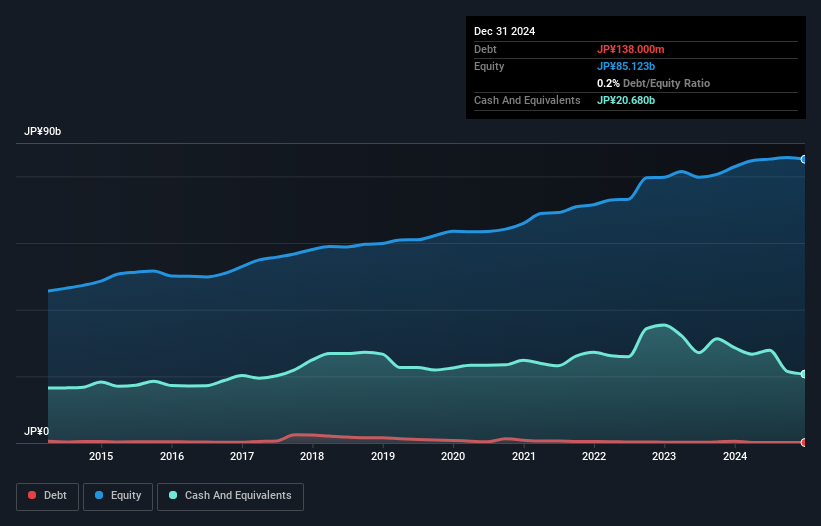

Konishi, a nimble player in the market, showcases a strong financial position with its debt-to-equity ratio dropping from 1.5 to 0.2 over five years, indicating prudent management of liabilities. The company has successfully repurchased 3.44% of its shares for ¥2,999 million recently, reflecting confidence in its value proposition. With a price-to-earnings ratio of 11.9x below the JP market average of 13.7x and earnings growth at 14% last year surpassing industry peers, Konishi seems poised for steady progress despite current challenges in free cash flow generation and high non-cash earnings levels.

- Click here and access our complete health analysis report to understand the dynamics of Konishi.

Understand Konishi's track record by examining our Past report.

Trusco Nakayama (TSE:9830)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Trusco Nakayama Corporation is involved in the wholesale distribution of machine tools and other equipment both in Japan and internationally, with a market cap of ¥136.04 billion.

Operations: Trusco Nakayama generates revenue primarily through the wholesale distribution of machine tools and equipment. The company has reported a gross profit margin of 22.5% in its recent financial period.

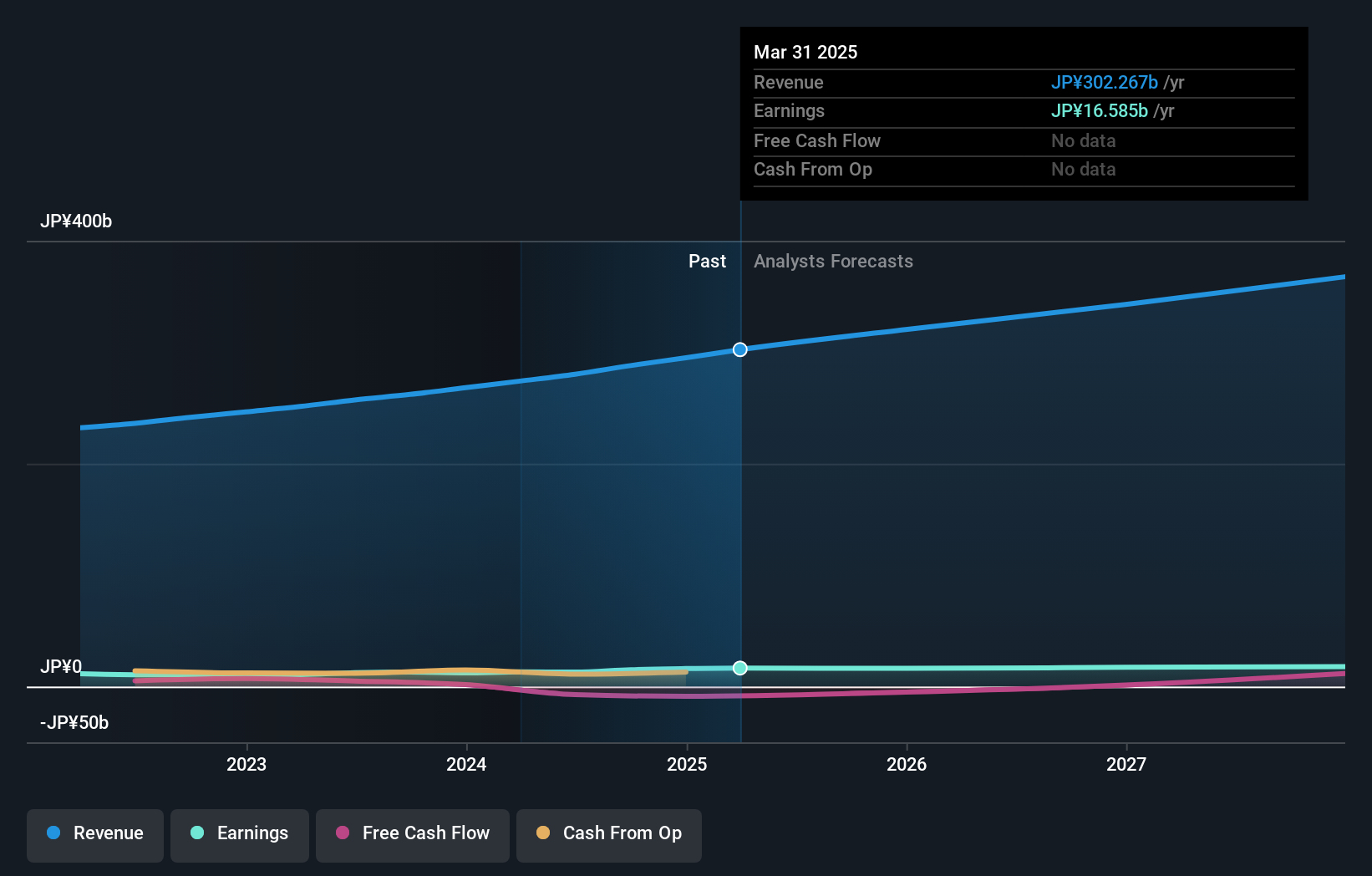

Trusco Nakayama, a promising player in the market, has shown robust earnings growth of 16.9% over the past year, outpacing its industry peers. This growth is complemented by a satisfactory net debt to equity ratio of 7.9%, indicating prudent financial management. The company's interest payments are well covered with EBIT at 153 times coverage, showcasing strong operational efficiency. Despite an increase in debt to equity from 31.3% to 33.4% over five years, it remains competitively valued with a price-to-earnings ratio of 9.1x against the JP market's average of 13.7x, suggesting potential for future appreciation.

- Click here to discover the nuances of Trusco Nakayama with our detailed analytical health report.

Assess Trusco Nakayama's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Access the full spectrum of 4677 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Takamatsu Construction Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Takamatsu Construction Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1762

Takamatsu Construction Group

Engages in the construction business in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives