Market Participants Recognise Puequ CO.,LTD.'s (TSE:9264) Revenues Pushing Shares 30% Higher

Despite an already strong run, Puequ CO.,LTD. (TSE:9264) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 51%.

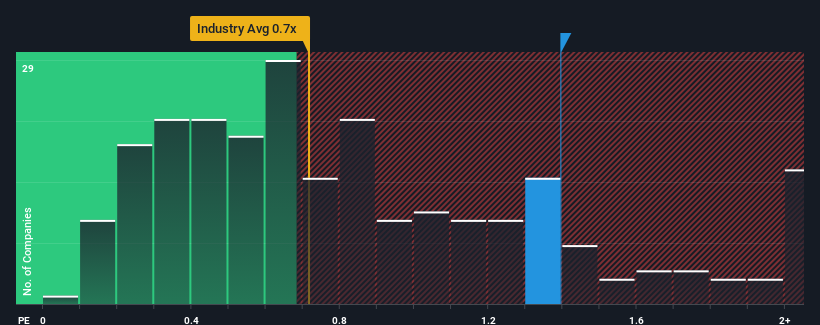

Following the firm bounce in price, given close to half the companies operating in Japan's Machinery industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider PuequLTD as a stock to potentially avoid with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for PuequLTD

How PuequLTD Has Been Performing

PuequLTD has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on PuequLTD will help you shine a light on its historical performance.How Is PuequLTD's Revenue Growth Trending?

PuequLTD's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. Revenue has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.4% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why PuequLTD's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

PuequLTD shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that PuequLTD maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 6 warning signs for PuequLTD (5 can't be ignored!) that you need to take into consideration.

If you're unsure about the strength of PuequLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade PuequLTD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9264

PuequLTD

Manufactures and sells pumps, blowers, air conditioners, and factory equipment in Japan.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives