- Japan

- /

- Trade Distributors

- /

- TSE:8093

Kyokuto Boeki Kaisha, Ltd. (TSE:8093) Might Not Be As Mispriced As It Looks After Plunging 26%

To the annoyance of some shareholders, Kyokuto Boeki Kaisha, Ltd. (TSE:8093) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 26% share price drop.

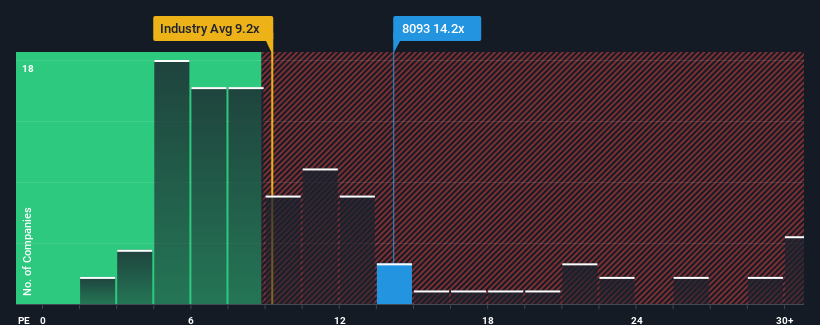

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Kyokuto Boeki Kaisha's P/E ratio of 14.2x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

The earnings growth achieved at Kyokuto Boeki Kaisha over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Kyokuto Boeki Kaisha

Is There Some Growth For Kyokuto Boeki Kaisha?

In order to justify its P/E ratio, Kyokuto Boeki Kaisha would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. Pleasingly, EPS has also lifted 314% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.8% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Kyokuto Boeki Kaisha is trading at a fairly similar P/E to the market. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Kyokuto Boeki Kaisha's plummeting stock price has brought its P/E right back to the rest of the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kyokuto Boeki Kaisha revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Kyokuto Boeki Kaisha, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Kyokuto Boeki Kaisha, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kyokuto Boeki Kaisha might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8093

Kyokuto Boeki Kaisha

Primarily operates as an engineering trading company in Japan and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives