Emerging Asian Innovators And 2 Other Small Caps with Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, Asian markets are navigating through a complex mix of economic indicators and geopolitical tensions, with recent tariff announcements affecting major trading partners like Japan and South Korea. Despite these challenges, small-cap stocks in Asia continue to offer intriguing opportunities for investors seeking growth potential amidst broader market uncertainties. Identifying promising stocks often involves looking for companies that demonstrate innovation and resilience in volatile environments. In this article, we explore three such emerging Asian innovators that stand out as potential hidden gems in the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| FALCO HOLDINGS | 4.93% | -0.16% | 1.44% | ★★★★★★ |

| Araya Industrial | 17.96% | 3.77% | 10.32% | ★★★★★★ |

| Orient Pharma | 15.09% | 26.72% | 68.10% | ★★★★★★ |

| Tokyo Tekko | 8.47% | 8.06% | 24.39% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| Iljin DiamondLtd | 2.55% | -3.23% | 0.91% | ★★★★☆☆ |

| Ningbo Henghe Precision IndustryLtd | 66.02% | 5.50% | 23.91% | ★★★★☆☆ |

| JinXianDai Information IndustryLtd | 16.46% | -0.60% | -32.74% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Bloom Technology (SHSE:603325)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Bloom Technology Inc. specializes in manufacturing and supplying powder and granular material handling system solutions with pneumatic conveying in China, with a market capitalization of CN¥6.92 billion.

Operations: Shanghai Bloom Technology generates revenue primarily from manufacturing and supplying powder and granular material handling system solutions with pneumatic conveying. The company's market capitalization stands at CN¥6.92 billion.

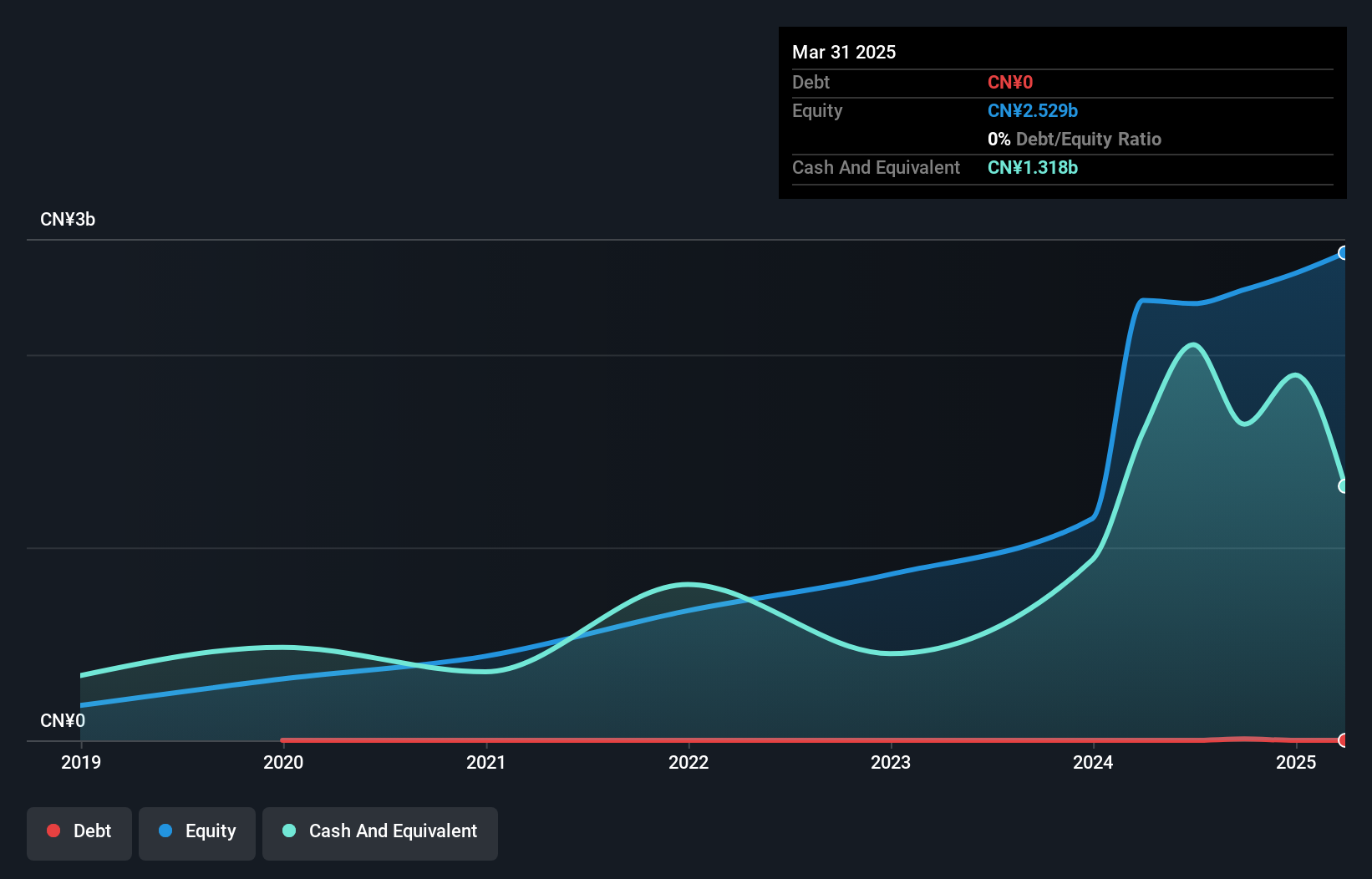

Shanghai Bloom Technology, a nimble player in the tech scene, has shown impressive growth with earnings surging by 85% over the past year, outpacing its industry peers. The company's recent quarterly results highlight a robust performance with sales reaching CNY 328 million and net income at CNY 104 million. Additionally, it boasts a favorable Price-to-Earnings ratio of 18.5x compared to the broader CN market's 40.1x. With no debt on its books for five years and positive free cash flow, Shanghai Bloom seems well-positioned in its sector despite being relatively under-the-radar.

Zhejiang JW Precision MachineryLtd (SZSE:300984)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang JW Precision Machinery Co., Ltd. focuses on the research, development, production, and sale of bearing rings both domestically and internationally, with a market capitalization of approximately CN¥7.23 billion.

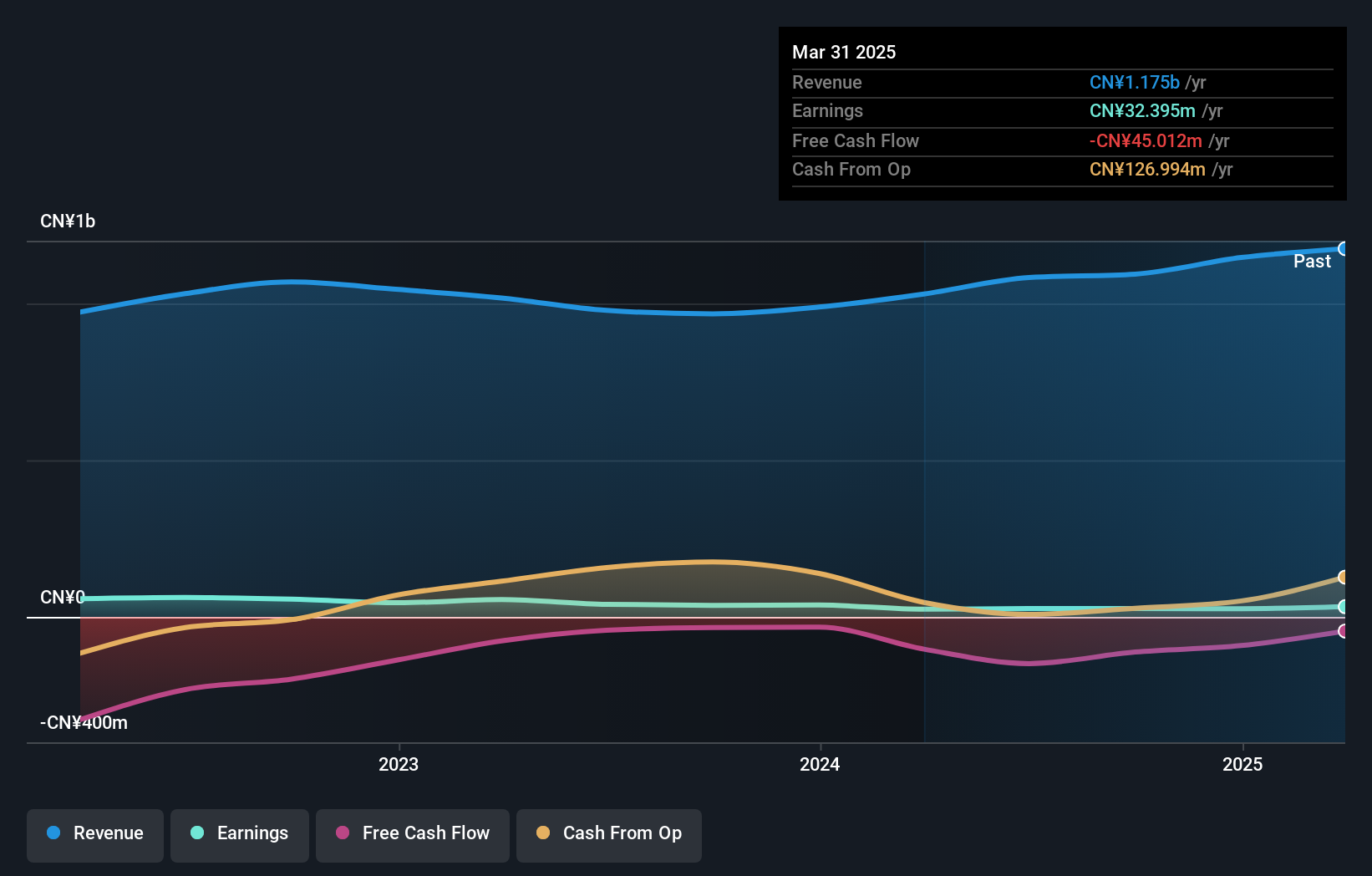

Operations: JW Precision Machinery generates revenue primarily from the sale of bearing ferrules, totaling approximately CN¥1.12 billion. The company's financial performance is highlighted by a net profit margin trend that provides insight into its profitability.

Zhejiang JW Precision Machinery, a small player in the machinery sector, has shown impressive earnings growth of 33.1% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 7.3%, reflecting prudent financial management as it reduced from 26.9% over five years. Despite high volatility in share price recently, its interest payments are well covered with an EBIT coverage of 3.9x, indicating robust operational performance. Recent amendments to its articles of association suggest strategic shifts that could influence future growth dynamics positively or negatively depending on execution and market conditions.

Hanwa (TSE:8078)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hanwa Co., Ltd. is a diversified trading company engaged in the international and domestic trade of steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products with a market cap of approximately ¥240.40 billion.

Operations: The company's revenue streams are primarily derived from its diverse trading activities in steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, and machinery. It operates both domestically in Japan and internationally. The market cap stands at approximately ¥240.40 billion.

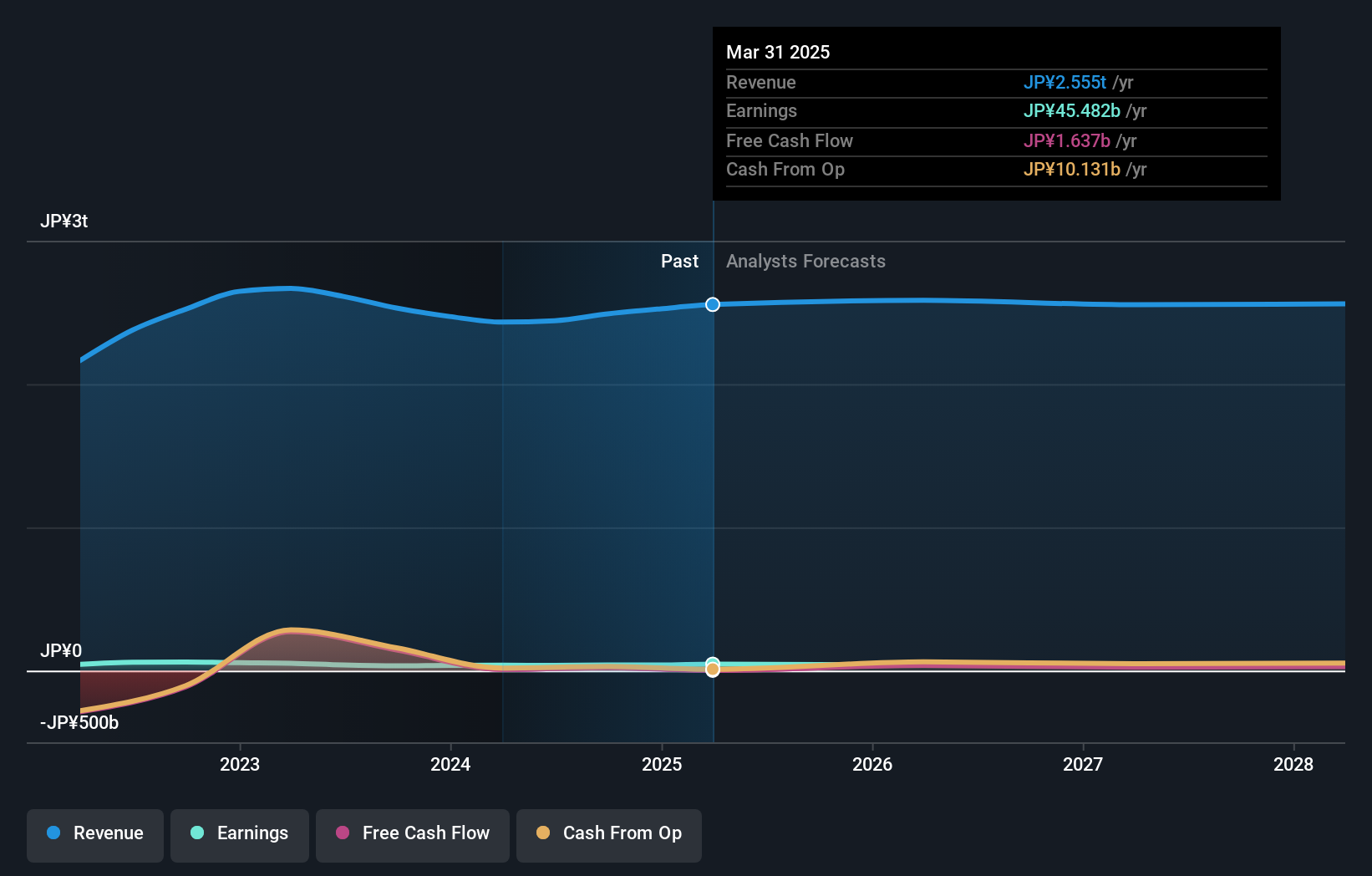

Hanwa, a notable player in the trade distribution sector, has made strides with its debt to equity ratio dropping from 198.4% to 97% over five years. The company boasts high-quality earnings and a robust EBIT coverage of interest payments at 94.7 times, indicating strong financial health. Recent share repurchases amounting to ¥1,295 million for 248,800 shares highlight efforts to enhance shareholder value and capital efficiency. Trading at a good value compared to peers and industry standards, Hanwa's earnings growth of 18.4% last year outpaced the industry's average of 5.7%, showcasing its competitive edge in the market.

- Click to explore a detailed breakdown of our findings in Hanwa's health report.

Examine Hanwa's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Click here to access our complete index of 2604 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603325

Shanghai Bloom Technology

Manufactures and supply powder and granular material handling system solutions with pneumatic conveying in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives