Undiscovered Gems with Promising Potential for February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility, driven by AI competition concerns and fluctuating interest rates, investors are keeping a close eye on small-cap stocks for potential opportunities. In this dynamic environment, identifying promising stocks involves looking beyond current market turbulence to find companies with strong fundamentals and growth potential that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Seika (TSE:8061)

Simply Wall St Value Rating: ★★★★★★

Overview: Seika Corporation is involved in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and internationally with a market cap of ¥54.39 billion.

Operations: Seika Corporation generates revenue primarily from its Product Business, Electric Power Business, and Industrial Machinery Business, with respective revenues of ¥33.53 billion, ¥33.32 billion, and ¥25.98 billion.

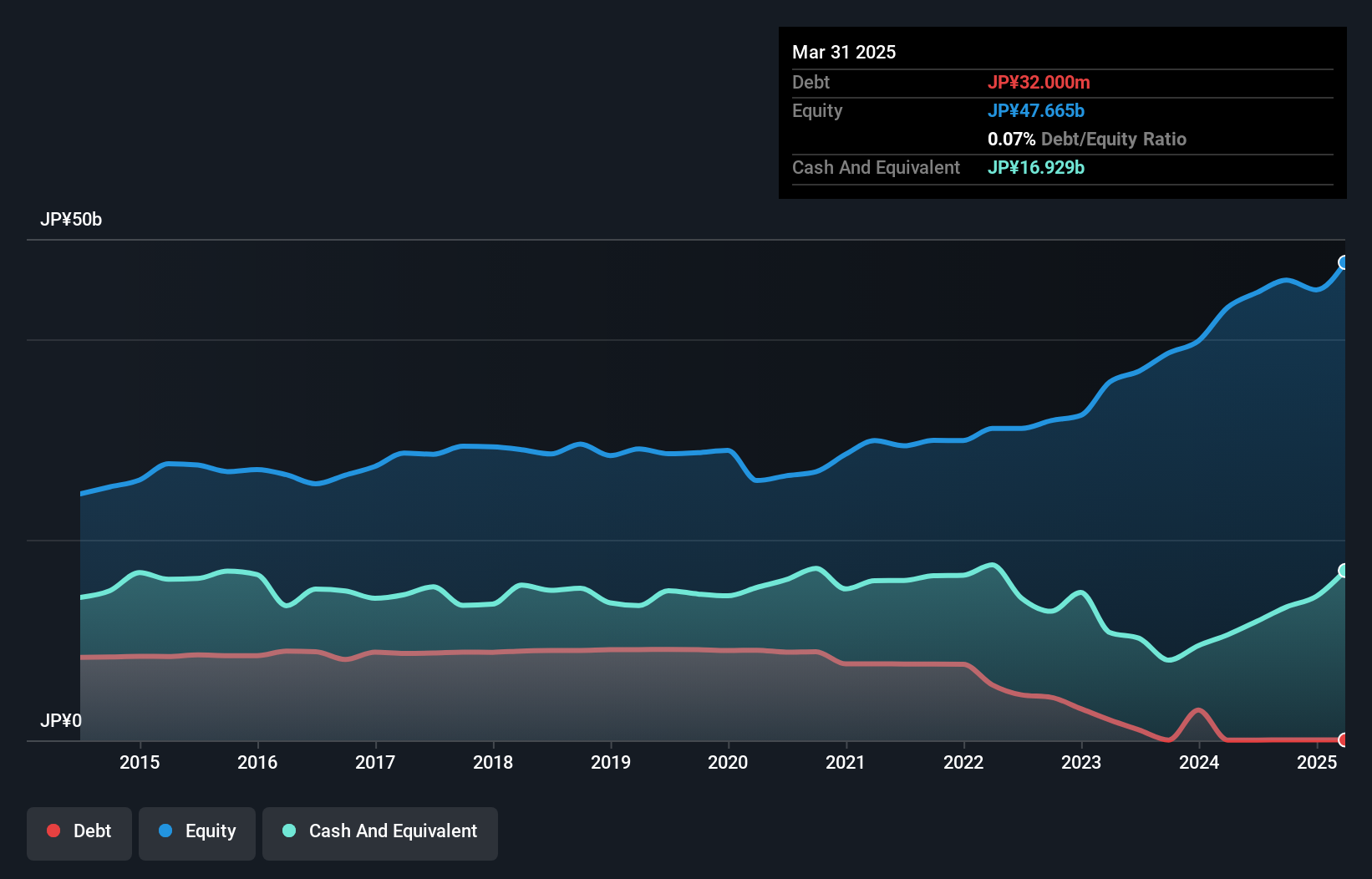

Seika's recent performance paints a promising picture, with earnings surging by 43%, outpacing the Trade Distributors industry. Its debt to equity ratio has impressively shrunk from 31.5% to 0.09% over five years, indicating strong financial health and more cash than total debt. Despite a ¥2.9 billion one-off gain impacting results, Seika is trading at a significant discount of 93.5% below its estimated fair value, suggesting potential undervaluation. The company announced an increased dividend of ¥90 per share for Q2 and expects further growth in dividends by year-end, reflecting confidence in its ongoing profitability and shareholder value enhancement strategies.

- Delve into the full analysis health report here for a deeper understanding of Seika.

Examine Seika's past performance report to understand how it has performed in the past.

Fukui Bank (TSE:8362)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Fukui Bank, Ltd., along with its subsidiaries, offers a range of banking products and services in Japan with a market cap of ¥43.18 billion.

Operations: Fukui Bank generates revenue primarily from its comprehensive financial services, amounting to ¥58.71 billion.

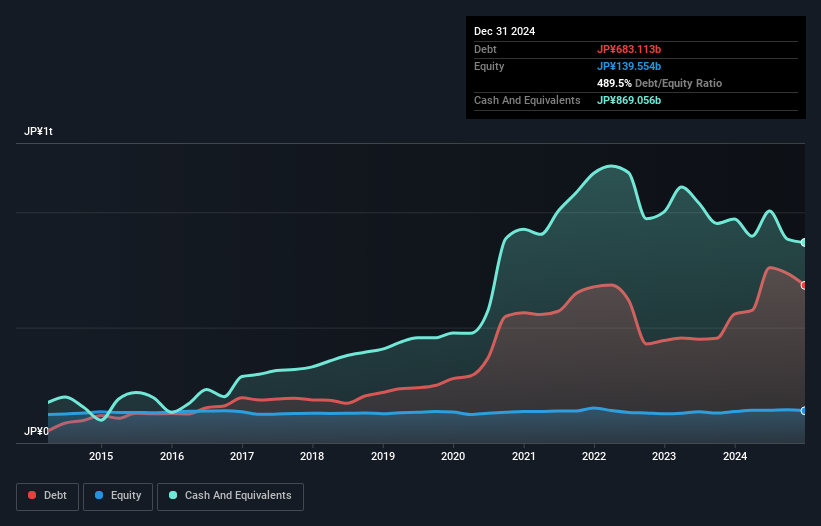

Fukui Bank, a smaller player in the banking sector, has shown impressive earnings growth of 361.6% over the past year, outpacing the industry average of 22%. With total assets amounting to ¥4,318.3 billion and total equity at ¥143.7 billion, it boasts a solid financial foundation. Its non-performing loans are at an appropriate level of 1.7%, reflecting prudent risk management practices. The bank's liabilities are primarily low-risk customer deposits (81%), which is less risky than external borrowing. Trading at 7.1% below its estimated fair value suggests potential undervaluation in the market for this resilient institution.

- Click to explore a detailed breakdown of our findings in Fukui Bank's health report.

Explore historical data to track Fukui Bank's performance over time in our Past section.

Nan Pao Resins Chemical (TWSE:4766)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nan Pao Resins Chemical Co., Ltd. is involved in the production and distribution of synthetic resins, plastics, adhesives, resin coatings, dyes, and pigments across multiple continents including Asia and Oceania, with a market capitalization of NT$39.55 billion.

Operations: The company generates significant revenue from its operations in Taiwan (NT$8.34 billion), Vietnam (NT$7.44 billion), and the Mainland Area (NT$7.68 billion). It also has notable revenue contributions from Australia, amounting to NT$3.09 billion.

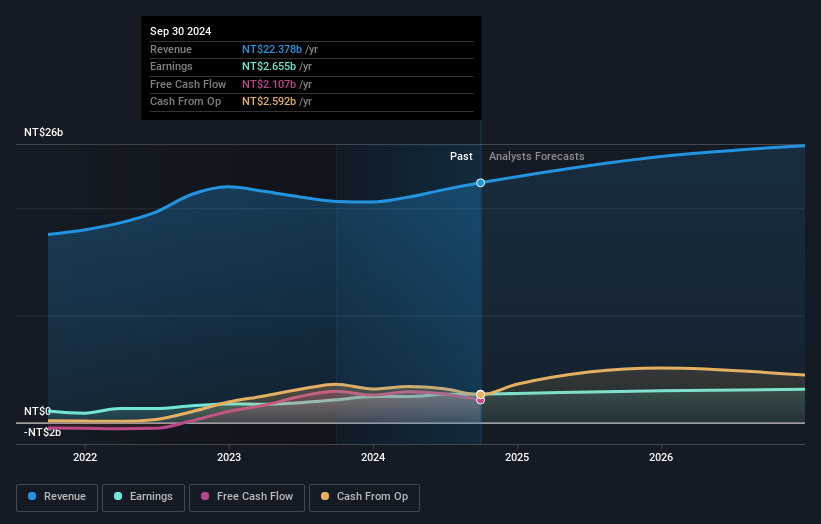

Nan Pao Resins, a notable player in the chemicals sector, has shown robust financial performance with earnings growth of 24.9% over the past year, outpacing the industry average of 13.7%. The company reported third-quarter sales of TWD 6.09 billion and net income of TWD 660.57 million, reflecting solid operational results compared to previous periods. With a price-to-earnings ratio at 14.9x, it trades favorably against the TW market's average of 20.4x, suggesting good relative value for investors seeking potential opportunities in this niche market segment. Recent executive changes could further bolster its strategic direction toward sustainability initiatives.

- Take a closer look at Nan Pao Resins Chemical's potential here in our health report.

Learn about Nan Pao Resins Chemical's historical performance.

Turning Ideas Into Actions

- Discover the full array of 4668 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Pao Resins Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4766

Nan Pao Resins Chemical

Engages in the manufacturing, wholesale, and retail sale of synthetic resins and plastics, adhesives, resin coatings, dyes, and pigments in Taiwan, rest of Asia, Oceania, Europe, Africa, and America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026