- Hong Kong

- /

- Healthtech

- /

- SEHK:2192

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets saw mixed performances with small-cap stocks demonstrating resilience amid broader market volatility. As large-cap indices like the S&P 500 faced downward pressure, small-caps held up better, highlighting potential opportunities in lesser-known equities that may not be on every investor's radar. In this environment, identifying promising stocks involves looking beyond immediate market fluctuations to uncover companies with strong fundamentals and growth potential that are often overlooked.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Medlive Technology (SEHK:2192)

Simply Wall St Value Rating: ★★★★★★

Overview: Medlive Technology Co., Ltd. operates an online professional physician platform in Mainland China and internationally, with a market cap of HK$6.59 billion.

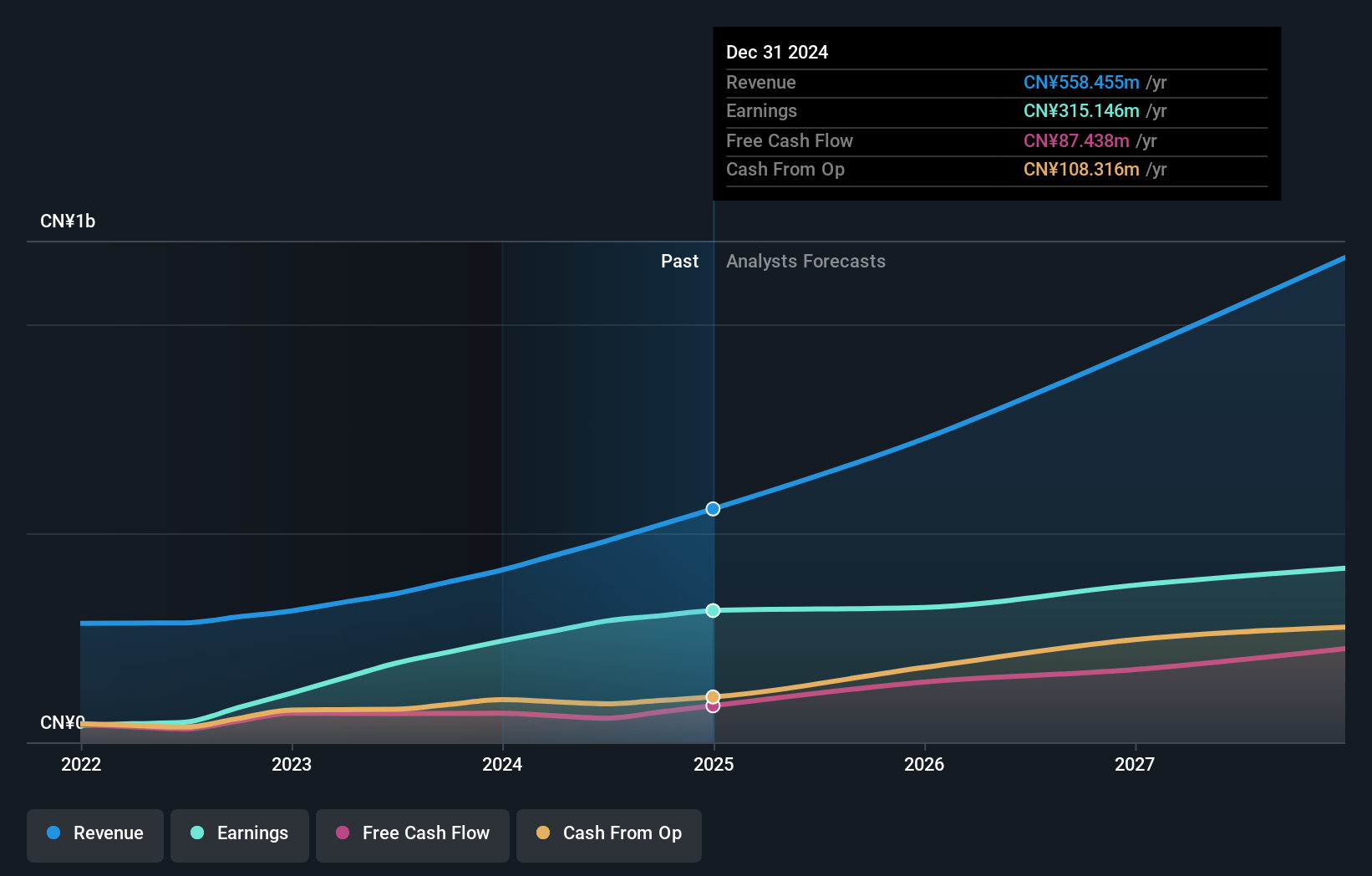

Operations: Medlive generates revenue primarily from healthcare software, amounting to CN¥481.94 million.

Medlive Technology, a nimble player in the healthcare services sector, has shown robust financial performance recently. The company's earnings surged by 53% over the past year, outpacing the industry average of 11%. With no debt on its books, Medlive's interest coverage is not a concern and it boasts high-quality non-cash earnings. For the first half of 2024, sales climbed to CNY 243 million from CNY 174 million last year, while net income rose to CNY 147 million from CNY 99 million. Additionally, Medlive announced an interim dividend of HKD 0.132 per share for this period.

- Click here to discover the nuances of Medlive Technology with our detailed analytical health report.

Evaluate Medlive Technology's historical performance by accessing our past performance report.

Daiichi Jitsugyo (TSE:8059)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daiichi Jitsugyo Co., Ltd. supplies industrial machinery worldwide and has a market capitalization of approximately ¥84.24 billion.

Operations: The company generates revenue primarily from the sale of industrial machinery. It has a market capitalization of approximately ¥84.24 billion.

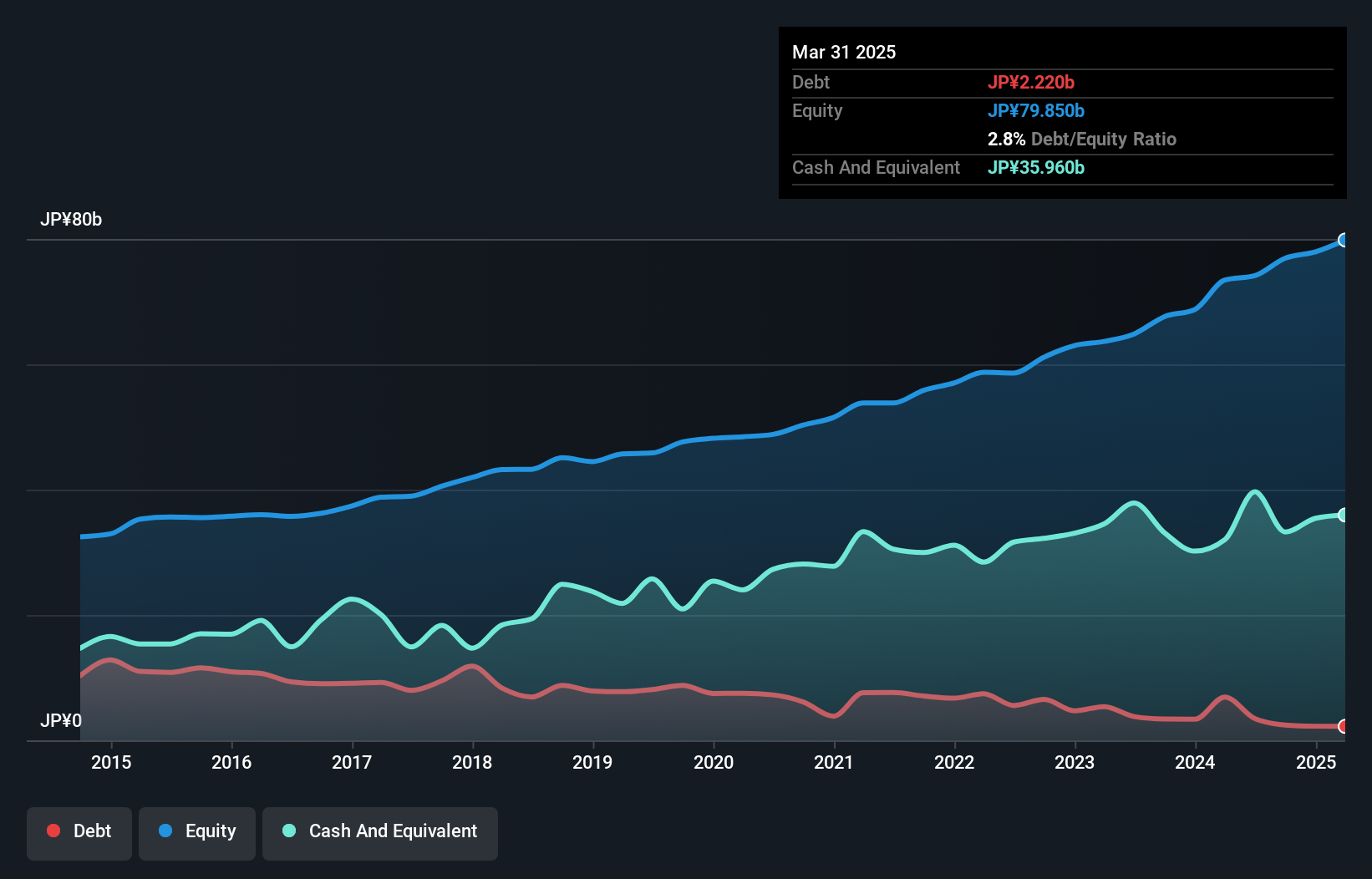

Daiichi Jitsugyo, a company with a market presence that might not be on everyone's radar, has shown impressive financial resilience. Over the past year, its earnings surged by 29.8%, outpacing the Trade Distributors industry average of 5.3%. The firm boasts a strong balance sheet, with cash exceeding total debt and a debt-to-equity ratio that decreased from 17.6% to 4.7% over five years, indicating effective debt management. Despite not being free cash flow positive recently, it maintains high-quality earnings and covers interest payments comfortably. Its price-to-earnings ratio at 10.4x suggests it's valued attractively compared to Japan's market average of 13.3x.

Ricoh Leasing Company (TSE:8566)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ricoh Leasing Company, Ltd. operates in Japan, providing leasing, investment, and financial services with a market capitalization of ¥159.98 billion.

Operations: Ricoh Leasing generates revenue primarily through its leasing, investment, and financial services businesses in Japan. The company has a market capitalization of ¥159.98 billion.

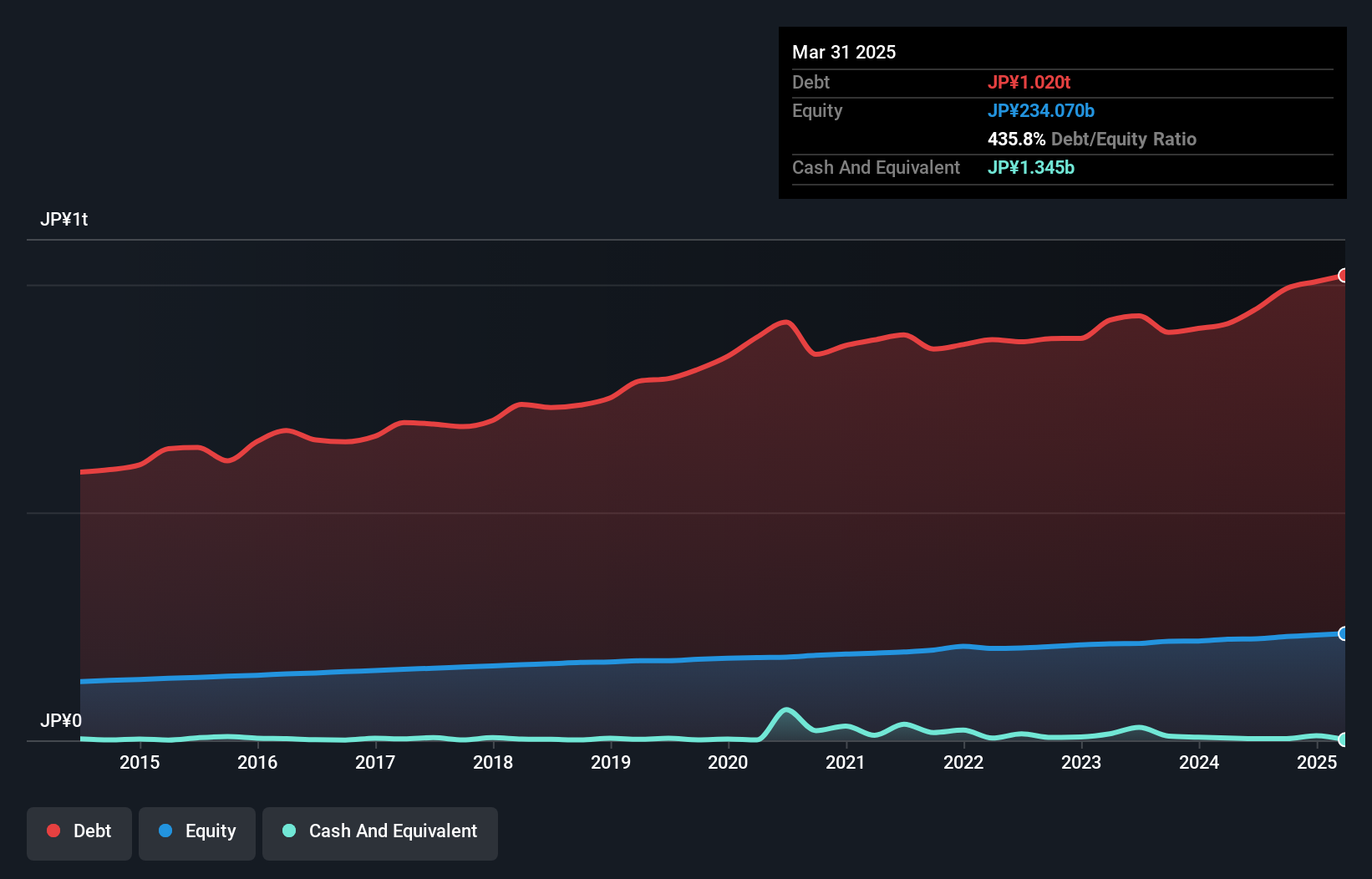

Ricoh Leasing, a smaller player in the financial sector, has shown resilience with a reduction in its debt to equity ratio from 458% to 436% over five years. Despite high net debt levels at 434%, interest payments are well-covered by profits. The company is trading at a notable discount of 36% below estimated fair value, suggesting potential upside. Recent board decisions include disposing of treasury shares for stock-based remuneration and revising dividend forecasts, with dividends expected to rise from ¥75 to ¥95 per share for the year ending March 2025. Earnings guidance projects net sales of ¥315 billion and operating profit of ¥21 billion.

Where To Now?

- Unlock our comprehensive list of 4703 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2192

Medlive Technology

Operates an online professional physician platform in Mainland China and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives