- Japan

- /

- Trade Distributors

- /

- TSE:8058

Did Hawai’i Renewable Fuels Venture Just Shift Mitsubishi's (TSE:8058) Low-Carbon Investment Narrative?

Reviewed by Sasha Jovanovic

- Par Pacific Holdings recently closed a US$100 million deal to construct Hawai’i’s largest renewable fuels manufacturing facility, forming a joint venture with Mitsubishi Corporation and Eneos, in which Mitsubishi and Eneos hold a 36.5% equity stake.

- This investment marks a significant step for Mitsubishi, bolstering its presence in advanced renewable energy production and reflecting growing commitment to low-carbon transition efforts.

- We’ll examine how Mitsubishi’s increased exposure to renewable fuels through the Hawai’i joint venture could reshape the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsubishi Investment Narrative Recap

To be a Mitsubishi shareholder, you need confidence in the company's ability to balance cyclical resource exposure with efforts to diversify into growth areas like renewable energy, food, and infrastructure. The Hawai’i renewable fuels joint venture showcases this potential, but near-term results will likely still be dominated by volatility in commodities, while slower-than-expected progress in renewables remains a key risk. For now, the news does not materially shift the short-term catalyst or the largest risk facing the business.

Among Mitsubishi's recent moves, the decision to halt offshore wind projects due to adverse market conditions is especially relevant, underscoring that even as new renewable investments progress, execution risks and external headwinds still persist. This context reinforces why the success of the Hawai’i facility, and its impact on Mitsubishi's diversification efforts, will be closely watched by investors.

In contrast, investors should also consider that volatility in commodity prices continues to threaten cash flow and earnings stability…

Read the full narrative on Mitsubishi (it's free!)

Mitsubishi's narrative projects ¥19,785.2 billion in revenue and ¥915.4 billion in earnings by 2028. This requires 2.9% yearly revenue growth and a ¥115.9 billion earnings increase from the current earnings of ¥799.5 billion.

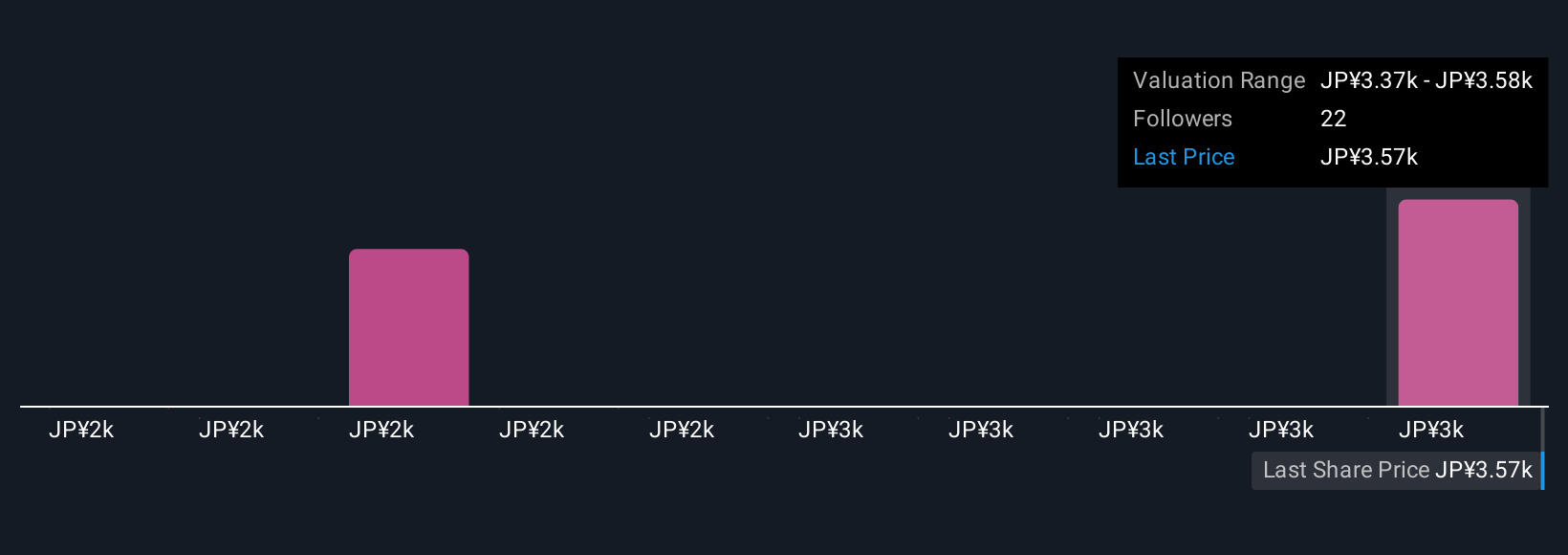

Uncover how Mitsubishi's forecasts yield a ¥3405 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span from ¥1,520 to ¥3,405 per share, reflecting significant differences in outlook. As you weigh these views, remember that Mitsubishi’s reliance on capital-intensive resources could amplify earnings swings and affect long-term confidence.

Explore 4 other fair value estimates on Mitsubishi - why the stock might be worth as much as ¥3405!

Build Your Own Mitsubishi Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mitsubishi research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi's overall financial health at a glance.

No Opportunity In Mitsubishi?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives