- Japan

- /

- Trade Distributors

- /

- TSE:8053

Sumitomo (TSE:8053) Valuation After ¥300 Billion Bond Shelf Registration Spurs Growth Strategy Questions

Reviewed by Simply Wall St

Sumitomo (TSE:8053) just filed a ¥300 billion bond shelf registration, a move that puts fresh financing within easy reach and immediately raises questions about how management plans to deploy that firepower.

See our latest analysis for Sumitomo.

The move comes after a strong run for the stock, with a 47.2% year to date share price return and a 56.1% one year total shareholder return signaling momentum rather than fatigue.

If Sumitomo’s financing plans have you thinking bigger picture, this is a good moment to explore fast growing stocks with high insider ownership that could be driving their next wave of growth.

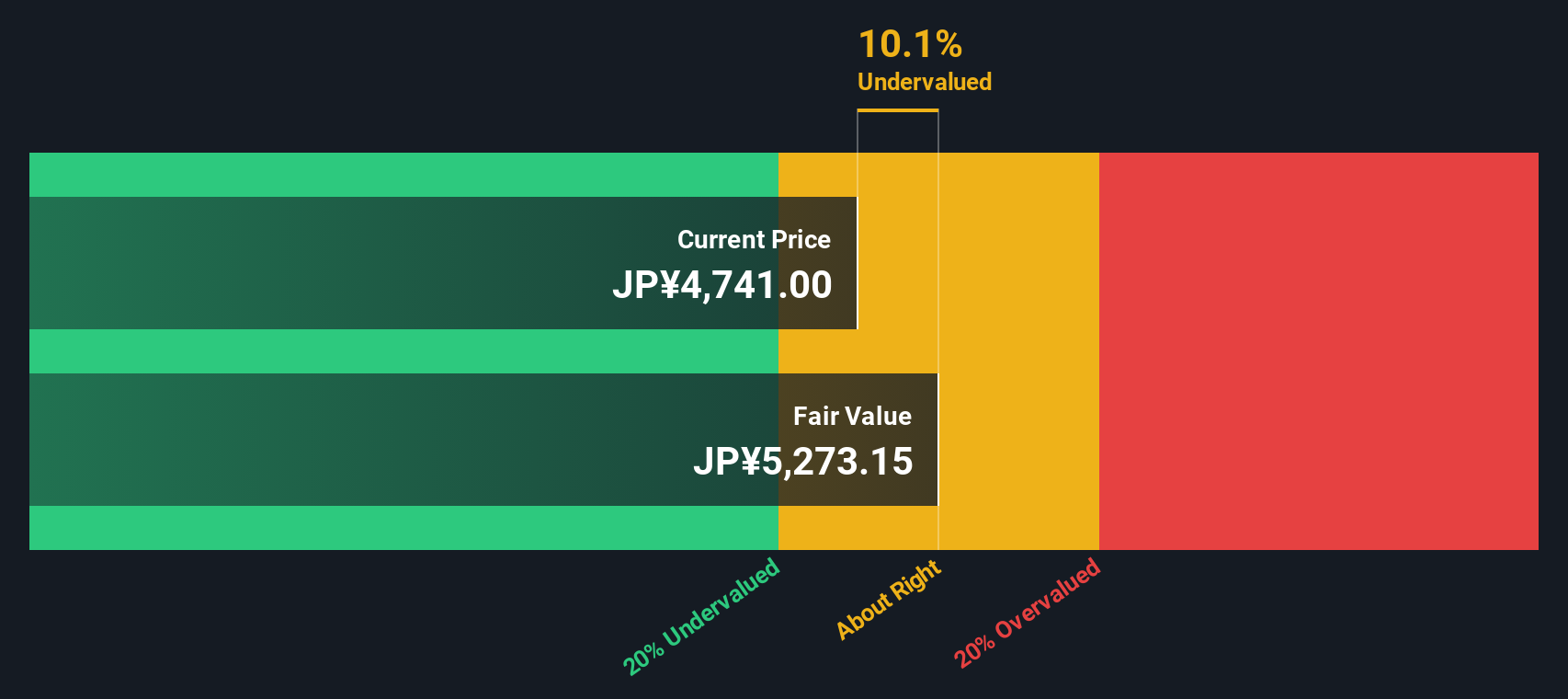

With earnings still growing, a modest discount to analyst targets, and a sizable bond program ready to fund new projects, investors now face the key question: Is Sumitomo still attractively priced, or is future growth already reflected in the share price?

Price-to-Earnings of 10x: Is it justified?

On a price-to-earnings ratio of 10x at the last close of ¥5,065, Sumitomo looks cheaper than the broader Japanese market but not outright cheap versus its niche peers.

The price-to-earnings multiple compares what investors pay today for each unit of current earnings. This can be a useful lens for a diversified trading and industrial group like Sumitomo, where profits are already established and growing.

Relative to the JP market average P/E of 14.1x, the company trades at a noticeable discount. This implies investors are not fully pricing in its recent 71.4% earnings growth and improved profit margins, yet that discount sits alongside a slight premium to the Trade Distributors industry average of 9.9x.

Against the estimated Fair Price-to-Earnings Ratio of 19.9x, the current 10x multiple appears markedly conservative. This suggests meaningful room for re rating if the market begins to value its earnings profile closer to that fair ratio benchmark.

Explore the SWS fair ratio for Sumitomo

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, stretched multi year returns and reliance on cyclical commodities and global trade mean that a sentiment turn or macro slowdown could quickly compress that attractive multiple.

Find out about the key risks to this Sumitomo narrative.

Another Take on Value

Our SWS DCF model paints a cooler picture, putting fair value at ¥3,938.1 versus the current ¥5,065 share price. That points to Sumitomo trading at a premium on cash flow terms rather than at a bargain. This raises the question of whether investors are now paying up for momentum rather than fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sumitomo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sumitomo Narrative

If you read the numbers differently, or simply want to test your own assumptions against the data, you can build a narrative in minutes: Do it your way.

A great starting point for your Sumitomo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing angles?

Sumitomo might suit your strategy today, but you will stay ahead of the crowd by scanning fresh opportunities tailored to different themes and market conditions.

- Capture mispriced opportunities by scanning these 909 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Explore the next wave of innovation by targeting these 27 AI penny stocks at the forefront of algorithm development and real world AI adoption.

- Focus on reliable income streams by looking at these 15 dividend stocks with yields > 3% that offer attractive yields while maintaining balance sheet discipline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026