- Japan

- /

- Trade Distributors

- /

- TSE:8031

Mitsui (TSE:8031): Reassessing Valuation After Strategic Shift Away from Blue Water Alliance Joint Venture

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 2.6% Undervalued

The prevailing narrative views Mitsui as modestly undervalued, with price targets just above current trading levels. Analysts are factoring in a mix of opportunity and risk as the business pivots toward the energy transition and broad portfolio changes.

Mitsui's ongoing investments in LNG, low-carbon ammonia, and related infrastructure projects (such as Blue Point and Ruwais LNG) position the company to capture growth from the increasing global demand for cleaner energy sources. This is likely to boost revenue and long-term earnings stability as the energy transition accelerates.

What is really pushing this new fair value? Want to see which future profit drivers and bold financial assumptions get baked into this narrative? There is a hidden formula at work here, centering on projected growth and shifting margins, that could surprise you. The answer is in the numbers only the full narrative reveals.

Result: Fair Value of ¥3,823 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on commodities and the risk of overextension into new investments could present challenges for Mitsui's ability to sustain steady long-term growth.

Find out about the key risks to this Mitsui narrative.Another View: Looking Beyond Analyst Targets

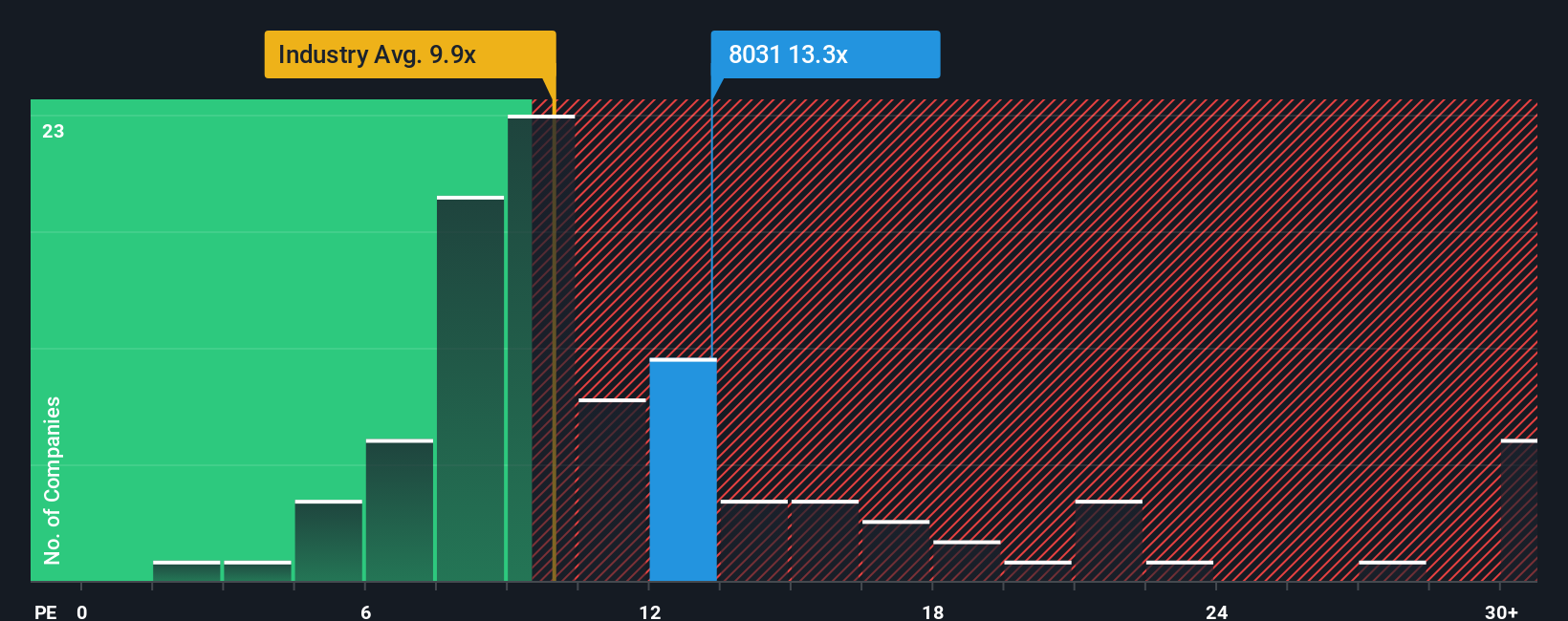

Take a look at how Mitsui is valued compared to the industry using its price-to-earnings ratio. This method suggests the shares are actually priced on the expensive side versus sector peers. Does this challenge the earlier undervalued narrative, or is there more at play beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Mitsui to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Mitsui Narrative

If you see things differently or want to do your own digging, you can shape your own Mitsui narrative in just a few minutes. Do it your way.

A great starting point for your Mitsui research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities are always out there, and now is the time to uncover new ways to power your portfolio. Act fast and check out these exciting themes before the crowd catches on:

- Capitalize on skyrocketing tech by checking out promising AI breakthroughs with AI penny stocks integrated directly into their business models.

- Strengthen your passive income by zeroing in on companies with reliable high yields through our expertly curated dividend stocks with yields > 3% picks.

- Ride the momentum in digital innovation and payment disruption. Let cryptocurrency and blockchain stocks lead you to pioneers shaping the blockchain and cryptocurrency world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives