- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600694

Undiscovered Gems on None Exchange for February 2025

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, small-cap stocks have faced their own set of challenges, reflected in the recent decline of indices like the Russell 2000. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gallant Precision Machining | 29.51% | -2.07% | 4.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Advanced International Multitech | 36.42% | 6.79% | 4.08% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Dashang (SHSE:600694)

Simply Wall St Value Rating: ★★★★★★

Overview: Dashang Co., Ltd. is a Chinese company that operates a chain of department stores, supermarkets, and electrical appliance stores, with a market capitalization of CN¥7.44 billion.

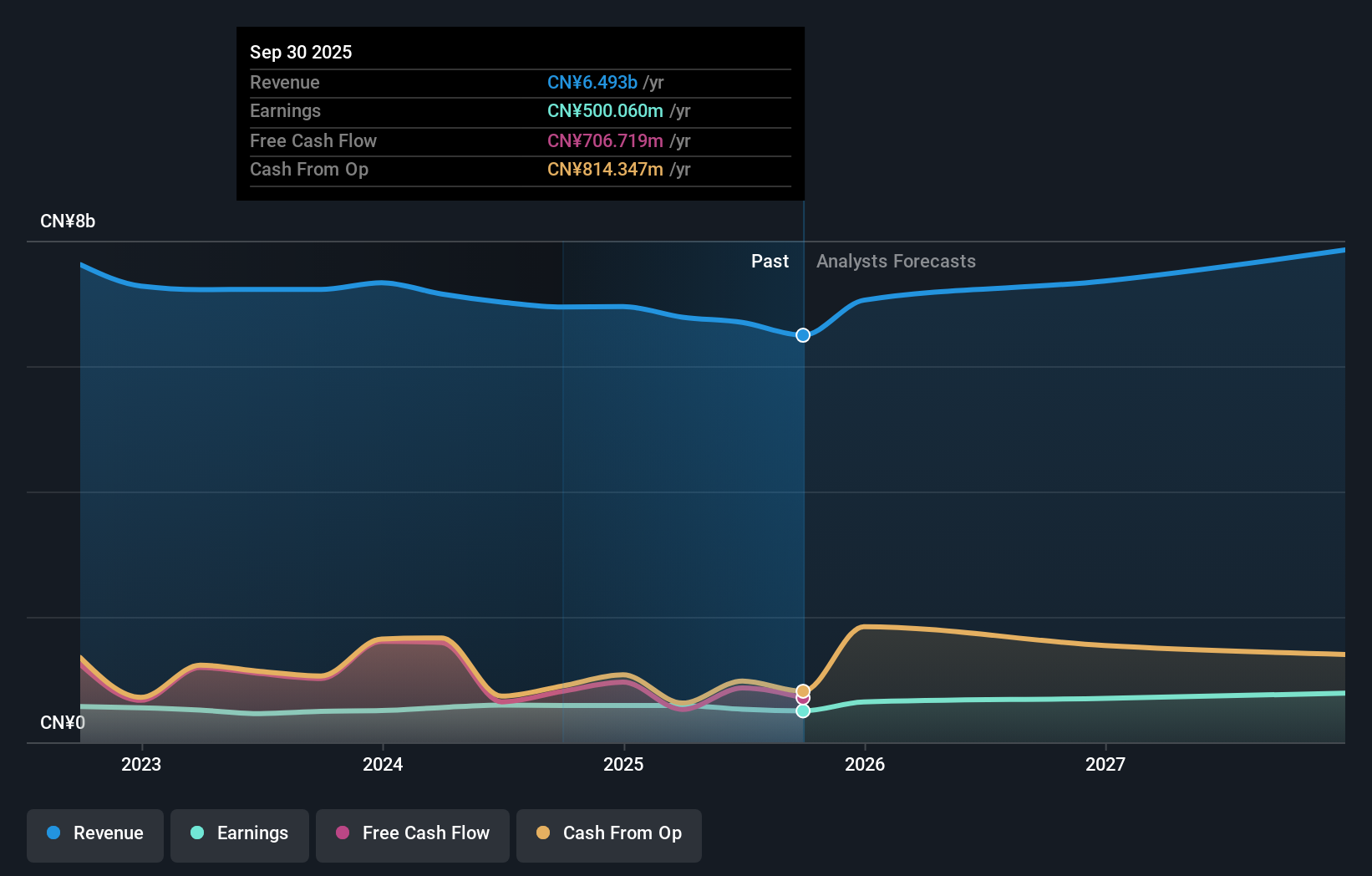

Operations: Dashang generates revenue primarily from its department stores, supermarkets, and electrical appliance stores. The company has observed a net profit margin of 3.5%.

Dashang, a notable player in the retail sector, has been making waves with its debt-free status and robust earnings growth of 18.8% over the past year. This performance outpaces the broader Multiline Retail industry, which saw a -5.3% change. Trading at 16.7% below its estimated fair value suggests potential for investors seeking undervalued opportunities. The company also boasts high-quality earnings and positive free cash flow, reflecting strong financial health and operational efficiency. Despite recent share price volatility, Dashang's strategic positioning in the market seems promising for future growth prospects as it continues to outperform peers financially.

- Navigate through the intricacies of Dashang with our comprehensive health report here.

Review our historical performance report to gain insights into Dashang's's past performance.

Shantui Construction Machinery (SZSE:000680)

Simply Wall St Value Rating: ★★★★★★

Overview: Shantui Construction Machinery Co., Ltd. is a company that provides construction machinery products both in China and internationally, with a market cap of CN¥14.28 billion.

Operations: Shantui Construction Machinery generates revenue primarily from the sale of construction machinery products. The company focuses on optimizing its cost structure to manage expenses effectively. Its financial performance is influenced by various factors, including market demand and operational efficiency.

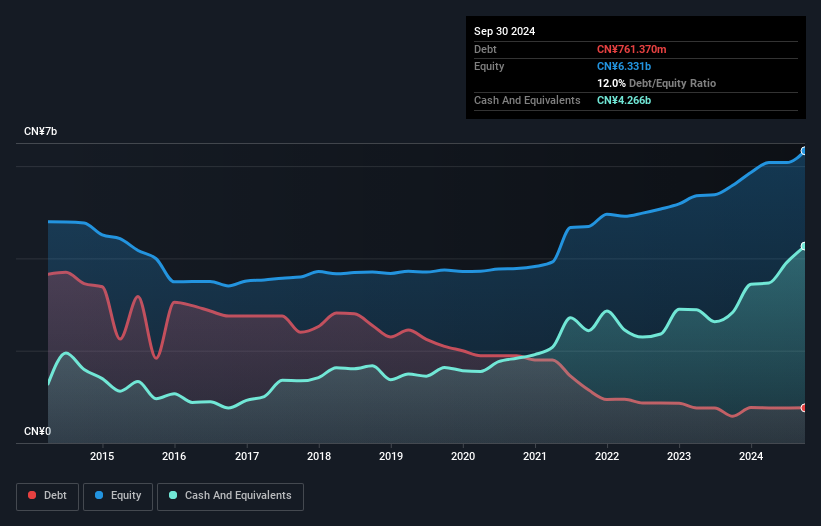

Shantui Construction Machinery, a smaller player in the machinery industry, has demonstrated robust performance with earnings surging by 45% over the past year. The company's debt to equity ratio improved significantly from 56% to 12% in five years, reflecting prudent financial management. Trading at a notable discount of 70% below its estimated fair value, Shantui appears undervalued compared to peers. With high-quality earnings and more cash than total debt, it seems well-positioned financially. A recent dividend approval of CNY 0.30 per ten shares further underscores its commitment to shareholder returns amidst strong growth prospects forecasted at over 21% annually.

- Click to explore a detailed breakdown of our findings in Shantui Construction Machinery's health report.

Learn about Shantui Construction Machinery's historical performance.

Kanematsu (TSE:8020)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kanematsu Corporation is engaged in the trading of commercial products both in Japan and internationally, with a market capitalization of approximately ¥209.94 billion.

Operations: Kanematsu generates revenue primarily from its Electronic Devices and Food, Meat & Grain segments, contributing ¥356.83 billion and ¥356.06 billion respectively. The Motor Vehicles & Aerospace segment adds ¥104.78 billion, while Steel / Materials / Plants contributes ¥205.34 billion to the overall revenue stream.

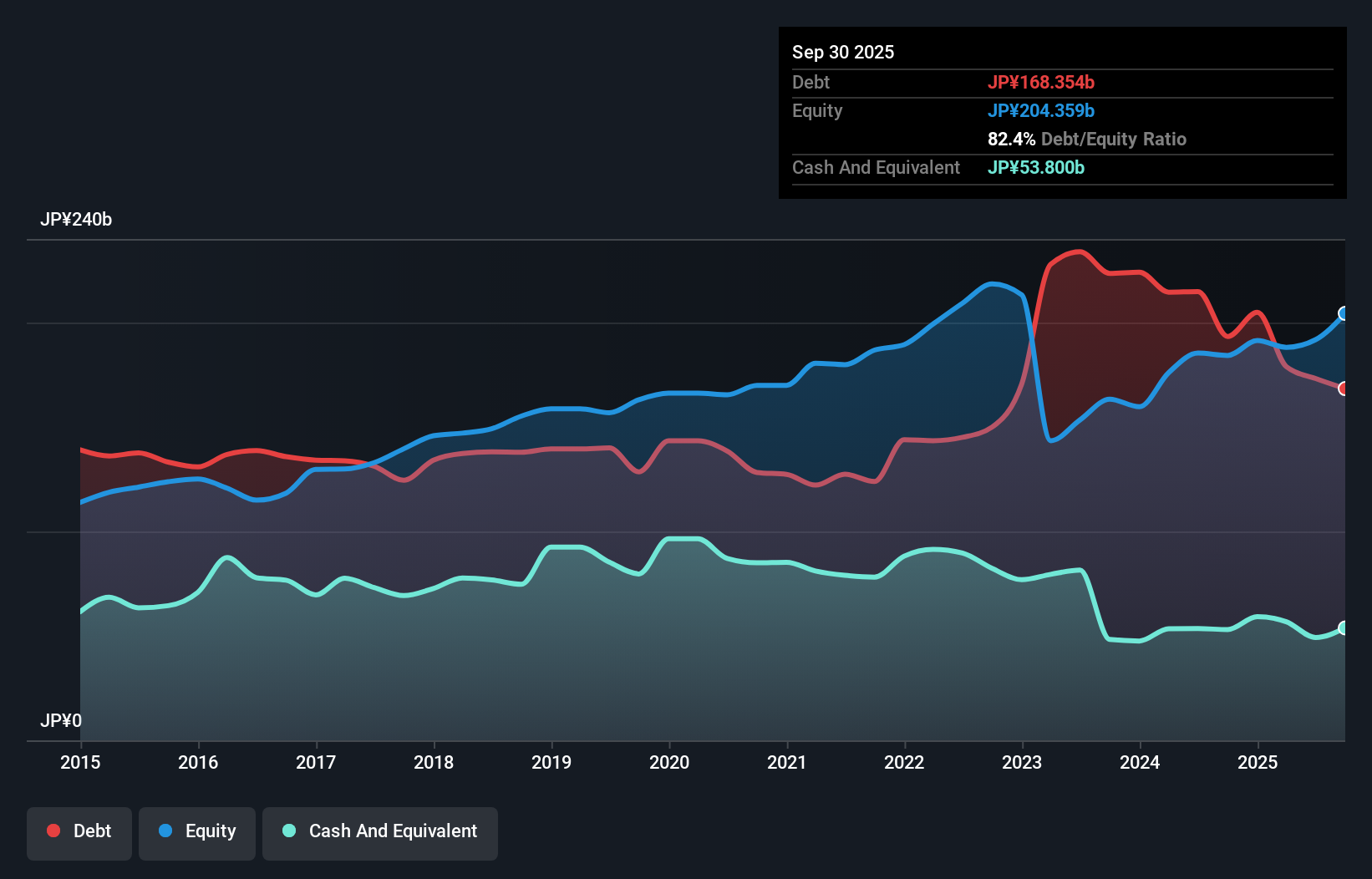

Kanematsu, a smaller player in the trade distribution sector, showcases high-quality earnings and a robust 33% growth over the past year. Despite a high net debt to equity ratio of 76.1%, its interest payments are well covered with an EBIT coverage of 12.4 times. Trading at nearly 90% below estimated fair value, it represents good relative value compared to peers. Recent fixed-income offerings totaling ¥12 billion suggest strategic financial maneuvers to bolster operations or fund future projects. With earnings forecasted to grow at nearly 10% annually, Kanematsu appears poised for continued expansion in its industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Kanematsu.

Examine Kanematsu's past performance report to understand how it has performed in the past.

Next Steps

- Delve into our full catalog of 4752 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600694

Dashang

Operates a chain of department stores, supermarkets, and electrical appliance stores in China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives