- Japan

- /

- Real Estate

- /

- TSE:3452

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, with U.S. stocks reaching record highs fueled by optimism around trade policies and AI investments, investors are increasingly looking for stable income sources amid the dynamic market environment. In this context, dividend stocks stand out as a compelling option for those seeking regular income streams while participating in potential market growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

MUGEN ESTATELtd (TSE:3299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MUGEN ESTATE Co., Ltd. operates in Japan by purchasing and reselling used real estate properties, with a market cap of ¥40.35 billion.

Operations: MUGEN ESTATE Ltd. generates revenue primarily from its Real Estate Sales Business, which accounts for ¥57.62 billion, and its Leasing and Other Business segment, contributing ¥2.41 billion.

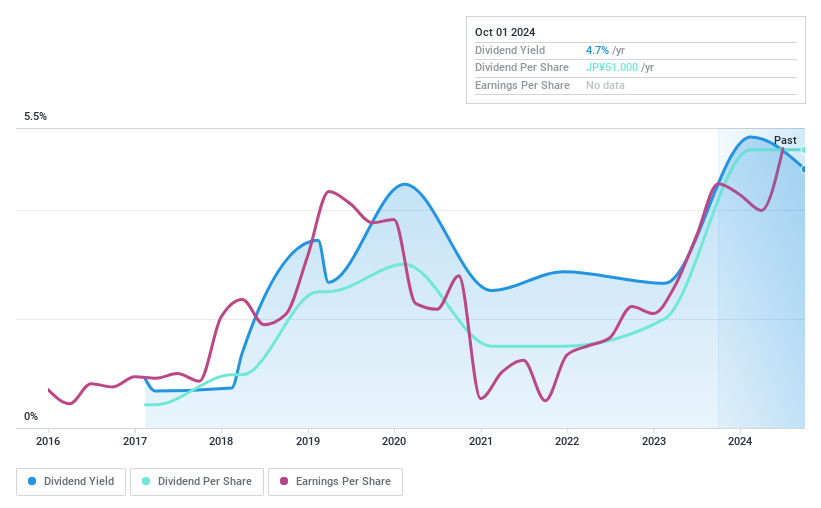

Dividend Yield: 4.6%

MUGEN ESTATE Ltd. offers a dividend yield of 4.64%, ranking in the top 25% of JP market dividend payers, yet its high cash payout ratio (410.9%) indicates dividends are not well covered by cash flows, raising sustainability concerns despite a low earnings payout ratio (28.4%). Recent organizational changes aim to enhance operational efficiency and expand business presence, potentially impacting future profitability and dividend stability amidst historically volatile payments over the past decade.

- Click here to discover the nuances of MUGEN ESTATELtd with our detailed analytical dividend report.

- The analysis detailed in our MUGEN ESTATELtd valuation report hints at an inflated share price compared to its estimated value.

B-Lot (TSE:3452)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B-Lot Company Limited operates in the real estate and financial consulting sectors in Japan, with a market cap of ¥23.81 billion.

Operations: B-Lot Company Limited generates revenue through its Real Estate Consulting Business (¥2.27 billion), Real Estate Management Business (¥4.36 billion), and Real Estate Investment Development Business (¥25.18 billion).

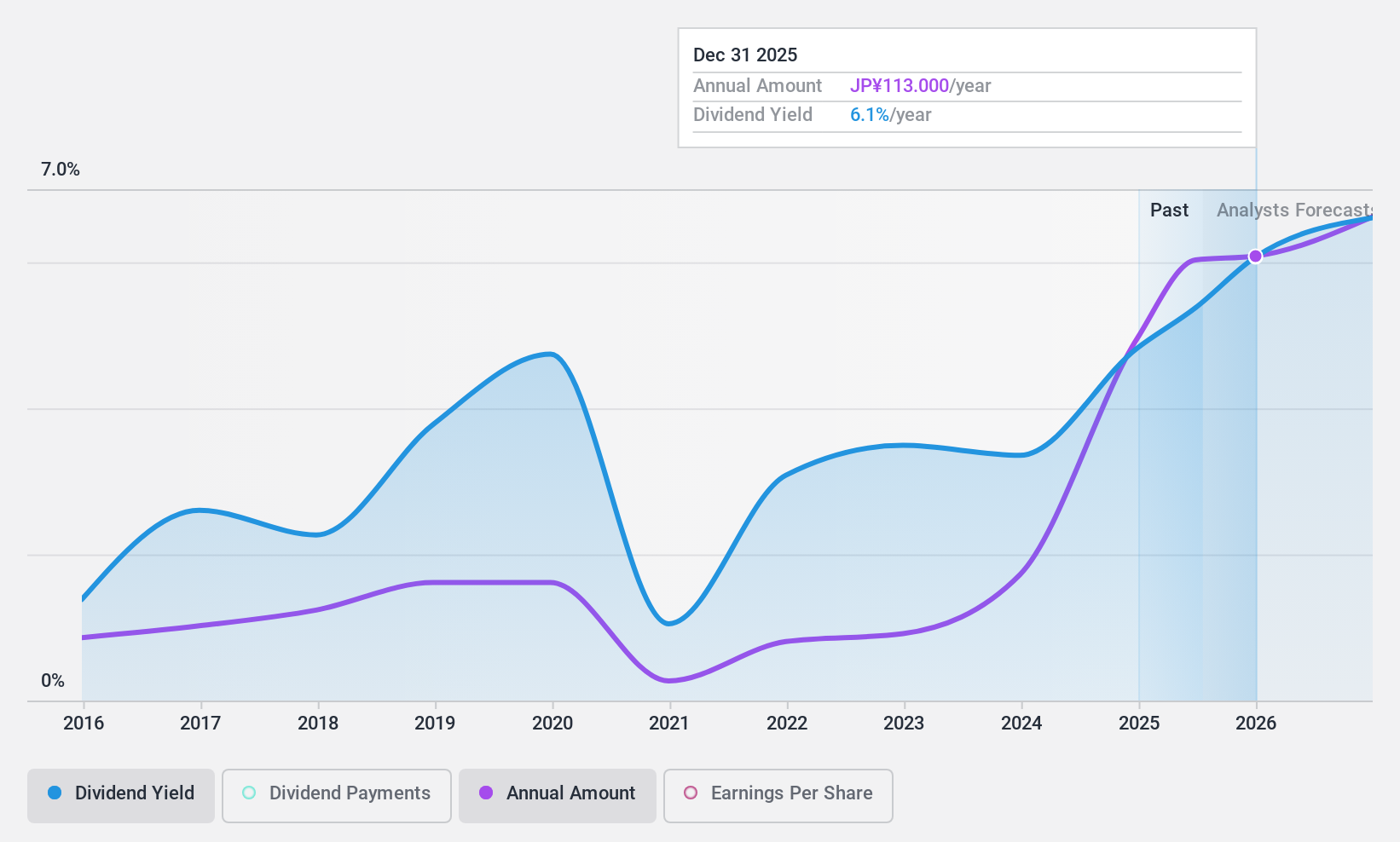

Dividend Yield: 4%

B-Lot's dividend yield of 4.02% places it among the top 25% in the JP market, supported by a low earnings payout ratio of 19.4%. However, its dividend history is volatile despite being covered by cash flows with a cash payout ratio of 64%. The recent completion of a share buyback may influence future dividends, although high share price volatility and insufficient debt coverage by operating cash flow present risks to dividend stability.

- Get an in-depth perspective on B-Lot's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, B-Lot's share price might be too optimistic.

Kanematsu (TSE:8020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kanematsu Corporation engages in the trading of commercial products both in Japan and internationally, with a market cap of ¥215.92 billion.

Operations: Kanematsu Corporation's revenue is primarily derived from its segments in Food, Meat & Grain (¥350.11 billion), Electronic Devices (¥307.53 billion), Steel / Materials / Plants (¥210.59 billion), and Vehicles/Aviation (¥110.63 billion).

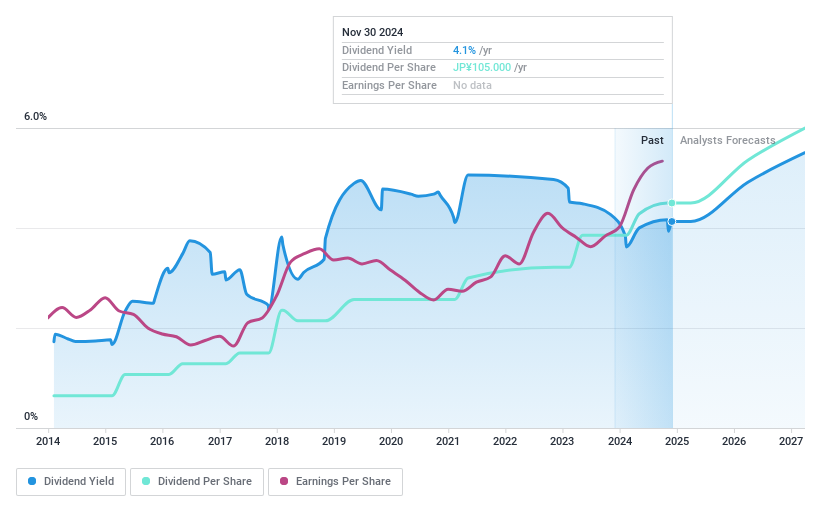

Dividend Yield: 4%

Kanematsu's dividend yield of 4% ranks it in the top 25% of JP market payers, with a low payout ratio of 31.3%, indicating strong earnings coverage. Despite a history of volatility and unreliability, recent increases in dividends and improved financial guidance suggest potential stability. The cash payout ratio stands at a mere 13.9%, ensuring robust cash flow support for dividends, although the company's high debt level could pose risks to future dividend consistency.

- Click here and access our complete dividend analysis report to understand the dynamics of Kanematsu.

- Our valuation report unveils the possibility Kanematsu's shares may be trading at a discount.

Summing It All Up

- Investigate our full lineup of 1951 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade B-Lot, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if B-Lot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3452

B-Lot

Engages in the real estate and financial consulting businesses in Japan.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives