NEPON's (TSE:7985) Returns On Capital Tell Us There Is Reason To Feel Uneasy

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. On that note, looking into NEPON (TSE:7985), we weren't too upbeat about how things were going.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on NEPON is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.009 = JP¥36m ÷ (JP¥6.9b - JP¥2.9b) (Based on the trailing twelve months to March 2024).

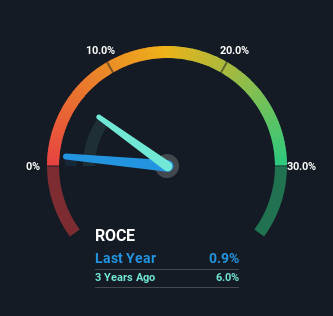

Therefore, NEPON has an ROCE of 0.9%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 7.9%.

See our latest analysis for NEPON

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of NEPON.

What The Trend Of ROCE Can Tell Us

There is reason to be cautious about NEPON, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 3.3% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect NEPON to turn into a multi-bagger.

Another thing to note, NEPON has a high ratio of current liabilities to total assets of 42%. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

Our Take On NEPON's ROCE

In summary, it's unfortunate that NEPON is generating lower returns from the same amount of capital. Investors must expect better things on the horizon though because the stock has risen 19% in the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

If you'd like to know more about NEPON, we've spotted 5 warning signs, and 1 of them is a bit unpleasant.

While NEPON isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you're looking to trade NEPON, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NEPON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7985

NEPON

Manufactures and sells agricultural, general purpose, construction, and sanitary equipment in Japan.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives