- Taiwan

- /

- Semiconductors

- /

- TWSE:3346

Paradise Entertainment And Two Other Prominent Dividend Stocks

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, with the U.S. experiencing volatility due to AI competition fears and Europe buoyed by strong earnings and interest rate cuts, investors are increasingly seeking stability in dividend stocks. As central banks maintain a cautious approach to monetary policy, dividend stocks offer potential income streams that can be appealing during uncertain economic times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.74% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.13% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.48% | ★★★★★★ |

Click here to see the full list of 1944 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

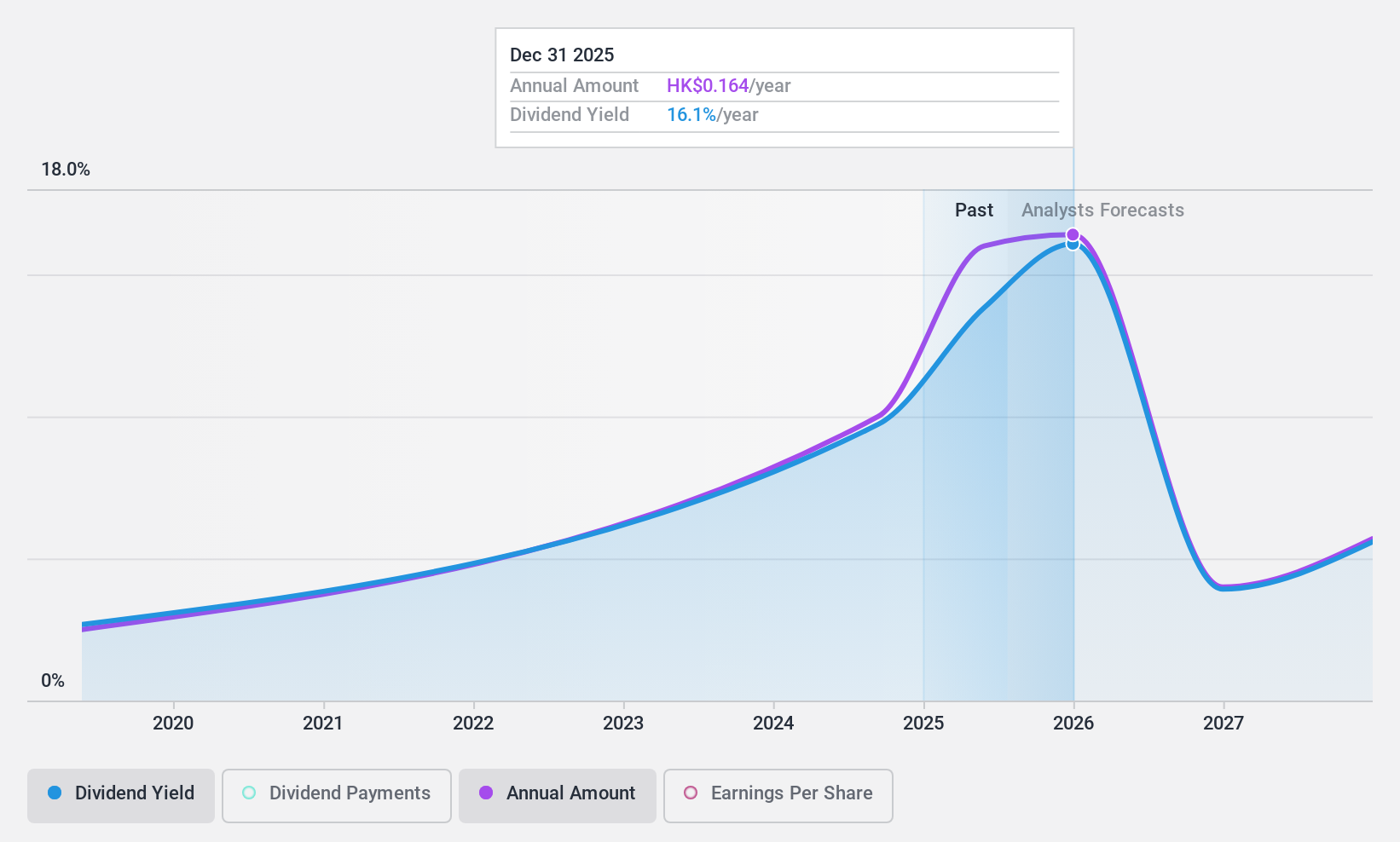

Paradise Entertainment (SEHK:1180)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Paradise Entertainment Limited is an investment holding company that primarily offers casino management services in Macau, the People’s Republic of China, and the United States, with a market cap of HK$957.49 million.

Operations: Paradise Entertainment Limited generates revenue through three main segments: Gaming Systems (HK$121.46 million), Casino Management Services (HK$681.22 million), and Innovative and Renewable Energy Solutions Business (HK$10.15 million).

Dividend Yield: 10%

Paradise Entertainment's dividend payments are well covered by earnings and cash flows, with a payout ratio of 29% and a cash payout ratio of 65.4%. The dividend yield is in the top 25% of Hong Kong market payers, yet its track record has been volatile over the past decade. Despite this instability, dividends have grown over ten years. Recent changes to company bylaws were approved at their December AGM, potentially impacting future governance and strategic decisions.

- Delve into the full analysis dividend report here for a deeper understanding of Paradise Entertainment.

- According our valuation report, there's an indication that Paradise Entertainment's share price might be on the cheaper side.

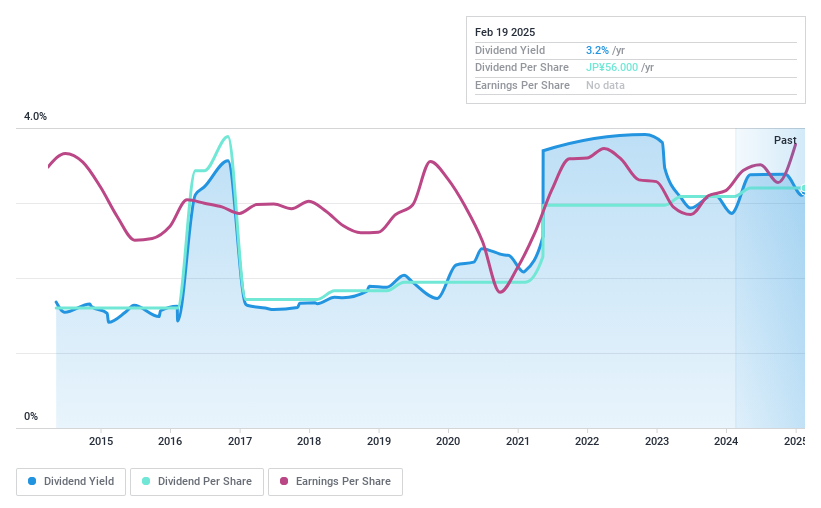

Takara StandardLtd (TSE:7981)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takara Standard Co., Ltd. manufactures and sells enameled products, with a market cap of ¥125.86 billion.

Operations: Takara Standard Ltd. generates revenue from its enameled products segment.

Dividend Yield: 3%

Takara Standard's dividends are well covered by earnings and cash flows, with a payout ratio of 36.4% and a cash payout ratio of 59.6%. Despite past volatility in dividend payments, they have grown over the last decade. The dividend yield is lower than the top quartile in Japan's market. A recent share buyback completed for ¥1.53 billion could indicate confidence in financial stability, though historical unreliability remains a concern for investors seeking consistent income.

- Navigate through the intricacies of Takara StandardLtd with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Takara StandardLtd's current price could be quite moderate.

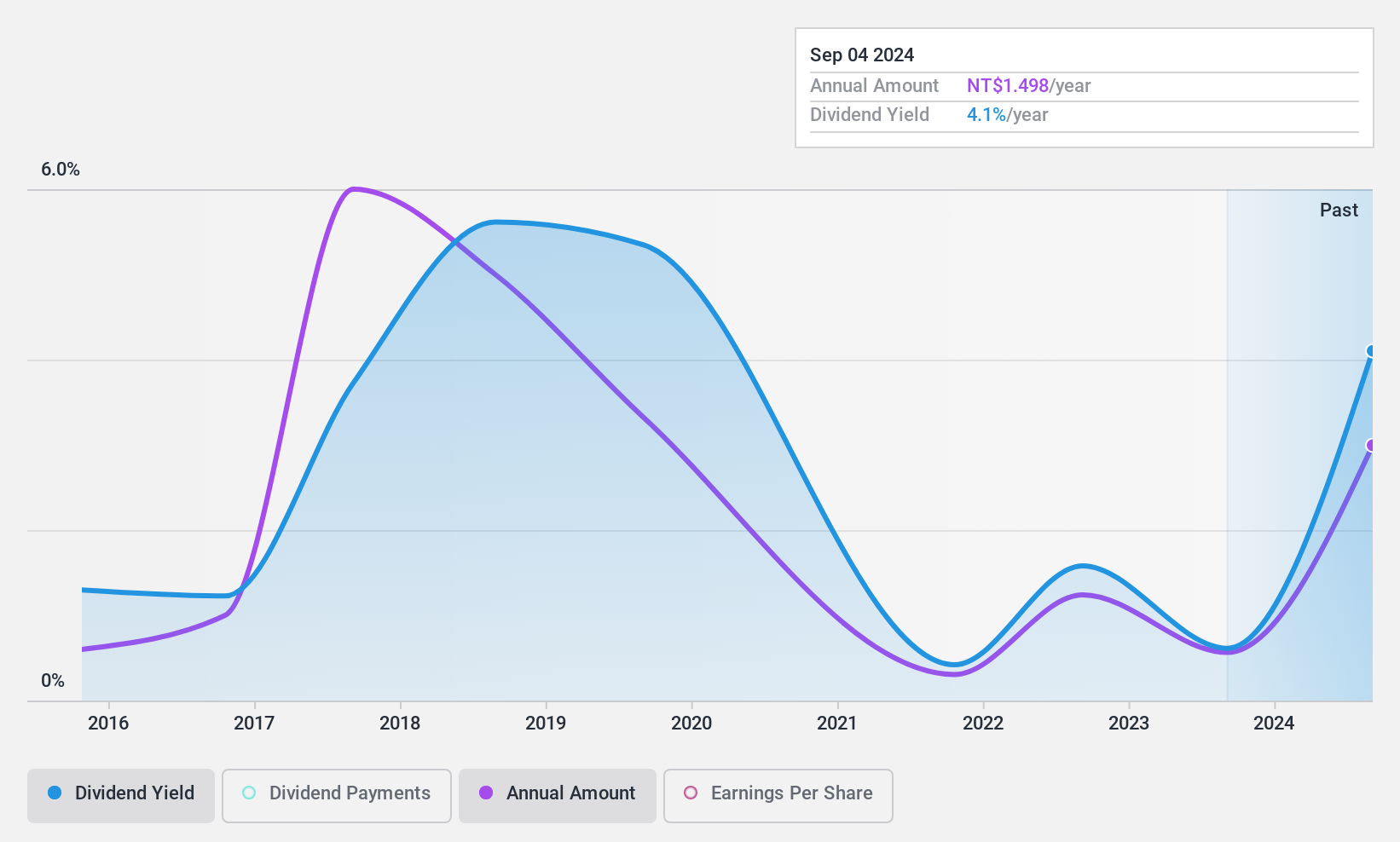

Laster Tech (TWSE:3346)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Laster Tech Co., Ltd. manufactures and sells LED chips and components in Taiwan, China, and Thailand with a market cap of NT$38 billion.

Operations: Laster Tech Co., Ltd.'s revenue is primarily derived from the LASTER Department (NT$2.43 billion), Laser Tech (Shanghai) Segment (NT$6.76 billion), and Laser Tech (Dong Guan) Segment (NT$698.56 million).

Dividend Yield: 4.4%

Laster Tech's dividend payments are well covered by earnings and cash flows, with payout ratios of 55.6% and 32.8%, respectively. Despite a history of volatility, dividends have increased over the past decade. The dividend yield is slightly below the top tier in Taiwan's market. Recent equity offerings raised TWD 192 million, which may impact future financial strategies but also suggests efforts to strengthen capital structure amidst high debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Laster Tech.

- Our expertly prepared valuation report Laster Tech implies its share price may be lower than expected.

Taking Advantage

- Unlock our comprehensive list of 1944 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3346

Laster Tech

Engages in the manufacture and sale of LED chips and components in Taiwan, China, and Thailand.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives