Jiangsu HHCK Advanced Materials Leads 3 Undiscovered Gems with Strong Foundations

Reviewed by Simply Wall St

In a week marked by volatility, global markets have seen mixed performances, with U.S. stocks mostly lower due to AI competition fears and ongoing tariff risks, while European indices reached record highs following the ECB's interest rate cut. Amid these fluctuations, small-cap stocks represented by indices like the Russell 2000 also faced downward pressure but remain a focal point for investors seeking growth opportunities in a challenging economic landscape. In such an environment, identifying stocks with strong foundations becomes crucial; companies that can navigate uncertainty with robust fundamentals and strategic positioning are often considered hidden gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Haisen Pharmaceutical | NA | 7.88% | 10.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Gem-Year IndustrialLtd | 1.70% | -3.85% | -33.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Shenzhen Jdd Tech New Material | NA | 19.07% | 20.23% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 35.63% | -20.15% | 40.51% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Jiangsu HHCK Advanced Materials (SHSE:688535)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu HHCK Advanced Materials Co., Ltd. is a company engaged in the production and development of specialty chemicals, with a market cap of CN¥6.56 billion.

Operations: Jiangsu HHCK Advanced Materials generates revenue primarily from its specialty chemicals segment, amounting to CN¥318.30 million.

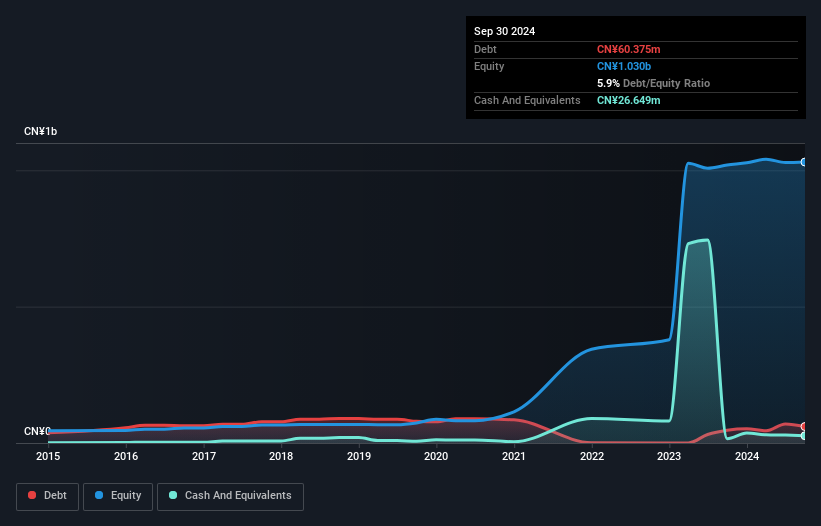

Jiangsu HHCK Advanced Materials, a nimble player in the materials sector, has demonstrated robust earnings growth of 24.8% annually over the past five years. The company's net debt to equity ratio stands at a commendable 3.3%, having significantly improved from 108.1% to 5.9% over this period, showcasing effective debt management strategies. Despite its high-quality earnings, the firm faces challenges with free cash flow remaining negative and share price volatility in recent months. A recently announced CNY 50 million share buyback program aims to enhance shareholder value and support employee stock plans or equity incentives moving forward.

Proto (TSE:4298)

Simply Wall St Value Rating: ★★★★★☆

Overview: Proto Corporation offers automobile-related information services focusing on new and used cars, parts, and supplies with a market capitalization of ¥51.60 billion.

Operations: Proto generates revenue primarily from automobile-related information services, focusing on new and used cars, parts, and supplies. The company's market capitalization stands at ¥51.60 billion.

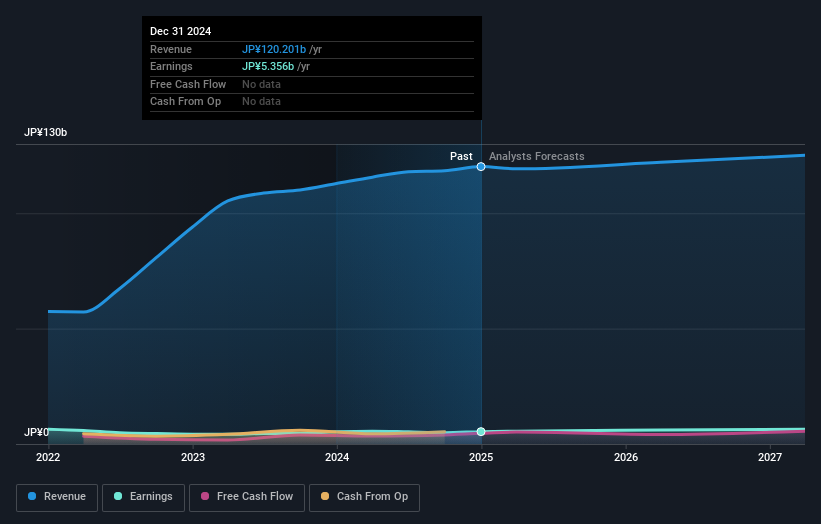

Proto's financial profile is intriguing, with its earnings growing at 1.1% annually over the past five years, though this pace lags behind the Media industry's 7.3%. Trading at a significant discount of 67.4% below estimated fair value, it offers compelling investment potential compared to peers. The company's debt situation is manageable, with interest payments well covered by EBIT at an impressive 1418 times coverage and more cash than total debt on hand. Recent board meetings focused on executive remuneration and interim reports suggest proactive governance ahead of their upcoming earnings release on February 4th, reflecting strategic planning for future growth prospects.

- Click here and access our complete health analysis report to understand the dynamics of Proto.

Review our historical performance report to gain insights into Proto's's past performance.

Takara StandardLtd (TSE:7981)

Simply Wall St Value Rating: ★★★★★★

Overview: Takara Standard Co., Ltd. specializes in the manufacturing and sale of enameled products, with a market capitalization of ¥112.18 billion.

Operations: Takara Standard generates revenue primarily through the sale of enameled products. The company has a market capitalization of ¥112.18 billion, reflecting its scale in the industry.

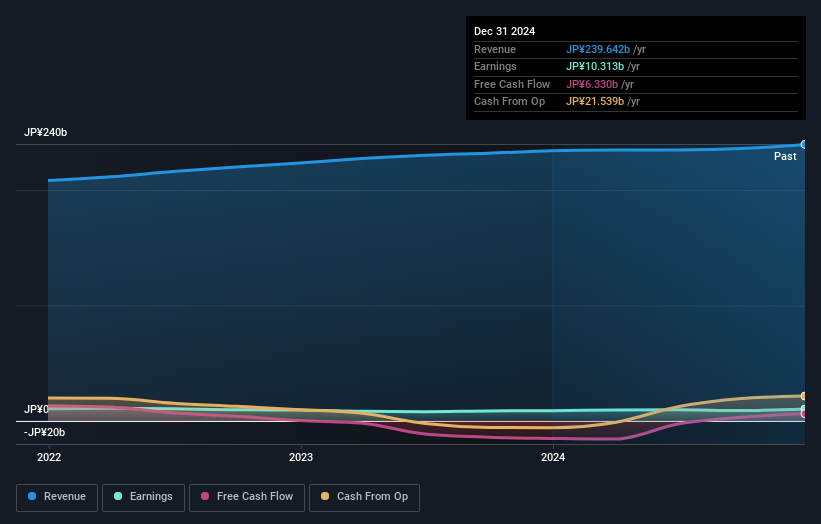

Takara Standard, a smaller player in its sector, has shown some intriguing financial dynamics. Over the last five years, its debt-to-equity ratio decreased from 5.8% to 4%, indicating improved financial leverage. Despite earnings growing at just 2% annually over this period, the company trades at a significant discount of 52.6% below estimated fair value. The recent share repurchase of 924,100 shares for ¥1.53 billion highlights active capital management strategies. Additionally, Takara's net income for the half-year ending September 2024 was ¥3.88 billion with basic earnings per share at ¥56.83, reflecting steady profitability amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Takara StandardLtd.

Assess Takara StandardLtd's past performance with our detailed historical performance reports.

Where To Now?

- Delve into our full catalog of 4678 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Takara StandardLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Takara StandardLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7981

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives