- Japan

- /

- Food and Staples Retail

- /

- TSE:7451

Exploring Three Undiscovered Gems in Global Markets

Reviewed by Simply Wall St

Amidst a backdrop of easing trade tensions and better-than-expected earnings, global markets have shown resilience with U.S. small- and mid-cap indexes advancing for the fourth consecutive week. While economic uncertainty persists, particularly in light of mixed job growth data and a contracting U.S. economy, investors remain optimistic about businesses' ability to navigate these challenges. In this environment, identifying stocks that demonstrate strong fundamentals and potential for growth can be crucial for uncovering hidden opportunities in the market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Anpec Electronics | NA | 2.62% | 7.38% | ★★★★★★ |

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.60% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Neoway TechnologyLtd (SHSE:688159)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Neoway Technology Co., Ltd. focuses on the research, development, production, and sale of communications products and related services for the Industrial Internet of Things (IoT) primarily in China, with a market capitalization of CN¥4.69 billion.

Operations: Neoway Technology generates revenue primarily from the sale of communications products and services related to the Industrial IoT sector. The company has a market capitalization of CN¥4.69 billion.

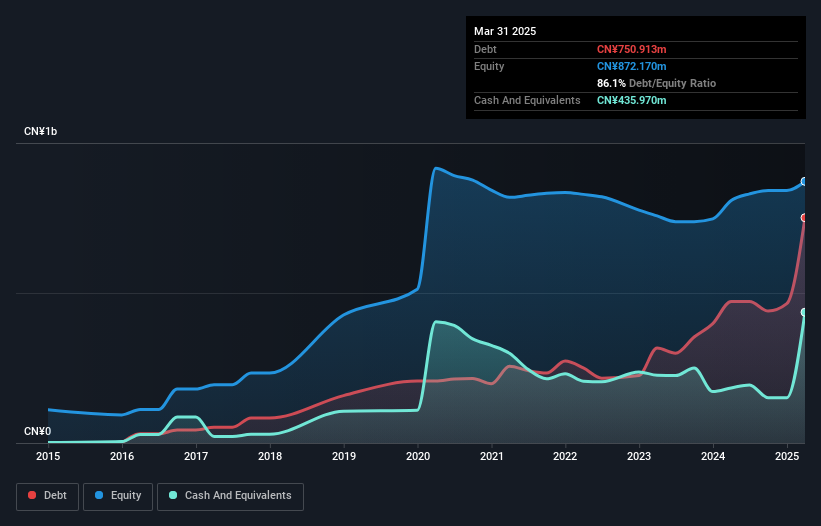

Shenzhen Neoway Technology seems to be navigating a dynamic landscape, with earnings growing 41% over the past year, outpacing the communications industry. Despite this growth, net profit margins have dipped from 2.5% to 1.7%. The company reported CNY 1,057.76 million in sales for Q1 2025 compared to CNY 862.35 million last year, but net income fell significantly to CNY 17.6 million from CNY 58.73 million previously. The debt-to-equity ratio has climbed from 22% to a concerning level of about 86%, though interest payments are well-covered by EBIT at nearly 26 times coverage, indicating solid operational efficiency despite financial challenges.

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitsubishi Shokuhin Co., Ltd. operates as a wholesaler of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries both in Japan and internationally, with a market cap of ¥234.66 billion.

Operations: The company generates revenue through the wholesale distribution of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries. It operates both domestically in Japan and internationally.

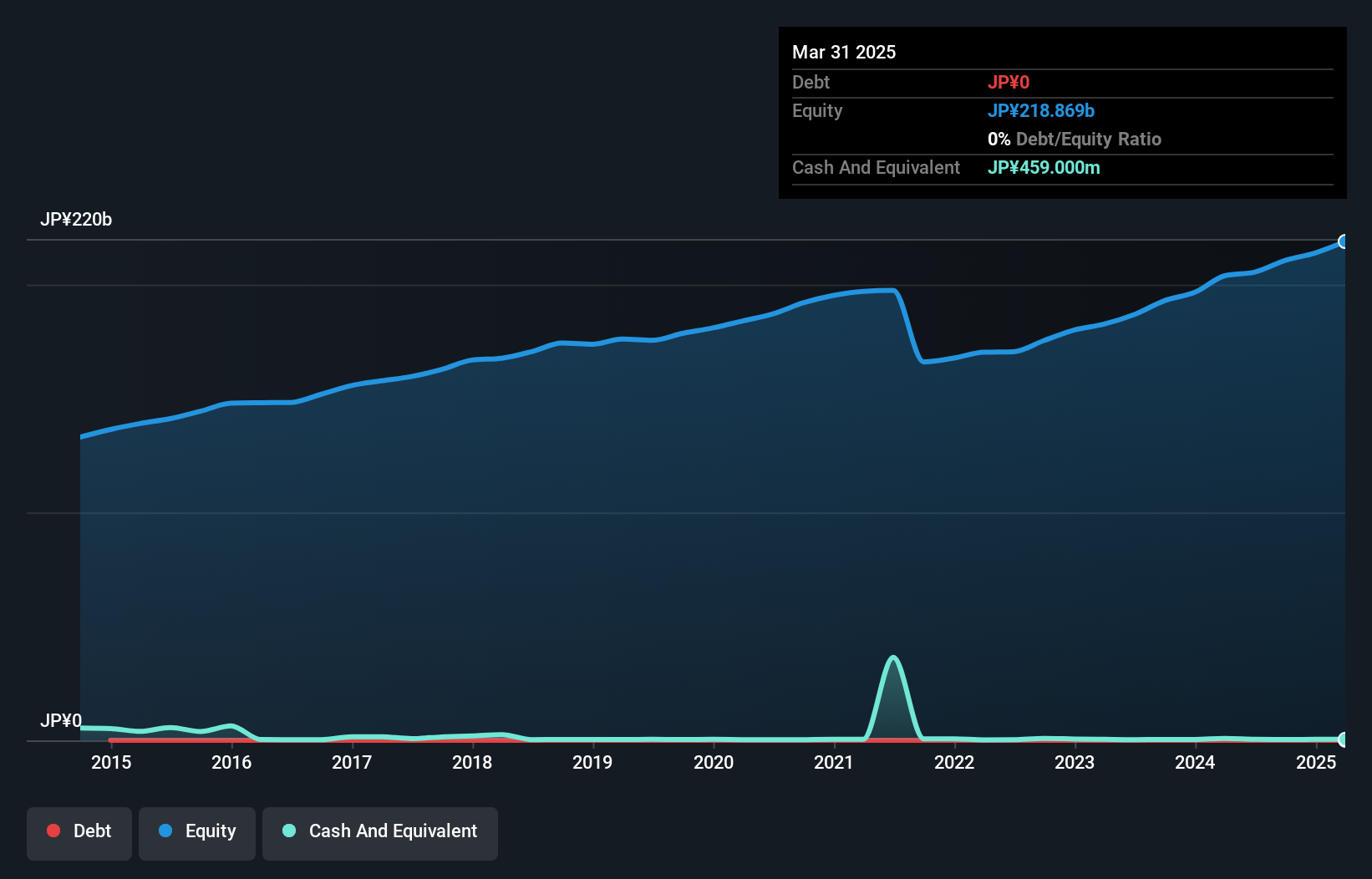

Mitsubishi Shokuhin, a smaller player in the consumer retailing sector, has been delivering solid performance with earnings growing at 17% annually over the past five years. Despite this, its recent annual growth of 2.8% lagged behind the industry average of 7.2%. The company is debt-free and trades at a favorable price-to-earnings ratio of 12x compared to Japan's market average of 13x. While not generating free cash flow currently, Mitsubishi Shokuhin boasts high-quality earnings and forecasts suggest an annual growth rate of nearly 9%, reflecting potential for future value appreciation in its niche market segment.

Takara StandardLtd (TSE:7981)

Simply Wall St Value Rating: ★★★★★★

Overview: Takara Standard Co., Ltd. specializes in the manufacturing and sale of enameled products, with a market capitalization of ¥121.98 billion.

Operations: Takara Standard generates revenue primarily from the sale of enameled products. The company has a market capitalization of ¥121.98 billion.

Takara Standard, a smaller player in its industry, exhibits strong financial health with cash exceeding total debt and a reduced debt-to-equity ratio from 5.7 to 3.5 over five years. Its earnings growth of 16.9% outpaces the building industry's average of 8.8%, indicating robust performance and high-quality earnings. Trading at 70% below estimated fair value suggests potential undervaluation opportunities for investors. Recent strategic moves include repurchasing shares worth ¥1,850 million and planning initiatives to achieve an 8% ROE, reflecting management's focus on enhancing shareholder value and profit growth prospects in the near term.

- Get an in-depth perspective on Takara StandardLtd's performance by reading our health report here.

Examine Takara StandardLtd's past performance report to understand how it has performed in the past.

Key Takeaways

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3263 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7451

Mitsubishi Shokuhin

Engages in the wholesale of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives