- Japan

- /

- Metals and Mining

- /

- TSE:5602

Global Dividend Stocks: KurimotoLtd And 2 More For Income Growth

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals and fluctuating indices, global markets have shown resilience, with U.S. stocks advancing despite the government shutdown and European markets buoyed by tech rallies. In this environment, dividend stocks like Kurimoto Ltd. can offer investors potential income growth through steady payouts, providing a buffer against market volatility while benefiting from favorable macroeconomic conditions such as anticipated interest rate cuts and stable inflation expectations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.91% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.88% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1359 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kurimoto Ltd. is a company that produces and distributes ductile iron pipes, valves, and industrial and construction materials both in Japan and internationally, with a market cap of ¥111.57 billion.

Operations: Kurimoto Ltd.'s revenue segments include ductile iron pipes and accessories, valves, and industrial and construction materials.

Dividend Yield: 3%

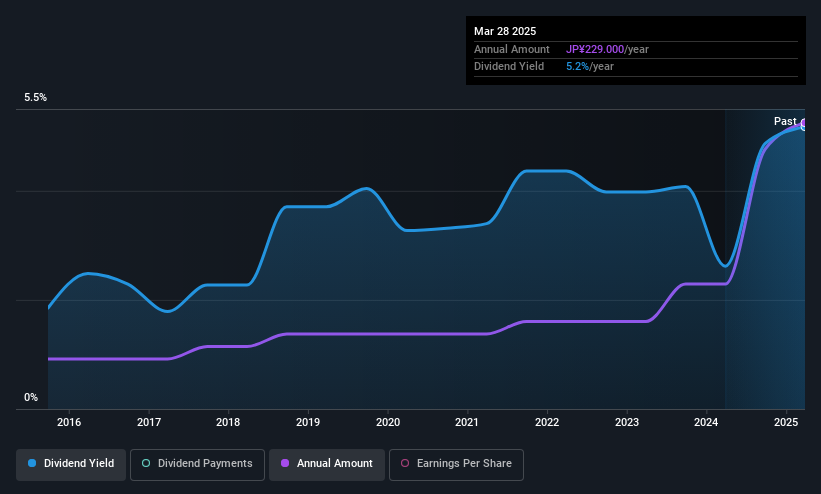

Kurimoto Ltd. recently announced a 5:1 stock split, effective October 1, 2025, and revised its dividend forecast to JPY 28.80 per share due to the split, maintaining payout consistency without substantive change. Despite a low dividend yield of 3.03% compared to top-tier JP market payers and lacking free cash flow coverage, Kurimoto's dividends are reliably covered by earnings with a stable history over the past decade amidst recent earnings growth of 36.2%.

- Click to explore a detailed breakdown of our findings in KurimotoLtd's dividend report.

- Our expertly prepared valuation report KurimotoLtd implies its share price may be too high.

Mitsubishi Steel Mfg (TSE:5632)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Steel Mfg. Co., Ltd. is involved in the manufacturing and sale of steel products, construction machinery parts, automotive parts, and machinery and equipment, with a market cap of ¥26.64 billion.

Operations: Mitsubishi Steel Mfg. Co., Ltd.'s revenue is primarily derived from its Special Steel segment at ¥79.70 billion, followed by the Spring segment at ¥65.69 billion, Machinery at ¥10.63 billion, and Formed & Fabricated Products at ¥8.83 billion.

Dividend Yield: 4.2%

Mitsubishi Steel Mfg. offers a dividend yield of 4.16%, placing it in the top quartile of JP market payers, though its dividends have been historically volatile and not well covered by free cash flows, with a high cash payout ratio of 98.8%. Despite this, dividends are covered by earnings due to a low payout ratio of 46.1%. Recent forecasts indicate expected full-year net sales of ¥159 billion and net income per share at ¥198.41 for fiscal year ending March 2026.

- Unlock comprehensive insights into our analysis of Mitsubishi Steel Mfg stock in this dividend report.

- In light of our recent valuation report, it seems possible that Mitsubishi Steel Mfg is trading beyond its estimated value.

Sanko Gosei (TSE:7888)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanko Gosei Ltd. specializes in the molding and sale of plastic parts both in Japan and internationally, with a market capitalization of ¥26.98 billion.

Operations: Sanko Gosei Ltd.'s revenue segments include ¥35.51 billion from Japan, ¥30.08 billion from Asia, ¥19.14 billion from North America, and ¥12.11 billion from Europe.

Dividend Yield: 3.1%

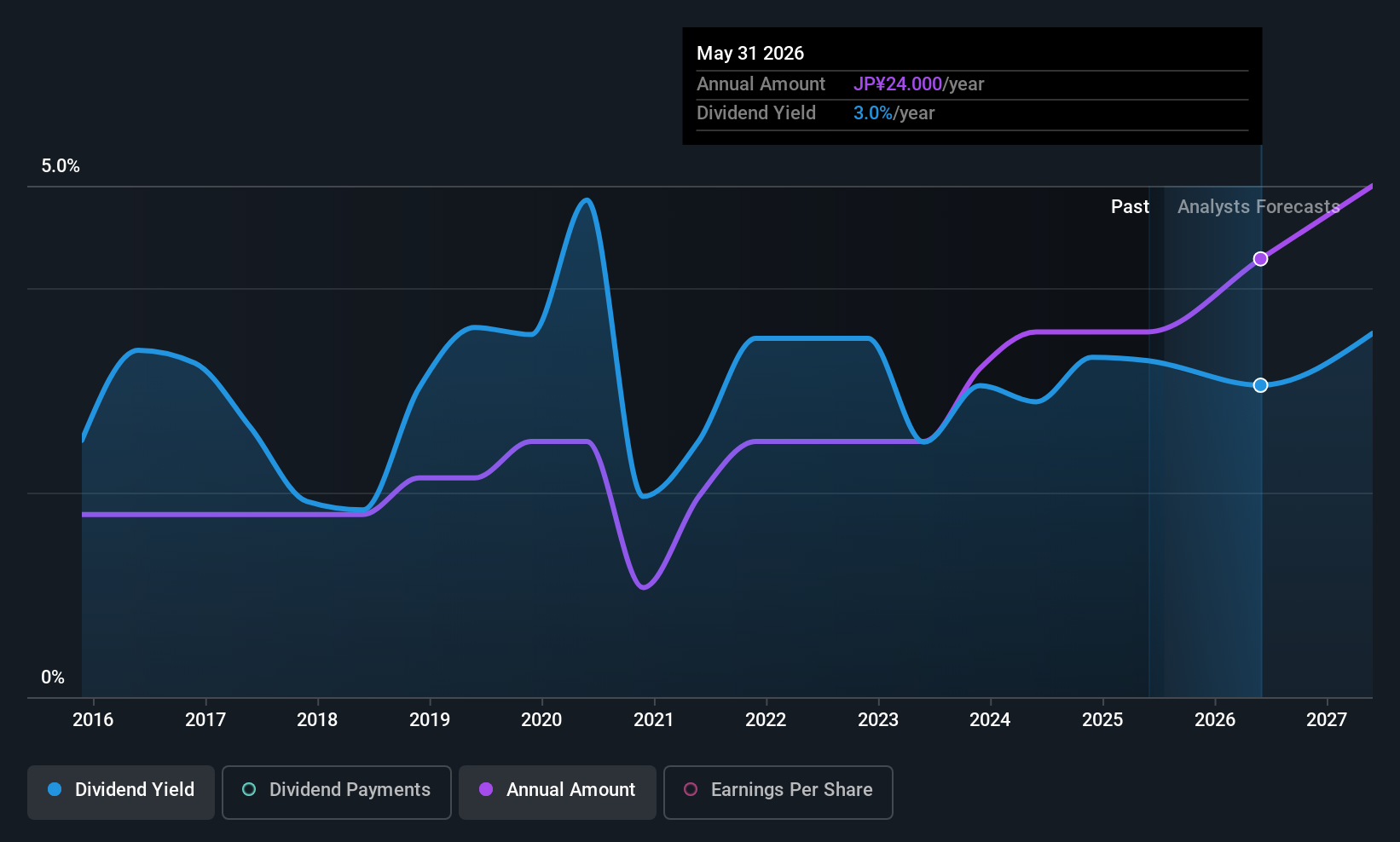

Sanko Gosei's dividend payments have been volatile over the past decade, yet recent increases from ¥10 to ¥14 per share reflect a positive shift. Despite a low 3.1% yield compared to top-tier JP market payers, dividends are well-covered by earnings and cash flows with payout ratios of 19% and 25.7%, respectively. The company forecasts net sales of ¥94 billion and EPS of ¥131.21 for fiscal year ending May 2026, indicating potential growth stability.

- Dive into the specifics of Sanko Gosei here with our thorough dividend report.

- Upon reviewing our latest valuation report, Sanko Gosei's share price might be too pessimistic.

Where To Now?

- Get an in-depth perspective on all 1359 Top Global Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KurimotoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5602

KurimotoLtd

Manufactures and sells ductile iron pipes and accessories, valves, and industrial and construction materials in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives