A Piece Of The Puzzle Missing From Eidai Co.,Ltd.'s (TSE:7822) 27% Share Price Climb

Despite an already strong run, Eidai Co.,Ltd. (TSE:7822) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 31%.

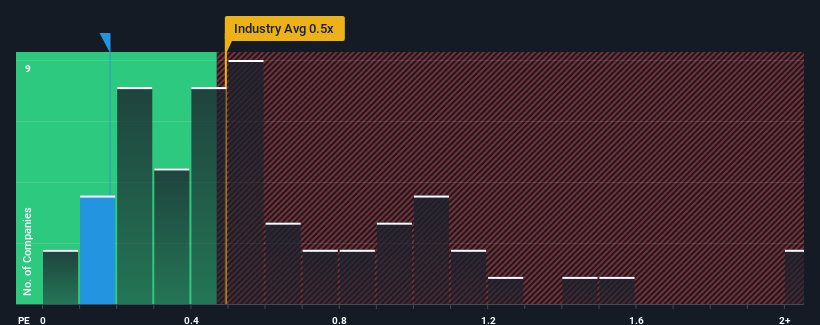

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about EidaiLtd's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Building industry in Japan is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for EidaiLtd

What Does EidaiLtd's Recent Performance Look Like?

Revenue has risen firmly for EidaiLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for EidaiLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is EidaiLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like EidaiLtd's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

This is in contrast to the rest of the industry, which is expected to grow by 3.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that EidaiLtd's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On EidaiLtd's P/S

Its shares have lifted substantially and now EidaiLtd's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To our surprise, EidaiLtd revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 4 warning signs for EidaiLtd (1 makes us a bit uncomfortable!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EidaiLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7822

EidaiLtd

Engages in the manufacture and sale of residential building materials and wooden boards primarily in Japan.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.