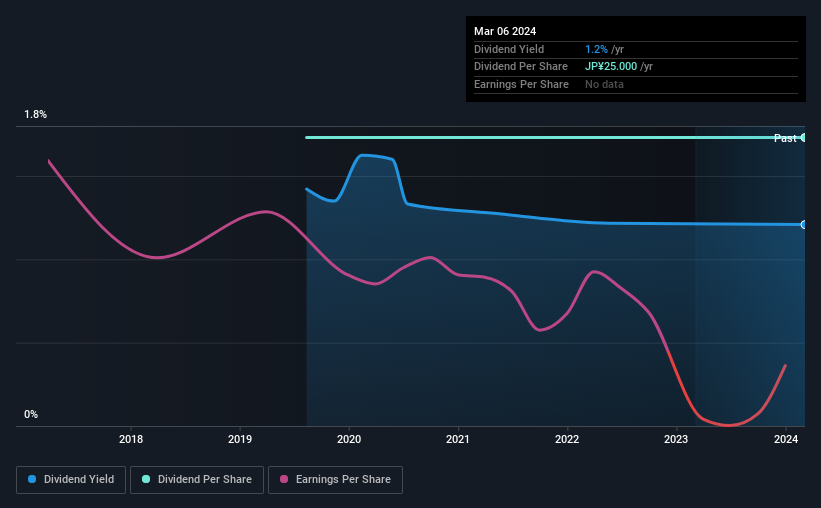

The board of Yashima & Co.,Ltd. (TSE:7677) has announced that it will pay a dividend of ¥25.00 per share on the 17th of June. This means the annual payment will be 1.2% of the current stock price, which is lower than the industry average.

See our latest analysis for YashimaLtd

YashimaLtd Might Find It Hard To Continue The Dividend

If it is predictable over a long period, even low dividend yields can be attractive. Despite not generating a profit, YashimaLtd is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Over the next year, EPS might fall by 56.2% based on recent performance. This will push the company into unprofitability, which means the managers will have to choose between suspending the dividend, or paying it out of cash reserves.

YashimaLtd Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 5 years of history we want to see a few more years of history before making any solid conclusions. The payments haven't really changed that much since 5 years ago. YashimaLtd hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. YashimaLtd's EPS has fallen by approximately 56% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of YashimaLtd's Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, YashimaLtd has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about. Is YashimaLtd not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7677

YashimaLtd

Engages in the sale, maintenance, and import/export of railway related products and electronic parts for industrial machines in Japan and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives