- Taiwan

- /

- Hospitality

- /

- TWSE:2707

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape of rate cuts and mixed economic signals, investors are keenly observing the performance of major indices, with the Nasdaq reaching new heights while others face declines. Amidst these dynamics, dividend stocks remain an attractive option for those seeking steady income and potential resilience in volatile times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.03% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1851 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

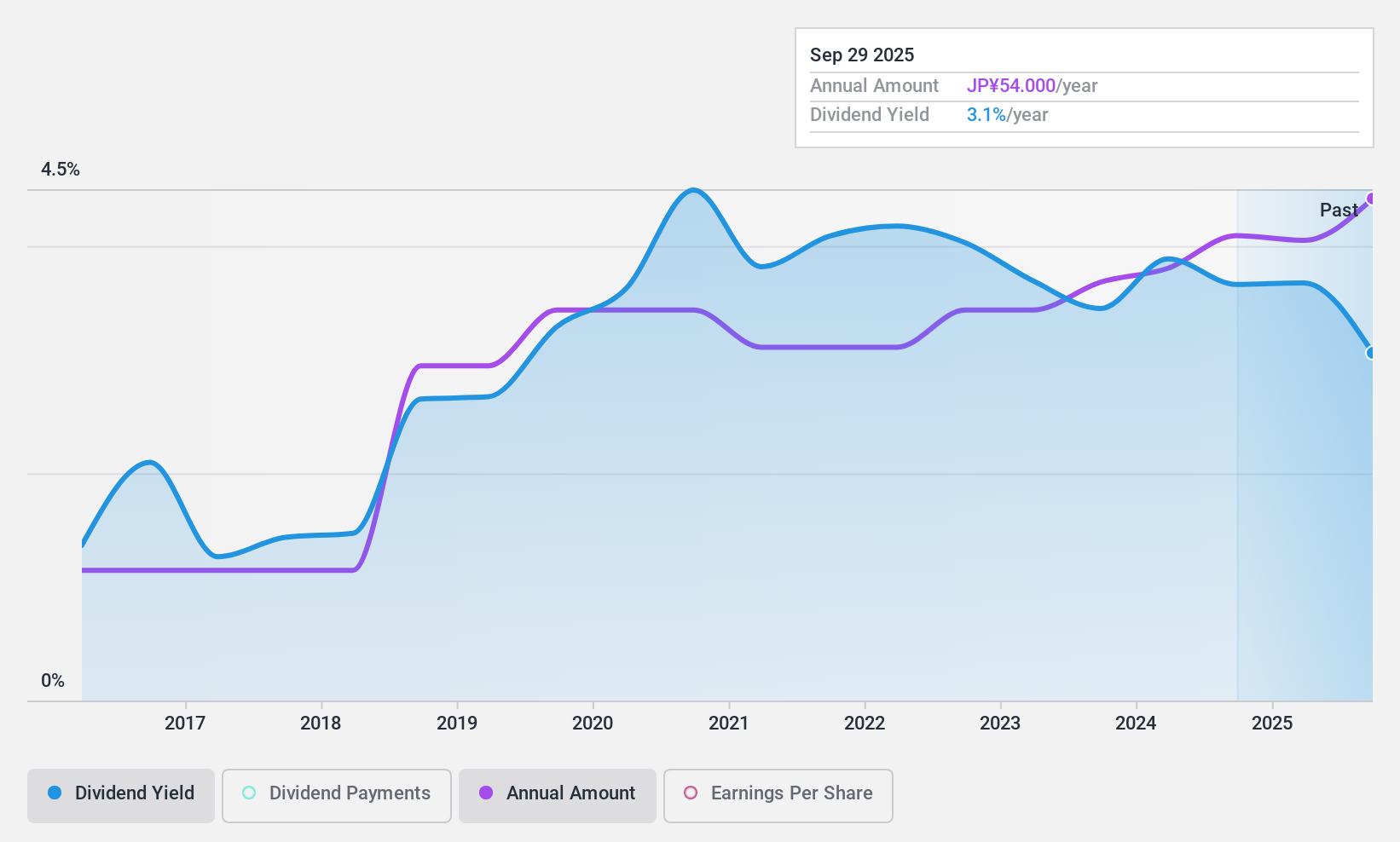

ShinMaywa Industries (TSE:7224)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShinMaywa Industries, Ltd. and its subsidiaries manufacture and sell transportation equipment across Japan, Asia, North America, and internationally with a market cap of ¥88.23 billion.

Operations: ShinMaywa Industries generates revenue from several segments: Fluid (¥27.24 billion), Aircraft (¥32.77 billion), Parking System (¥44.04 billion), Specially Equipped Vehicle (¥104.25 billion), and Industrial Machinery / Environmental System (¥40.21 billion).

Dividend Yield: 3.7%

ShinMaywa Industries' dividend payments have been volatile over the past decade, despite recent growth. The dividends are well-covered by earnings (43.7% payout ratio) and cash flows (11.5% cash payout ratio), indicating sustainability from a coverage perspective. However, its dividend yield of 3.68% is slightly below the top tier in Japan's market and its unstable track record may concern some investors seeking consistent income streams.

- Click to explore a detailed breakdown of our findings in ShinMaywa Industries' dividend report.

- The analysis detailed in our ShinMaywa Industries valuation report hints at an deflated share price compared to its estimated value.

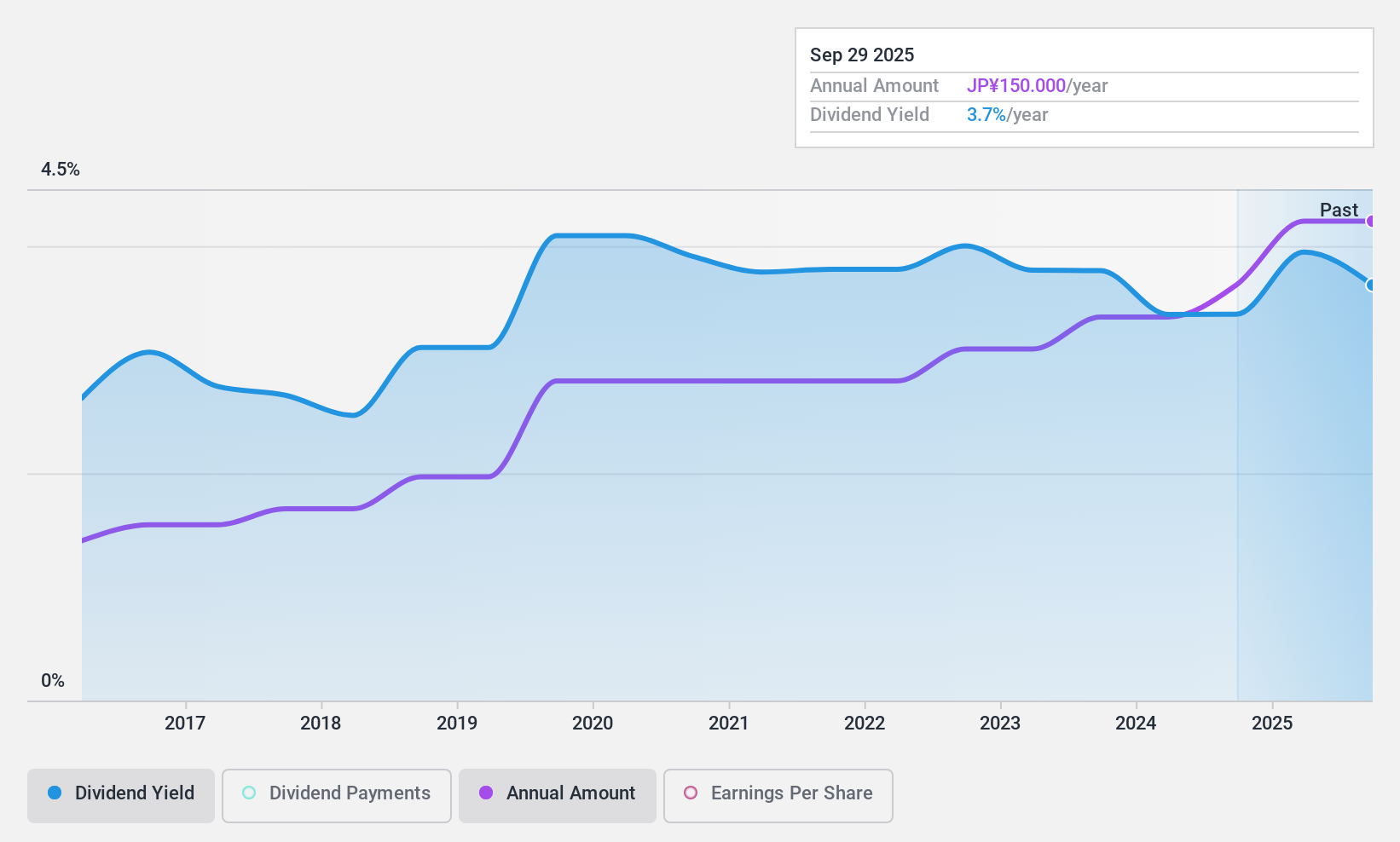

Inaba Denki SangyoLtd (TSE:9934)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inaba Denki Sangyo Co., Ltd. operates in Japan, offering electrical equipment and materials, industrial automation solutions, and proprietary products, with a market cap of ¥218.11 billion.

Operations: Inaba Denki Sangyo Co., Ltd. generates revenue from its Electrical Equipment Materials segment at ¥258.02 billion, the In-House Product Business at ¥78.12 billion, and the Industrial Equipment Business at ¥37.46 billion.

Dividend Yield: 3.6%

Inaba Denki Sangyo's dividend payments have been volatile over the past decade, though they have increased overall. The dividends are well-covered by earnings (40.6% payout ratio) and cash flows (49.2% cash payout ratio), suggesting sustainability from a coverage standpoint. However, its dividend yield of 3.58% is lower than the top 25% in Japan's market, which may be less appealing for investors prioritizing high yields despite its low trading price relative to estimated fair value.

- Unlock comprehensive insights into our analysis of Inaba Denki SangyoLtd stock in this dividend report.

- According our valuation report, there's an indication that Inaba Denki SangyoLtd's share price might be on the expensive side.

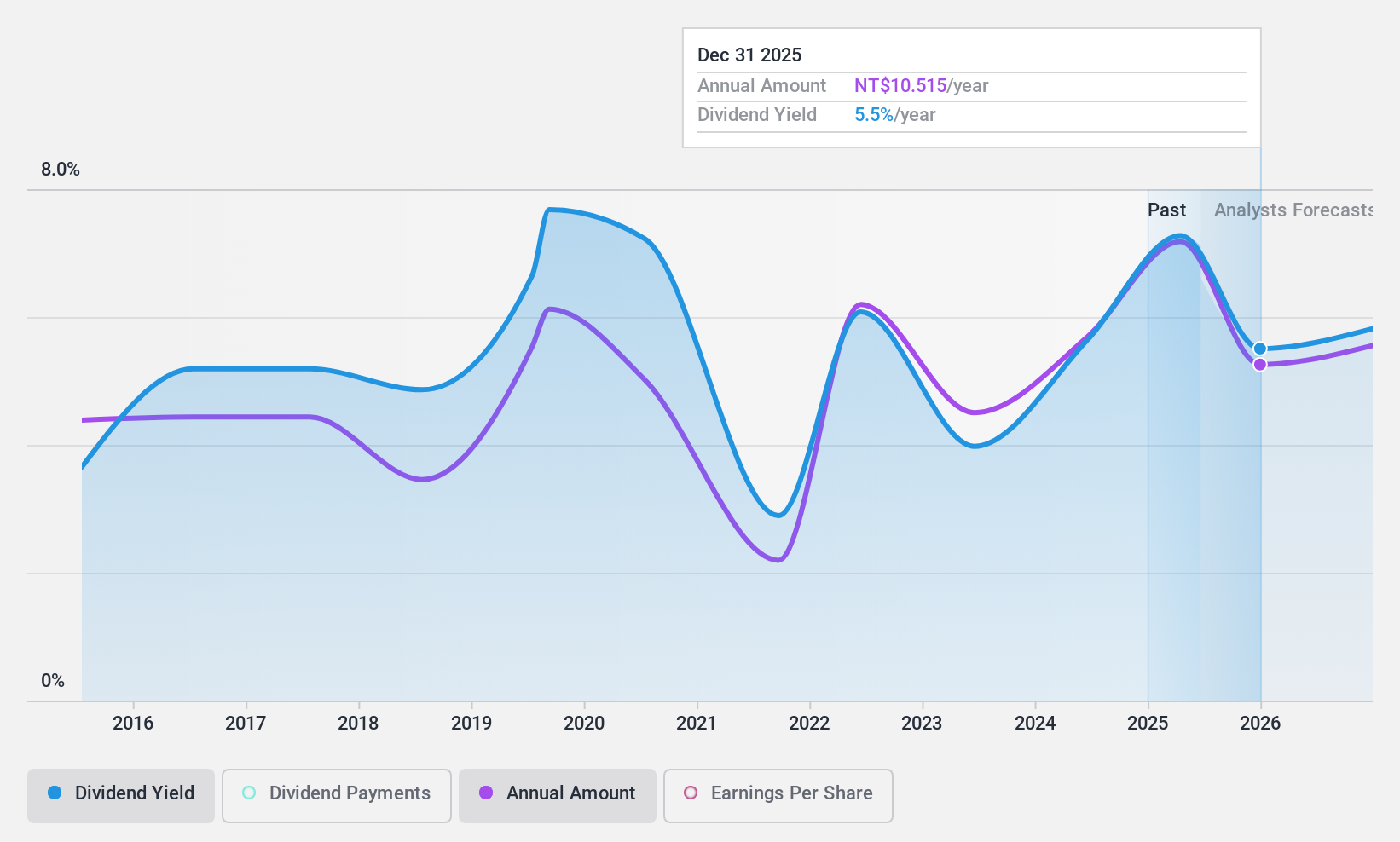

Formosa International Hotels (TWSE:2707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Formosa International Hotels Corporation, along with its subsidiaries, operates tourist hotels in Taiwan and internationally, with a market cap of NT$24.21 billion.

Operations: Formosa International Hotels Corporation generates revenue through its Room Segment (NT$2.35 billion), Catering Segment (NT$3.19 billion), Leasing Segment (NT$677.68 million), and Technical Services and Management (NT$167.98 million).

Dividend Yield: 5.9%

Formosa International Hotels' dividend yield of 5.99% is among the top 25% in Taiwan, but its sustainability is questionable due to a high payout ratio of 106.8%, not fully covered by earnings or cash flows. Despite growth in earnings and revenue, recent financial results show declining sales and net income, adding uncertainty to future payouts. The stock trades below estimated fair value, with analysts expecting a price increase of 22.5%.

- Click here and access our complete dividend analysis report to understand the dynamics of Formosa International Hotels.

- The valuation report we've compiled suggests that Formosa International Hotels' current price could be quite moderate.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1851 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2707

Formosa International Hotels

Engages in the operation of tourist hotels in Taiwan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives