3 Dividend Stocks Yielding Up To 5.4% For Your Investment Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, investors are seeking stability amid volatility. With U.S. job growth falling short of expectations and manufacturing showing signs of recovery, dividend stocks can offer a reliable income stream in uncertain times. In this environment, selecting stocks with solid dividend yields can be an effective strategy for enhancing portfolio resilience and generating consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

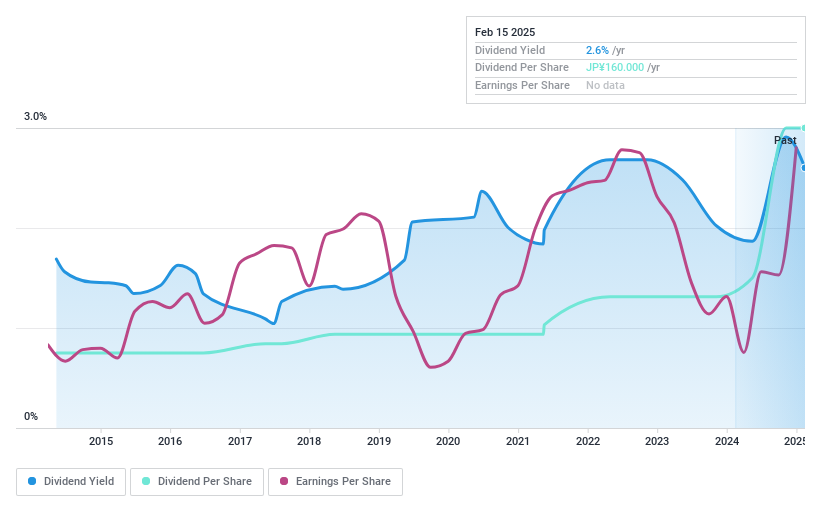

Takasago International (TSE:4914)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takasago International Corporation is involved in the manufacturing and sale of flavors, fragrances, aroma ingredients, and other fine chemicals, with a market cap of ¥100.38 billion.

Operations: Takasago International Corporation generates its revenue from various regions, with ¥43.63 billion from Asia, ¥94.10 billion from Japan, ¥41.42 billion from Europe, and ¥59.10 billion from the Americas.

Dividend Yield: 3.1%

Takasago International's dividend yield of 3.13% is below the top quartile in Japan, and while dividends have grown reliably over the past decade, they are not well covered by free cash flow due to a high cash payout ratio of 639.1%. Despite this, the payout ratio based on earnings is a manageable 41%, suggesting dividends are supported by profits but not cash flows. Earnings increased significantly by 33.8% last year, indicating potential for future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Takasago International.

- Our comprehensive valuation report raises the possibility that Takasago International is priced higher than what may be justified by its financials.

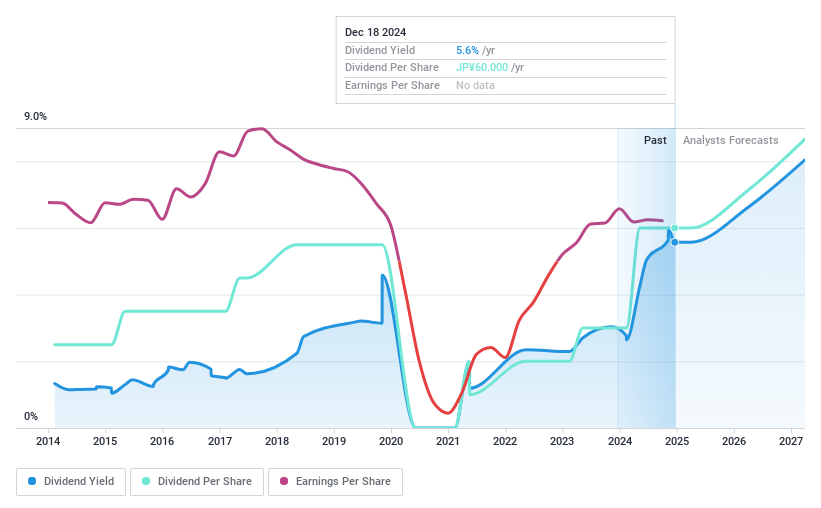

Unipres (TSE:5949)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Unipres Corporation manufactures and sells automotive parts in Japan, with a market cap of approximately ¥48.91 billion.

Operations: Unipres Corporation's revenue is derived from its operations in Asia (¥54.80 billion), Japan (¥118.99 billion), Europe (¥48.04 billion), and the Americas (¥123.26 billion).

Dividend Yield: 5.5%

Unipres offers a compelling dividend yield of 5.45%, ranking in the top quartile of JP market payers. The payout is well-supported by earnings and cash flows, with payout ratios at 41.1% and 15.5% respectively, indicating sustainability despite historical volatility. Recent initiatives like share buybacks worth ¥308.42 million may enhance shareholder value, though dividends have been unreliable over the past decade due to fluctuations exceeding 20%.

- Click here to discover the nuances of Unipres with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Unipres' current price could be quite moderate.

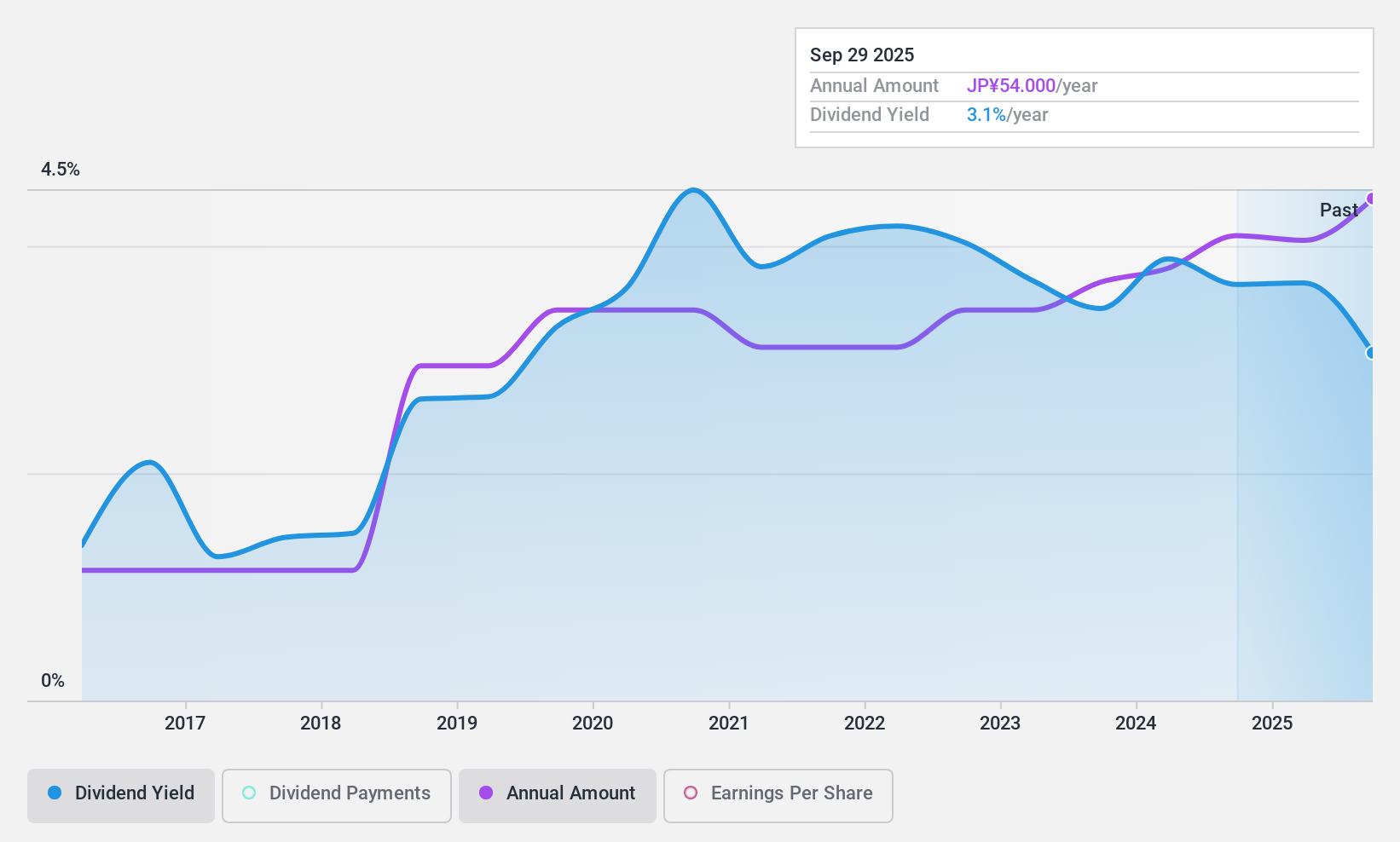

ShinMaywa Industries (TSE:7224)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ShinMaywa Industries, Ltd., along with its subsidiaries, is involved in the manufacture and sale of transportation equipment across Japan, Asia, North America, and other international markets, with a market cap of ¥91.40 billion.

Operations: ShinMaywa Industries generates revenue from several segments, including Specially Equipped Vehicles (¥107.33 billion), Parking Systems (¥45.20 billion), Aircraft (¥32.30 billion), Industrial Machinery/Environmental Systems (¥37.68 billion), and Fluid Equipment (¥26.68 billion).

Dividend Yield: 3.6%

ShinMaywa Industries' dividend payments have been volatile over the past decade, yet they are well covered by earnings and cash flows, with payout ratios at 38.1% and 9.4% respectively. The current yield of 3.59% is slightly below top-tier payers in Japan. Despite recent financial guidance revisions indicating lower net sales, the dividend has shown growth over ten years, supported by a robust earnings increase of 32.8% last year.

- Click to explore a detailed breakdown of our findings in ShinMaywa Industries' dividend report.

- Upon reviewing our latest valuation report, ShinMaywa Industries' share price might be too pessimistic.

Next Steps

- Get an in-depth perspective on all 1973 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ShinMaywa Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7224

ShinMaywa Industries

Engages in the manufacture and sale of transportation equipment in Japan, Asia, North America, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives